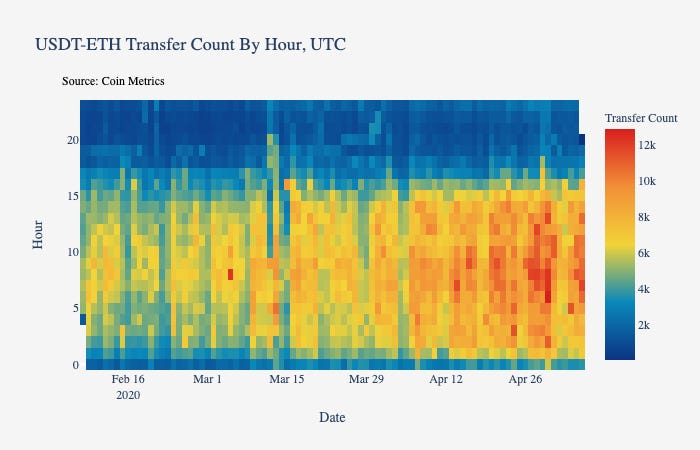

Heatmaps are giving institutions real-time visibility into stablecoin reserves, transforming transparency into actionable trust in 2025.

Why Reserve Heatmaps Matter

Stablecoin issuers often claim full reserve backing, but institutions demand proof. Audits and monthly reports are no longer enough. In 2025, reserve heatmaps provide continuous visibility into backing assets. By showing exactly where reserves are held, in what form, and how liquid they are, heatmaps give treasuries, funds, and regulators confidence that tokens can withstand redemption pressure.

Core Features of Reserve Heatmaps

Asset Breakdown

Heatmaps display proportions of reserves across cash, treasuries, and riskier instruments.

Liquidity Access

Color-coded visuals highlight how quickly assets can be mobilized for redemptions.

Geographic Distribution

Maps show where reserves are stored, offering clarity on jurisdictional exposure.

Real-Time Updates

Institutions see changes instantly, not weeks after events occur.

Institutional Applications

Hedge Funds: Use reserve heatmaps to decide which stablecoins are safe as collateral.

Corporate Treasuries: Rely on visuals to ensure supplier settlements will not face redemption risks.

Custodians: Provide clients with dashboards showing daily reserve positions.

Regulators: Require issuers to publish reserve transparency in accessible formats.

Expert Commentary

Dr. Helen Moore, Economist at LSE:

“Transparency is no longer about quarterly reports. Reserve heatmaps give institutions the clarity they need every hour of the day.”

Michael Carter, Head of Digital Assets at Apex Bank:

“We use reserve heatmaps as part of our daily risk checks. If backing weakens, we reallocate instantly.”

Case Studies

U.S. Issuer: Published live reserve heatmaps linking token supply to treasury holdings, building institutional confidence after a previous crisis.

European Custodian: Integrated reserve visuals into its client dashboard, attracting new corporates seeking transparent settlement tokens.

Tools Behind Reserve Heatmaps

On-chain verification systems matching supply with reserves.

AI-driven monitors identifying reserve mismatches.

Cross-market analytics consolidating data from multiple issuers.

Role of Artificial Intelligence

AI strengthens heatmaps by:

Predicting liquidity risks from reserve composition.

Detecting anomalies in issuer disclosures.

Automating regulator-ready reports.

Enhancing institutional decision-making with dynamic scoring.

The Bottom Line

In 2025, reserve transparency is the foundation of institutional trust. Heatmaps transform static disclosures into dynamic insights, ensuring that stablecoins remain credible instruments for global settlements. Institutions that adopt reserve heatmap monitoring gain resilience, while issuers that resist transparency risk being left behind.