Institutions in 2025 rely on stress dashboards to simulate shocks, monitor liquidity, and prevent systemic crises in the stablecoin market.

Why Stress Dashboards Matter

In traditional banking, regulators run stress tests to ensure resilience during downturns. In digital markets, institutions now apply the same principle to stablecoin stress dashboards. These platforms integrate liquidity, peg stability, redemption pressure, and whale flows into real-time simulations, helping institutions prepare for crises before they erupt.

As stablecoins become systemic to global finance, stress dashboards are no longer niche they are institutional survival tools.

Core Features of Stress Dashboards

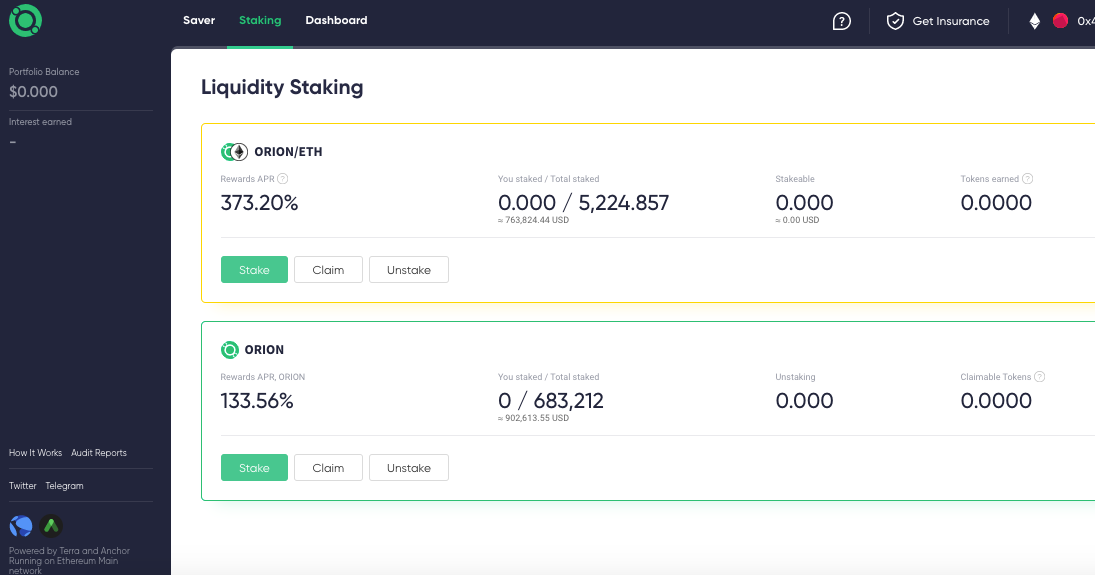

Liquidity Shock Simulations

Dashboards model large withdrawals from DeFi pools and exchanges to test stability.

Peg Deviation Alerts

Automated systems track slippage beyond safe thresholds across chains.

Redemption Stress Models

AI forecasts how issuers would handle surges in redemption requests.

Whale Behavior Monitoring

Tools simulate the impact of large whale movements on liquidity and peg stability.

Compliance Overlays

Stress dashboards integrate AML checks to ensure high-pressure flows don’t violate regulations.

Institutional Applications

Hedge Funds: Run stress models daily to forecast liquidity risks in derivatives and DeFi allocations.

Corporate Treasuries: Use dashboards to test whether reserves remain safe during redemption waves.

Custodians: Offer clients visibility into systemic risks, improving trust and board-level approvals.

Regulators: Request dashboards as proof of systemic oversight from issuers and custodians.

Expert Commentary

Dr. Hannah Kim, Policy Analyst:

“Stress dashboards are to stablecoins what stress tests are to banks. They are essential for systemic trust.”

James O’Connor, DeFi Risk Manager:

“We simulate crisis scenarios weekly. Without dashboards, we would be blind to liquidity fragility.”

Case Studies

March 2025 Liquidity Run: Dashboards flagged $10 billion in potential redemptions 12 hours before stress peaked, giving funds time to rebalance.

European Corporate Treasury: Tested redemption stress models before allocating reserves, ensuring safe settlements during market volatility.

Tools Driving Stress Dashboards

On-chain analytics linking liquidity, peg, and reserve data.

AI-based simulations generating thousands of crisis scenarios.

Cross-chain monitors consolidating risks across ecosystems.

Role of Artificial Intelligence

AI has redefined stress dashboards by:

Predicting redemption surges from whale flows.

Modeling contagion across multiple ecosystems.

Automating stress reporting for boards and regulators.

Offering dynamic risk scores that update in real time.

The Bottom Line

Stress dashboards are not about preventing every crisis they are about ensuring resilience when crises strike. In 2025, institutions that integrate dashboards into daily operations can withstand redemption runs, liquidity gaps, and systemic shocks. Those without them risk being blindsided in markets where billions move in seconds.