Stress testing provides institutions with the tools to prepare for shocks, simulate extreme conditions, and build resilience into stablecoin portfolios.

Introduction

Stablecoins have become critical to the functioning of global markets. They serve as collateral in decentralized finance (DeFi), power settlement systems, and act as safe havens during volatility. Yet their stability should not be taken for granted. Market crashes, liquidity crunches, regulatory shocks, and technical failures can all test their resilience.

For institutions managing billions, stress testing is the key to ensuring stability. Just as banks perform stress tests on their balance sheets, institutions must simulate scenarios that could impact stablecoin portfolios. Stress testing is not only about identifying risks but also about developing strategies to withstand them.

This guide provides a step-by-step framework for conducting institutional stress tests on stablecoin portfolios, the tools involved, and best practices for implementation.

What Is Stress Testing?

Stress testing involves simulating extreme but plausible events to assess the resilience of financial systems. In the context of stablecoins, stress tests evaluate how portfolios behave when:

Peg stability is threatened.

Liquidity dries up in DeFi pools.

Whale withdrawals accelerate.

Regulatory actions disrupt flows.

Cross-chain bridges fail.

The results inform allocation, risk controls, and compliance strategies.

Why Stress Testing Matters for Institutions

Anticipating Shocks

Stablecoin markets move at high speed. Stress tests reveal vulnerabilities before crises emerge.

Regulatory Expectations

Many regulators now expect institutions to demonstrate robust stress testing frameworks as part of oversight.

Portfolio Resilience

By simulating stress, institutions can reallocate capital, strengthen reserves, and improve systemic stability.

Competitive Advantage

Institutions that test and prepare outperform peers during crises, protecting both assets and reputation.

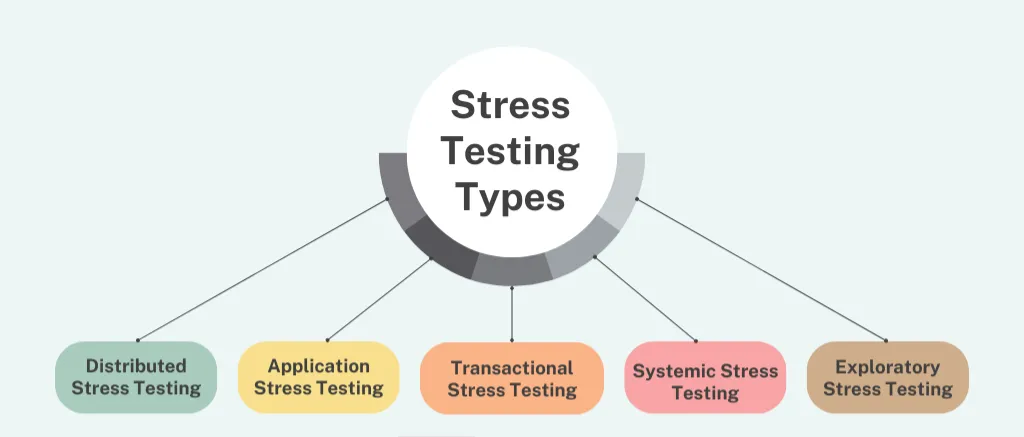

Types of Stress Tests for Stablecoin Portfolios

1. Peg Stress Tests

Simulating scenarios where a stablecoin deviates from its peg due to redemption surges, loss of reserves, or whale-driven panic.

2. Liquidity Stress Tests

Testing how portfolios react when liquidity dries up in major lending or trading protocols.

3. Redemption Run Simulations

Assessing how quickly reserves would be depleted if mass redemptions occur simultaneously.

4. Cross-Chain Risk Tests

Simulating the failure of a bridge or the sudden congestion of a chain, disrupting transfers.

5. Regulatory Shock Scenarios

Modeling the impact of new restrictions, bans, or enforcement actions.

Tools for Stress Testing

Risk Dashboards

Dashboards integrate peg monitoring, wallet analytics, and TVL data to provide the foundation for stress testing.

Simulation Engines

AI-powered systems run scenarios across multiple variables, showing how portfolios respond under different shocks.

Historical Replay Models

Institutions replay past crises (e.g., market crashes, liquidity collapses) to test how portfolios would have performed.

Compliance Integrations

Stress tests also evaluate compliance risks, ensuring institutions remain aligned with oversight even under stress.

Step-by-Step Guide to Conducting a Stress Test

Step 1: Define Objectives

Determine whether the test focuses on liquidity resilience, peg stability, or regulatory exposure.

Step 2: Collect Data

Pull transaction flows, wallet concentration metrics, and liquidity pool data across chains.

Step 3: Design Scenarios

Simulate both historical events and forward-looking shocks. For example, a 30 percent drop in TVL or a sudden 10 billion dollar whale withdrawal.

Step 4: Run Simulations

Use AI-powered models to test outcomes. Monitor peg deviations, redemption capacity, and liquidity depth.

Step 5: Analyze Results

Identify weak points, such as overreliance on a single protocol or high concentration risk.

Step 6: Implement Controls

Rebalance portfolios, increase reserves, or diversify across chains to mitigate risks.

Step 7: Report Findings

Generate audit-ready reports for boards, investors, and regulators.

Institutional Applications

Treasury Departments

Corporates use stress tests to ensure stablecoin reserves remain liquid during market stress.

Funds and Hedge Managers

Funds simulate whale-driven outflows to prepare hedging strategies.

Custodians and Market Makers

Market makers test liquidity stress to ensure spreads remain efficient.

Regulators

Supervisory bodies increasingly expect institutions to provide stress testing results as part of systemic oversight.

Role of Artificial Intelligence in Stress Testing

AI enhances stress testing by:

Forecasting new risks not captured by historical data.

Simulating thousands of scenarios simultaneously.

Detecting anomalies in how portfolios respond.

Recommending optimal allocation strategies.

This predictive capability makes stress testing proactive rather than reactive.

Challenges in Stress Testing

Complexity of Multi-Chain Systems

Stablecoins operate across many chains, making simulations technically complex.

Data Quality

Incomplete or inaccurate data can distort results.

Overreliance on Models

Models are only as good as their assumptions. Institutions must balance quantitative analysis with judgment.

Best Practices for Institutions

Regular Testing

Run stress tests quarterly or during major market shifts.

Combine Historical and Predictive Models

Use both replay models and AI-driven forecasts for comprehensive coverage.

Integrate With Dashboards

Link stress testing with portfolio and compliance dashboards for full visibility.

Involve Cross-Functional Teams

Include risk managers, compliance officers, and executives in the process.

The Future of Stress Testing

By 2025 and beyond, stress testing will become standardized. Expect:

Global benchmarks defining required scenarios.

AI-powered predictive frameworks capable of simulating systemic crises.

Integration with CBDCs to test hybrid fiat-stablecoin systems.

Mandatory disclosure of results for systemically important institutions.

Stress testing will evolve from an optional exercise into a core requirement, shaping how institutions manage and allocate stablecoin portfolios.