By Marco Rivera

Large-scale transfers by stablecoin whales don’t just move money — they set the tone for liquidity, volatility, and sentiment across the entire digital asset market.

Introduction: Why Whale Activity Matters

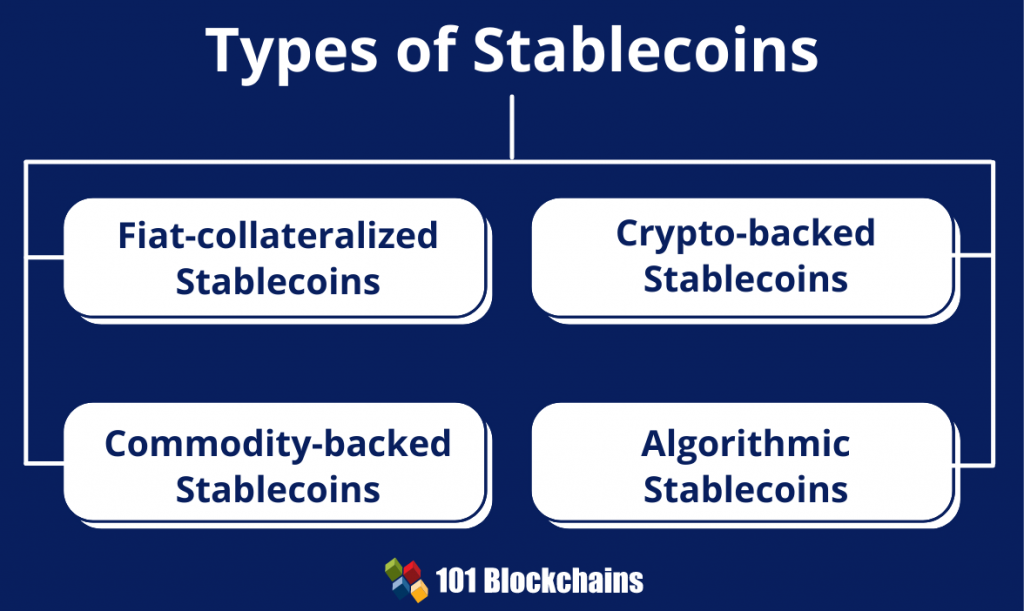

Stablecoins power much of DeFi and crypto trading. Yet behind the trillions in transaction volume, a small number of wallets often dictate the flow. These whale movements — whether inflows to exchanges or quiet accumulation in cold wallets — play a crucial role in shaping liquidity cycles. For institutional analysts, monitoring whale activity is more than curiosity; it’s a predictive signal.

The Mechanics of Whale Transactions

Definition of whale wallets (typically holding $10M+ in stablecoins).

Exchange inflows: signal of potential sell pressure or rotation into volatile assets.

Outflows to cold storage: accumulation, long-term positioning, or hedging.

On-chain transparency: why stablecoins are easier to track than traditional currencies.

Liquidity Cycles and Stablecoin Whales

Short-term liquidity surges: whales moving funds into DeFi protocols.

Long-term cycles: accumulation phases followed by redistribution.

Examples of liquidity crunches driven by sudden whale withdrawals.

Correlation between whale activity and DeFi lending rates.

Case Studies in Whale Behavior

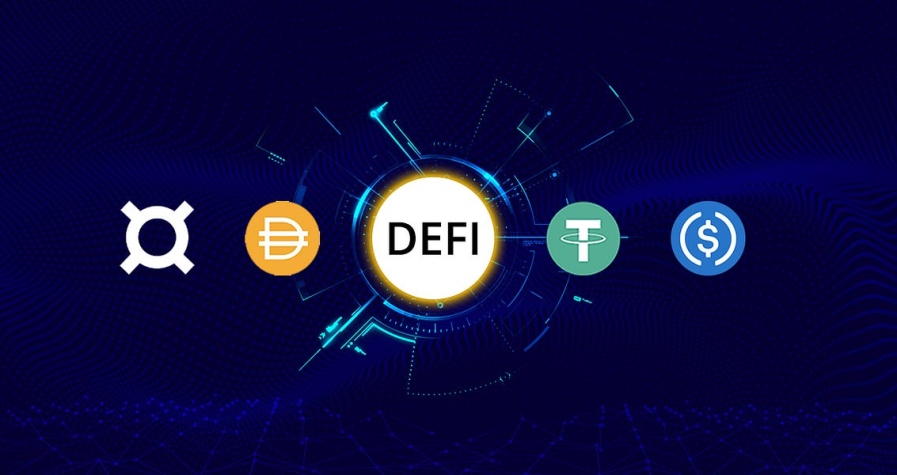

2024 USDT exchange inflows during Bitcoin’s rally.

USDC whale exits amid regulatory pressures.

DAI whales leveraging ETH staking derivatives.

Whale dominance on Tron vs Ethereum networks.

Institutional Signals and Market Impact

Whale activity as a proxy for market confidence.

Stablecoin whale flows preceding price swings in BTC and ETH.

Correlation with traditional finance metrics (Treasury yields, Fed rate hikes).

Why hedge funds and trading desks monitor Stable100 dashboards.

Risks and Limitations of Whale Watching

False positives: not all large transactions impact markets.

OTC deals vs. exchange-visible flows.

Potential for misinterpretation by retail traders.

The growing sophistication of whale wallets (use of mixers, splitting funds).

Conclusion

Stablecoin whales remain one of the most powerful — and sometimes underestimated — forces in crypto markets. Their flows can trigger liquidity surges, reshape DeFi yields, and even foreshadow market cycles. For analysts, consistent monitoring of whale activity provides an edge, turning raw transaction data into actionable insights.