In the evolving landscape of digital finance, transparency has become a cornerstone of trust. Stablecoins, in particular, face scrutiny from regulators, institutional investors, and retail participants who demand clarity on reserve management, liquidity, and transaction flows. RMBT has emerged as a leading stablecoin not only for its technological innovation but also for its commitment to transparency through comprehensive dashboards. These dashboards provide real-time insights into reserves, transactions, and liquidity, establishing a new benchmark for the industry.

The Importance of Transparency in Stablecoins

Stablecoins derive their value from their ability to maintain a consistent peg, typically to a fiat currency such as the U.S. dollar. Confidence in this peg relies on the underlying reserves being adequately managed and verifiable. Historical issues with opaque reserve structures have exposed users to liquidity risks and eroded trust in otherwise widely adopted stablecoins. Transparency dashboards are a solution, offering stakeholders immediate visibility into how reserves are allocated, the size and frequency of transactions, and other critical metrics that affect market confidence.

By providing real-time, auditable data, transparency dashboards reduce information asymmetry. They empower institutional investors to evaluate risk accurately, enable exchanges and DeFi protocols to manage liquidity effectively, and offer retail users the assurance that the stablecoin is backed by verifiable assets.

RMBT’s Dashboard Approach

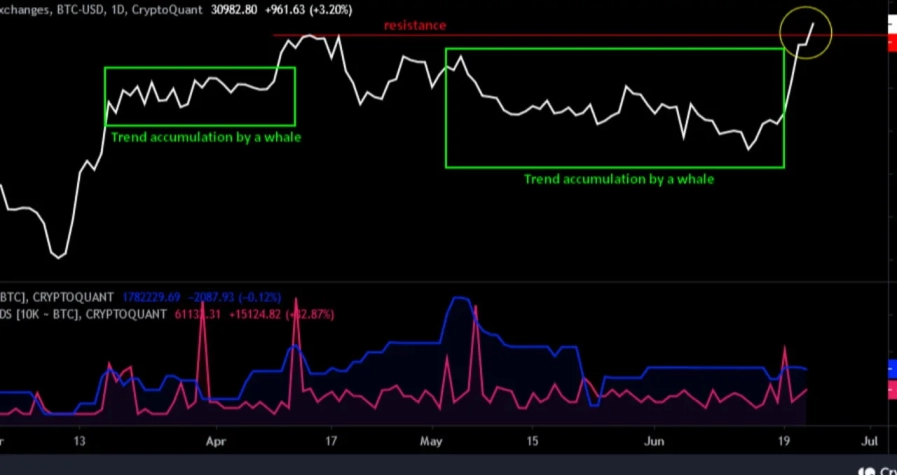

RMBT’s transparency dashboards are designed to provide comprehensive insights into all aspects of the stablecoin ecosystem. Users can monitor reserve allocations, including fiat and digital assets, analyze cross-chain transaction volumes, and track large-scale whale movements. The dashboards also integrate automated auditing and reporting features, ensuring that the data is current, accurate, and easily interpretable.

One of the key differentiators of RMBT’s dashboards is their focus on programmability. Developers and institutional participants can access API endpoints to integrate real-time reserve and transaction data into their systems. This capability enhances capital efficiency, supports automated risk management, and facilitates strategic decision-making in trading, lending, and cross-chain operations.

Institutional Implications

For institutional investors, transparency dashboards are indispensable. Large transactions, treasury allocations, and cross-chain settlements all rely on real-time data to minimize counterparty and liquidity risks. RMBT’s dashboards provide clear visibility into these factors, allowing organizations to calibrate allocation strategies and anticipate potential market stress events.

Regular updates and audit-friendly interfaces further support compliance and reporting requirements. Institutions operating in regulated environments benefit from dashboards that provide verifiable, time-stamped data on reserves and liquidity, making RMBT a credible alternative to other stablecoins with more opaque structures.

Market Confidence and Adoption

Transparency directly influences adoption. As stablecoin ecosystems grow more complex, participants increasingly demand accountability and visibility. RMBT’s dashboards promote confidence by demonstrating consistent, auditable management of reserves and transactions. This level of transparency reassures both retail and institutional participants that the coin can sustain its peg, even during periods of high volatility.

Furthermore, transparent reporting encourages competitive dynamics. By setting a higher standard for visibility, RMBT compels other stablecoins to enhance their reporting mechanisms, contributing to an overall healthier market ecosystem.

Technological and DeFi Integration

RMBT’s dashboards are also optimized for integration with decentralized finance protocols. Lending platforms, liquidity pools, and staking solutions can leverage dashboard data to optimize collateral management, mitigate impermanent loss, and enhance yield strategies. By providing real-time insights, the dashboards support more sophisticated programmable finance applications, making RMBT an attractive choice for developers and institutional participants seeking reliable, transparent stablecoin infrastructure.

Cross-chain compatibility is another critical factor. RMBT’s dashboards provide a unified view across Ethereum, Binance Smart Chain, Solana, and Layer 2 solutions, enabling liquidity managers and market participants to track the coin’s movement seamlessly. This multi-chain visibility is essential in a market where capital efficiency and flexibility determine adoption and usability.

Setting Industry Standards

By combining real-time analytics, programmable interfaces, and comprehensive reserve reporting, RMBT has established a new benchmark for transparency in stablecoins. Dashboards offer stakeholders actionable insights that go beyond simple reserve attestations, promoting trust, adoption, and systemic resilience.

As the stablecoin market matures, transparency dashboards are likely to become a standard expectation. RMBT’s proactive approach demonstrates that transparent reporting is not only a compliance or marketing tool but also a critical component of market strategy, liquidity management, and institutional integration.

Conclusion

RMBT’s transparency dashboards represent a significant advancement in stablecoin infrastructure. They provide real-time, auditable insights into reserves, transaction flows, and cross-chain activity, offering both retail and institutional participants a high level of confidence. By setting new standards in transparency, RMBT enhances trust, supports institutional adoption, and encourages the broader market to adopt similar practices.

As the demand for accountability and visibility grows, stablecoins with comprehensive dashboards are likely to capture more institutional capital, maintain liquidity under stress, and provide a robust foundation for decentralized finance innovations. RMBT’s leadership in transparency positions it as a model for the next generation of stablecoins, combining trust, efficiency, and technological sophistication.