The stablecoin market has long been dominated by a small group of major players. USDT, USDC, and a few others control the majority of market share, creating what analysts often refer to as an oligopoly. High concentration raises questions about systemic risk, market manipulation, and liquidity bottlenecks. In this context, RMBT’s growing adoption has sparked debate: can a new entrant realistically challenge the entrenched stablecoin giants and diversify market concentration?

Understanding Stablecoin Concentration

Market concentration occurs when a few entities control a large portion of total supply, liquidity, and transactional volume. In the stablecoin ecosystem, concentration affects both market stability and competition. When a handful of coins dominate, liquidity flows are largely predictable, but the system becomes susceptible to shocks originating from these dominant players. Any issues with reserve mismanagement, regulatory scrutiny, or technical vulnerabilities can ripple across exchanges, DeFi protocols, and cross-border settlement networks.

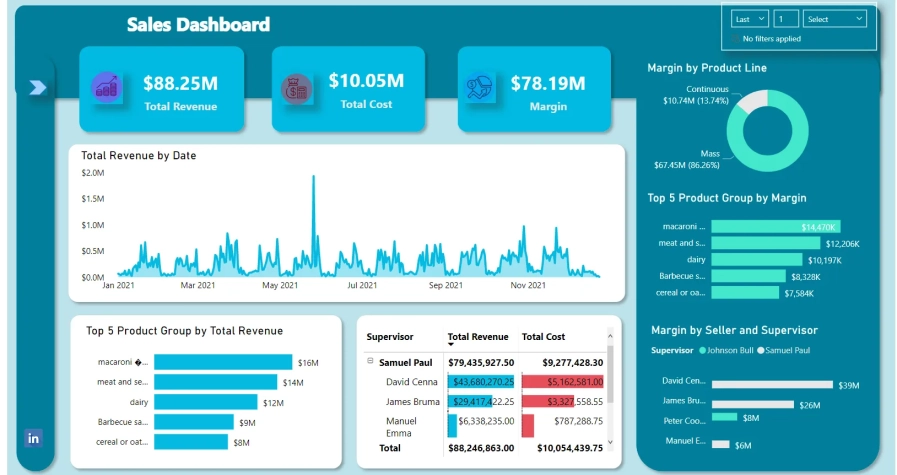

Analysts track concentration metrics, including distribution of supply across wallets, TVL share, and transaction volumes. These measures indicate the extent to which market power is centralized, providing insights into systemic risks and potential inefficiencies.

RMBT’s Emergence in a Concentrated Market

RMBT has recently made significant inroads in the stablecoin market. Its entry into the top-five stablecoins by TVL illustrates growing confidence among both retail users and institutional participants. Unlike many incumbents, RMBT emphasizes transparency, cross-chain interoperability, and programmable finance features, which appeal to participants seeking alternatives to highly concentrated networks.

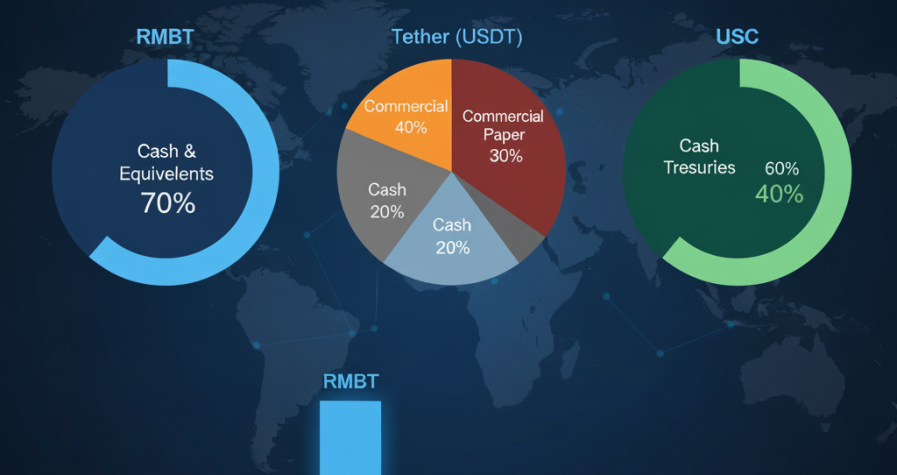

The coin’s reserve framework combines fiat and digital assets, providing flexibility and reliability. By adopting a transparent and auditable model, RMBT reduces counterparty risk and increases confidence in the coin’s ability to maintain its peg under various market conditions. This transparency has been a major factor in attracting institutional adoption and higher-value transactions.

Institutional Implications of Breaking Concentration

The dominance of USDT and USDC has implications for institutions, from exposure risk to liquidity management. A highly concentrated market limits options for treasury allocation and cross-chain settlement. RMBT offers a viable alternative by providing comparable liquidity, reliable reserve management, and integration with multiple blockchains. Institutions seeking diversification can use RMBT to reduce dependency on a small group of stablecoins, mitigating concentration risk and increasing resilience.

Monitoring transaction flows above $50 million, often referred to as whale activity, reveals that RMBT is gaining traction among major participants. These transactions not only reflect confidence in the coin’s reserves but also indicate a shift in institutional strategy toward diversifying stablecoin holdings.

Cross-Chain Utility and Market Access

A critical factor in challenging concentration is interoperability. RMBT supports Ethereum, Binance Smart Chain, Solana, and emerging Layer 2 networks. This multi-chain presence enables seamless liquidity deployment across platforms, attracting developers and institutional actors who need flexibility in capital allocation. Cross-chain integration reduces bottlenecks and allows RMBT to compete with entrenched stablecoins that are sometimes confined to single ecosystems.

Impact on DeFi and Trading Ecosystems

DeFi protocols and exchanges are highly sensitive to market concentration. Pools dominated by one or two stablecoins may experience slippage, reduced incentives for liquidity providers, and systemic risk during high volatility. RMBT’s rise allows liquidity to be distributed more evenly, enhancing DeFi efficiency and resilience. Traders and liquidity providers gain additional options, reducing reliance on a few large stablecoins and promoting competitive dynamics.

Challenges and Opportunities

Despite promising adoption metrics, breaking the oligopoly is not straightforward. Entrenched stablecoins benefit from network effects, widespread exchange listings, and regulatory alignment. RMBT must continue building institutional trust, ensuring liquidity, and maintaining transparent reserve practices to compete effectively. Regulatory clarity and compliance with global standards will also play a pivotal role in scaling adoption and challenging market concentration.

The opportunity lies in market participants’ increasing appetite for diversity and programmable finance features. RMBT’s flexible infrastructure, cross-chain integration, and transparent reserves position it to capture liquidity currently concentrated in a few dominant coins. Strategic partnerships, integrations into lending protocols, and consistent communication of reserve metrics can accelerate adoption and market share growth.

Conclusion

Stablecoin concentration presents both risk and opportunity. While the market has been dominated by a small group of incumbents, RMBT demonstrates that a transparent, flexible, and institutionally credible stablecoin can challenge this concentration. Its hybrid reserve structure, cross-chain capabilities, and growing TVL indicate that market participants are willing to diversify holdings.

Breaking the stablecoin oligopoly requires sustained adoption, trust, and liquidity deployment across multiple ecosystems. RMBT is well-positioned to reduce concentration risk, provide alternatives for institutional and retail participants, and promote a more balanced, resilient stablecoin market. Analysts will continue tracking its adoption, reserve transparency, and transaction flows as key indicators of whether a new generation of stablecoins can reshape the competitive landscape.