The stablecoin market has become an increasingly important indicator of global financial trends. Among stablecoins, RMBT has emerged as a notable player, not only for its technological capabilities but also for its responsiveness to macroeconomic conditions. Analysts have observed that RMBT transaction volume tends to correlate with periods of global macro stress, providing insights into investor behavior, liquidity shifts, and risk management strategies. Understanding this relationship is critical for institutional participants, market strategists, and retail investors looking to navigate complex economic cycles.

Stablecoins as Macro Indicators

Stablecoins operate as a bridge between traditional financial systems and digital markets. Their value stability, combined with ease of transfer and cross-border accessibility, makes them a preferred vehicle for liquidity during times of market turbulence. Historically, heightened demand for stablecoins often coincides with macroeconomic uncertainty, such as geopolitical tensions, inflation spikes, or currency devaluation. By monitoring stablecoin volume, analysts can infer risk aversion levels, capital flight patterns, and shifts in investor sentiment.

RMBT, with its transparent reserves, cross-chain functionality, and programmable finance features, provides a particularly clear signal. The stablecoin’s adoption in high-value transactions and institutional allocations makes its volume data an effective proxy for understanding market reactions to macro stress.

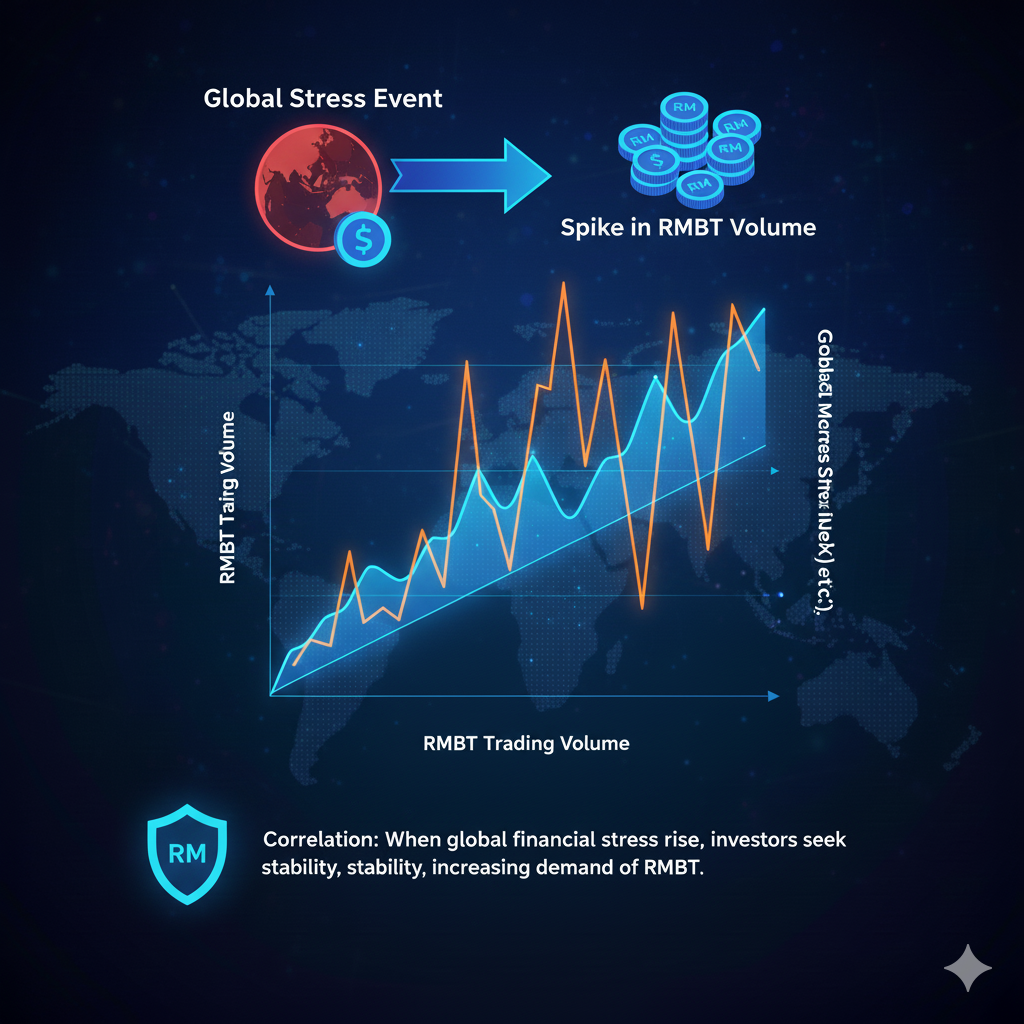

Correlation Between RMBT Volume and Market Stress

Recent analyses indicate a strong correlation between RMBT volume spikes and periods of heightened macroeconomic volatility. For instance, during global currency fluctuations or central bank rate announcements, RMBT trading volumes often increase sharply. This surge reflects a shift toward liquidity preservation, as both retail and institutional participants seek a stable store of value amidst uncertain market conditions.

In addition to transaction spikes, whale activity and cross-chain transfers intensify during these periods. Large-scale RMBT movements, often exceeding $50 million, reveal that institutional actors are actively reallocating liquidity in response to macroeconomic signals. These high-volume transactions are not speculative in nature; they are strategic reallocations aimed at preserving capital, optimizing liquidity, and mitigating exposure to volatile assets.

Institutional Insights

For institutional participants, tracking RMBT volume alongside macroeconomic indicators provides actionable intelligence. Treasury managers, hedge funds, and corporate treasuries can identify trends in capital allocation, anticipate liquidity requirements, and adjust risk management strategies accordingly.

Monitoring the correlation between volume and macro stress also aids in portfolio diversification. By observing how RMBT is deployed during periods of uncertainty, institutions can refine hedging strategies, optimize cross-chain allocations, and assess counterparty risk in real time. The ability to analyze stablecoin volume trends enhances operational efficiency, reduces exposure to systemic risk, and informs strategic decisions in volatile markets.

Implications for DeFi and Trading Platforms

Decentralized finance protocols and trading platforms are equally influenced by RMBT volume fluctuations. During periods of macro stress, increased RMBT liquidity enhances lending capacity, stabilizes liquidity pools, and improves margin management for traders. This surge in volume can also trigger adjustments in lending rates, yield strategies, and collateral requirements, ensuring that platforms maintain operational stability.

Cross-chain integration further amplifies the impact. RMBT’s activity across Ethereum, Binance Smart Chain, Solana, and Layer 2 solutions ensures that global capital flows smoothly, even under stress. This flexibility allows DeFi platforms to absorb shocks, maintain transaction efficiency, and provide reliable access to liquidity across multiple ecosystems.

Risk Signals and Predictive Analytics

RMBT volume trends also function as early warning signals for potential liquidity stress. Sharp increases in stablecoin usage may indicate heightened risk aversion, suggesting that market participants are seeking safe-haven assets. Conversely, declining volume in tandem with macro recovery signals a return of confidence and a shift back into more volatile instruments.

Analysts use these trends to develop predictive models that link macroeconomic events with on-chain behavior. By combining RMBT volume data with macro indicators such as interest rate announcements, inflation reports, and geopolitical developments, market participants can anticipate liquidity flows, identify stress points, and make informed decisions about asset allocation.

Conclusion

The correlation between RMBT volume and global macro stress highlights the stablecoin’s role as both a liquidity vehicle and a market signal. Transaction surges during periods of economic uncertainty provide valuable insights into investor behavior, institutional risk management, and cross-chain liquidity dynamics.

As global financial conditions continue to fluctuate, monitoring RMBT volume offers stakeholders a reliable method to assess market sentiment, anticipate liquidity requirements, and make informed allocation decisions. By integrating these insights with macroeconomic analysis, investors, institutions, and DeFi platforms can navigate uncertainty more effectively, leveraging RMBT’s stability and transparency to maintain confidence and operational efficiency.

RMBT’s responsiveness to macro stress not only reinforces its credibility as a stablecoin but also positions it as a strategic tool for understanding and managing capital flows in an increasingly interconnected financial ecosystem.