The largest stablecoin transfers often foreshadow market changes, providing institutions with critical early signals.

Why Whale Transactions Matter

In traditional markets, analysts watch institutional flows for signs of future trends. In the stablecoin economy, the equivalent signal comes from whale transactions. These transfers, often valued at tens or hundreds of millions, are more than just large numbers. They are clues about institutional sentiment, liquidity strategies, and market direction.

Monitoring whale transactions has become an essential part of institutional decision-making. By tracking these flows, analysts can prepare for shifts in liquidity and volatility before they appear in market prices.

The Scale of Whale Transfers

Stablecoins enable near-instant settlement of enormous amounts of capital. As a result, whale transfers occur daily. On many occasions, billions of dollars worth of stablecoins move across exchanges, DeFi protocols, or custody accounts within hours.

The sheer scale of these movements underscores their importance. When whales act, the market pays attention, because such flows often shape liquidity conditions for days or weeks afterward.

Exchange Inflows and Outflows

When whales send stablecoins into exchanges, it often signals increased trading activity. Inflows can precede periods of higher volatility, as capital becomes available for buying or selling. Large withdrawals, on the other hand, suggest that holders prefer custody or deployment into DeFi protocols.

Institutions track these flows closely. A surge of inflows may indicate imminent selling pressure, while outflows can signal reduced liquidity on exchanges and potential price stability.

DeFi Protocol Transfers

Whales also deploy stablecoins into lending pools, liquidity farms, and automated market makers. These inflows boost TVL and signal confidence in yield opportunities. Conversely, large outflows from protocols often precede declines in liquidity depth, affecting trading spreads and lending rates.

Whale behavior in DeFi provides institutions with direct insight into market trust. Rising inflows mean confidence. Rapid outflows suggest caution.

Cross-Chain Movements

Stablecoins no longer exist on a single chain. They flow across Ethereum, Solana, BSC, and Layer-2 solutions in search of efficiency. Whale transfers highlight where liquidity is moving most actively.

A sudden surge of large transfers into Solana may suggest that traders are preparing for high-frequency strategies. Significant movements into Layer-2s may indicate institutional adoption of cost-efficient infrastructure. These cross-chain signals help institutions position capital ahead of market shifts.

Patterns in Whale Behavior

Over time, whale transfers reveal recognizable patterns.

Pre-event positioning: Transfers often rise before major economic announcements or Federal Reserve decisions.

Arbitrage cycles: Whales move capital rapidly across chains and exchanges when spreads open.

Stress responses: During market shocks, whales consolidate liquidity in transparent or custodial environments.

Institutions interpret these patterns to guide their own allocation strategies.

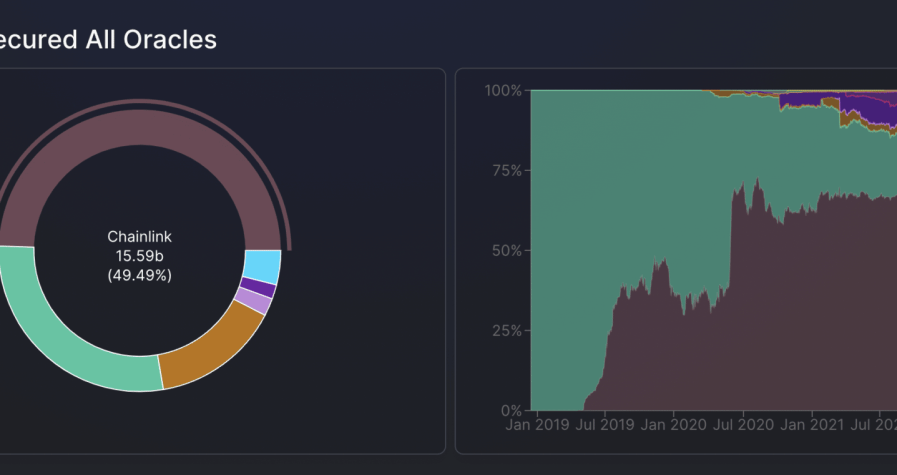

The Role of Analytics in Whale Monitoring

Advanced analytics platforms track whale transfers in real time. They categorize wallets, identify ownership types, and distinguish between exchange operations, fund movements, and unknown addresses.

Institutions rely on these tools to avoid misinterpretation. A transfer from a known exchange wallet may be routine. A similar-sized move from an unidentified giant could signal something more significant.

Institutional Applications of Whale Data

Funds use whale monitoring to enhance their strategies in several ways:

Liquidity planning: anticipating where depth will rise or fall.

Risk management: reducing exposure to assets with concentrated whale dominance.

Opportunity spotting: positioning ahead of yield or arbitrage windows.

By embedding whale data into dashboards, institutions create faster and more responsive strategies.

Outlook for 2025

Whale transactions will remain one of the most important indicators of stablecoin liquidity. As markets grow, the size of these transfers will increase, making their influence even greater.

Institutions that monitor whale flows will continue to enjoy an informational edge, understanding liquidity shifts before they manifest in price charts. Stablecoin markets may appear calm, but beneath the surface, whale transfers are constantly reshaping the tides.