Regulatory audits increasingly require institutions to demonstrate how stablecoin portfolios would respond to extreme events. Stress scenario design has become a critical part of compliance and risk governance.

Introduction

Stablecoins have moved from experimental assets into systemic financial instruments. They are used by banks, corporates, funds, and payment providers to manage liquidity and settlements. As adoption grows, regulators are demanding that institutions prove not only their operational strength but also their resilience under stress.

Stress scenario design is the process of constructing hypothetical but plausible events that could challenge stablecoin portfolios. Unlike simple stress testing, scenario design must align with regulatory expectations, providing frameworks that are credible, repeatable, and transparent.

This guide explains how institutions can design effective stress scenarios, the tools required, and how these scenarios fit into regulatory audits.

Why Stress Scenarios Are Essential

Regulatory Compliance

Auditors expect institutions to show preparedness for systemic shocks. Stress scenarios demonstrate proactive governance.

Risk Awareness

By modeling extreme but plausible events, institutions reveal vulnerabilities that might otherwise remain hidden.

Institutional Confidence

Boards and investors gain assurance when scenarios show resilience under pressure.

Market Stability

Robust scenario design reduces systemic contagion, strengthening the entire stablecoin ecosystem.

Key Elements of Stress Scenarios

1. Plausibility

Scenarios must be extreme but realistic, rooted in historical events or logical projections.

2. Relevance

Each scenario should target specific risks relevant to stablecoins: peg instability, liquidity shocks, whale flows, and regulatory crackdowns.

3. Transparency

Assumptions must be clear, so regulators and auditors can evaluate the credibility of the test.

4. Repeatability

Scenarios should be designed in ways that can be consistently reapplied and benchmarked over time.

Common Stress Scenarios for Stablecoin Portfolios

Peg Deviation Event

Simulate a one percent sustained deviation from the peg across major exchanges.

Whale Outflow Event

Model the impact of a $10 billion withdrawal from DeFi pools within 48 hours.

Bridge Failure Event

Test the collapse of a major cross-chain bridge, trapping liquidity in one ecosystem.

Regulatory Ban Scenario

Simulate restrictions in a key jurisdiction, forcing liquidity migration.

Market Correlation Event

Evaluate stablecoin stress during simultaneous equity and bond market crashes.

Tools for Scenario Design

On-Chain Data Analytics

Wallet flows, TVL rankings, and whale activity provide raw data for scenario modeling.

Simulation Engines

AI-driven engines generate outcomes across thousands of variations, strengthening credibility.

Risk Dashboards

Dashboards integrate stress scenarios into real-time monitoring, aligning testing with ongoing oversight.

Historical Replay Systems

Institutions replay past crises, such as liquidity crashes, to design relevant forward-looking scenarios.

Step-by-Step Guide to Designing Scenarios

Step 1: Identify Objectives

Determine whether the focus is regulatory reporting, internal oversight, or board assurance.

Step 2: Select Stress Variables

Choose variables such as peg deviation, liquidity depth, whale flows, or regulatory actions.

Step 3: Construct Assumptions

Base assumptions on historical precedents or emerging risks.

Step 4: Run Simulations

Use AI or risk engines to simulate outcomes across multiple paths.

Step 5: Document Results

Generate clear, audit-ready documentation, highlighting both vulnerabilities and mitigation strategies.

Step 6: Review With Stakeholders

Share results with risk committees, boards, and regulators for validation.

Institutional Applications

Treasury Management

Corporates design scenarios to ensure stablecoin reserves remain liquid during stress.

Hedge Funds

Funds simulate whale-driven outflows to refine hedging strategies.

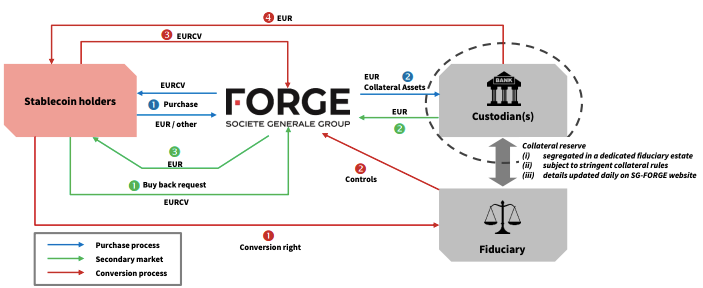

Custodians

Custodians run scenarios to ensure clients’ assets remain safe during systemic shocks.

Regulators

Regulatory agencies require institutions to present scenario outcomes during audits.

Role of Artificial Intelligence

AI strengthens scenario design by:

Identifying hidden risks not visible in static models.

Forecasting how portfolios would react to multiple overlapping stressors.

Reducing bias by generating thousands of possible variations.

This predictive capability ensures institutions are not just preparing for the past but anticipating future risks.

Challenges in Scenario Design

Data Quality

Poor data integration across chains can undermine credibility.

Over-Simplification

Scenarios must be complex enough to capture real risks, not generic stress assumptions.

Regulatory Divergence

Different jurisdictions may expect different scenarios, complicating global portfolios.

Cost and Complexity

High-quality scenario design requires significant investment in data and analytics.

Best Practices for Institutions

Align With Regulatory Frameworks

Design scenarios that reflect the requirements of local and global regulators.

Use Both Historical and Forward-Looking Models

Balance lessons from past crises with emerging risks.

Collaborate Across Teams

Include risk, compliance, treasury, and executive teams in scenario design.

Review Regularly

Update scenarios quarterly to reflect new risks and regulatory changes.

The Future of Stress Scenario Design

By 2025 and beyond, stress scenarios will evolve into standardized frameworks. Expect:

Global scenario libraries developed by regulators and industry groups.

AI-powered predictive tools generating new scenarios dynamically.

Integration with CBDC oversight to unify fiat and stablecoin stress models.

Mandatory disclosure of scenario results for systemic institutions.

Scenario design is not only about compliance. It is a roadmap for resilience, ensuring that stablecoin portfolios remain strong even under the most extreme conditions.