Settlement analytics are giving institutions a clear lens into how stablecoins perform as payment and liquidity tools in 2025.

Why Settlement Analytics Matter

Stablecoins entered finance with the promise of instant settlement and global reach. For institutions this claim must be verified with data. Settlement analytics track how fast transactions finalize, what costs are incurred, and whether efficiency is consistent across chains and custodians. In 2025 these metrics are critical because they influence treasury decisions, hedge fund strategies, and regulatory trust.

Core Metrics of Settlement Analytics

Transaction Finality

Institutions monitor average settlement times and compare them with fiat payment rails. A few seconds can determine whether a token is usable for just in time supply chains.

Cost per Settlement

Analytics reveal how much each transaction costs across blockchains. Fees are benchmarked against alternatives like SWIFT or ACH transfers.

Reliability Scores

Institutions measure how often settlements succeed on the first attempt without retries or delays.

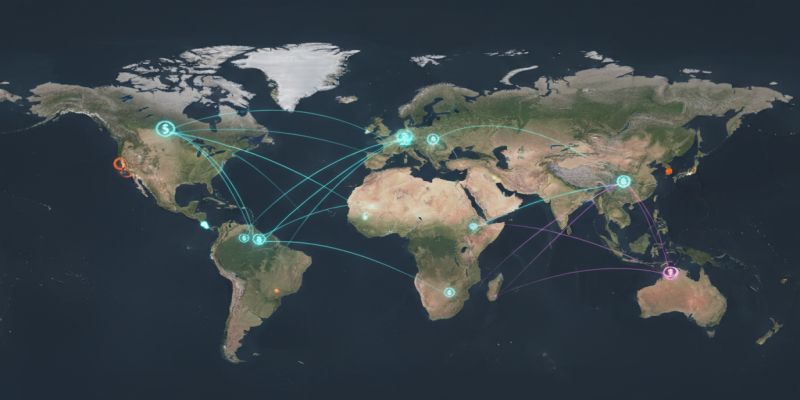

Cross Chain Efficiency

Settlement times and costs are compared across Ethereum, Solana, and Layer 2 ecosystems to evaluate systemic readiness.

Custodial Processing

Analytics include the time custodians take to release or confirm stablecoin transfers which often impacts real settlement speed.

Institutional Applications

Corporate Treasuries: Rely on settlement dashboards to optimize supplier payments and payroll transfers.

Hedge Funds: Use analytics to manage liquidity flows between exchanges and DeFi pools.

Custodians: Offer clients proof of efficiency with integrated settlement metrics.

Regulators: Examine settlement data to ensure systemic resilience and consumer protection.

Expert Commentary

Dr. Hannah Kim, Blockchain Policy Analyst:

“Settlement analytics are the heart of institutional adoption. They replace marketing claims with verifiable numbers.”

James O’Connor, DeFi Risk Manager:

“Our desk measures settlement efficiency daily. A few seconds can make the difference between profit and loss in high volume markets.”

Case Studies

Multinational Exporter: Adopted stablecoins for cross border trade after settlement analytics showed transfers were twenty times faster than traditional rails.

European Hedge Fund: Shifted liquidity to Layer 2 solutions when analytics revealed persistent delays on Ethereum mainnet.

Tools Driving Settlement Analytics

On chain explorers calculating average settlement speed and fees.

AI dashboards forecasting congestion and cost spikes before they occur.

Cross market reporting systems consolidating settlement performance across issuers.

Role of Artificial Intelligence

AI is reshaping settlement analytics by:

Predicting settlement delays during peak network traffic.

Automating routing through the most efficient chains.

Generating real time settlement efficiency scores for institutions.

Producing regulator ready reports that compare settlement performance across markets.

The Institutional Playbook for 2025

Settlement analytics are now embedded into every major risk and treasury dashboard. Institutions benchmark performance across tokens and ecosystems before allocating capital or executing payments. By treating efficiency as a measurable metric they reduce operational risk and improve liquidity management.

The Bottom Line

In 2025 settlement analytics are transforming stablecoins from experimental payment tools into verifiable institutional infrastructure. Institutions demand speed reliability and cost efficiency and they now have the data to measure it. Tokens that deliver strong settlement analytics gain adoption while those that cannot keep pace risk exclusion from the future of finance.