Liquidity risk management is becoming central to institutional stablecoin strategies, ensuring that portfolios remain resilient during stress events and market volatility.

Introduction

Stablecoins are valued for their predictability and liquidity. They act as cash equivalents within digital markets, power cross-border settlement systems, and anchor decentralized finance (DeFi) ecosystems. Yet their utility does not eliminate risk. Institutions managing billions in stablecoin holdings face the constant challenge of liquidity risk the possibility that funds may not be available where and when they are needed.

In traditional markets, liquidity risk arises from funding mismatches or sudden market freezes. In stablecoin markets, risks are amplified by whale concentration, fragmented liquidity across chains, bridge vulnerabilities, and redemption surges. This guide provides institutions with a practical framework for managing liquidity risk in stablecoin portfolios.

Understanding Liquidity Risk in Stablecoin Markets

Redemption Risk

A sudden surge of redemptions can deplete reserves and disrupt peg stability.

Market Depth Risk

Liquidity pools may lack sufficient depth, causing slippage when institutions move large amounts.

Concentration Risk

Stablecoin supply held by a small group of whales increases systemic vulnerability.

Cross-Chain Risk

Liquidity scattered across multiple chains complicates management and increases operational risks.

Regulatory Risk

Restrictions in one jurisdiction can reduce liquidity access across ecosystems.

Why Institutions Must Manage Liquidity Risk

Operational Stability

Treasuries and funds require assurance that liquidity is available for settlements and allocations.

Compliance Assurance

Regulators expect institutions to monitor and control systemic risks.

Market Confidence

Strong liquidity frameworks build trust with boards, investors, and counterparties.

Strategic Flexibility

Institutions with resilient liquidity positions can act opportunistically during stress events.

Core Tools for Liquidity Risk Management

Wallet Analytics

Track distribution and whale flows to identify vulnerabilities in liquidity concentration.

TVL Rankings

Monitor where liquidity is deepest across protocols and chains.

Risk Dashboards

Consolidate peg monitoring, whale alerts, and compliance data into unified oversight platforms.

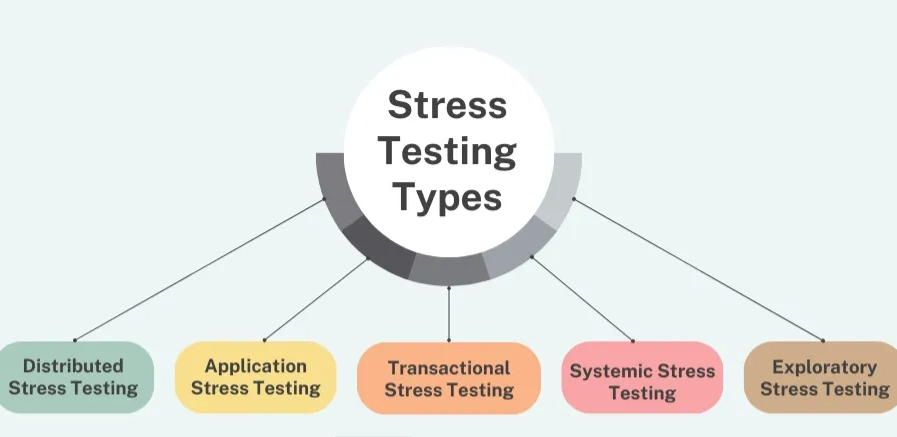

Stress Testing Engines

Simulate redemption surges and liquidity drains to test portfolio resilience.

Custodial Integrations

Custodians help manage liquidity across multiple accounts, reducing fragmentation.

Step-by-Step Guide to Liquidity Risk Management

Step 1: Identify Exposures

Map holdings across tokens, chains, and protocols. Assess whether exposure is concentrated.

Step 2: Set Liquidity Buffers

Maintain reserves in highly liquid pools or custodial accounts to cover sudden outflows.

Step 3: Diversify Across Chains and Protocols

Avoid overreliance on a single ecosystem by spreading capital across multiple venues.

Step 4: Monitor Whale Flows

Track whale wallets to anticipate shifts in liquidity supply.

Step 5: Conduct Stress Tests

Simulate extreme conditions to test whether buffers are sufficient.

Step 6: Build Compliance Safeguards

Ensure that liquidity management remains aligned with jurisdictional regulations.

Step 7: Report and Review

Generate regular reports for boards and regulators to demonstrate oversight.

Institutional Applications

Treasury Operations

Corporates maintain buffers for cross-border payments, ensuring smooth settlement during volatility.

Hedge Funds

Funds actively monitor whale flows and TVL shifts to adjust liquidity allocations.

Custodians

Custodians consolidate liquidity oversight for clients, reducing risks tied to fragmentation.

Regulators

Supervisory bodies increasingly expect institutions to disclose liquidity risk management practices.

Role of Artificial Intelligence

AI enhances liquidity risk management by:

Forecasting redemption surges based on wallet behavior.

Predicting TVL fragmentation across chains.

Detecting anomalies in whale concentration.

Recommending optimal reallocation strategies.

For institutions, AI transforms liquidity management into a predictive discipline.

Case Studies

Whale-Driven Stress Events

In past crises, whale withdrawals triggered TVL collapses. Institutions that monitored wallet flows and maintained buffers avoided severe losses.

Cross-Chain Liquidity Shortages

Institutions overexposed to a single bridge faced disruptions. Diversified liquidity strategies proved more resilient.

Redemption Surges

Stablecoins with weak redemption policies suffered liquidity crises. Institutions favoring tokens with transparent reserves and clear redemption frameworks remained protected.

Challenges in Liquidity Risk Management

Fragmented Data

Liquidity metrics are spread across chains, complicating oversight.

Rapid Shifts

Liquidity can move within minutes, requiring real-time monitoring.

Regulatory Conflicts

Different jurisdictions impose varying rules on liquidity practices.

Cost of Safeguards

Maintaining large buffers can reduce capital efficiency.

Best Practices for Institutions

Maintain Conservative Buffers

Reserves may reduce yield but increase stability.

Integrate AI Dashboards

Adopt predictive monitoring to stay ahead of stress.

Diversify Systematically

Spread liquidity across chains, pools, and custodians.

Review Regularly

Update frameworks quarterly to adapt to evolving risks.

The Future of Liquidity Risk Management

By 2025 and beyond, expect:

Global liquidity standards defining institutional safeguards.

AI-powered monitoring systems predicting stress in real time.

Integration with CBDCs to unify digital and fiat liquidity management.

Mandatory regulatory reporting of liquidity buffers for systemic institutions.

Liquidity risk management is no longer an optional exercise. It is a cornerstone of institutional trust in stablecoin portfolios.