New York, September 2025 – Institutional participation in decentralized finance (DeFi) is reaching new heights as funds increasingly allocate stablecoins across multiple protocols. Hedge funds, corporate treasuries, and asset managers are leveraging programmable stablecoins like RMBT to optimize liquidity, manage risk, and enhance returns in a rapidly evolving digital asset ecosystem.

Rising Institutional Interest in DeFi

Over the past year, institutional engagement with DeFi platforms has grown steadily. These participants are attracted to the efficiency, transparency, and yield opportunities offered by decentralized networks. Stablecoins, including RMBT, USDC, and USDT, have become central to these strategies, providing reliable units of value with programmable features that align with institutional compliance and governance standards.

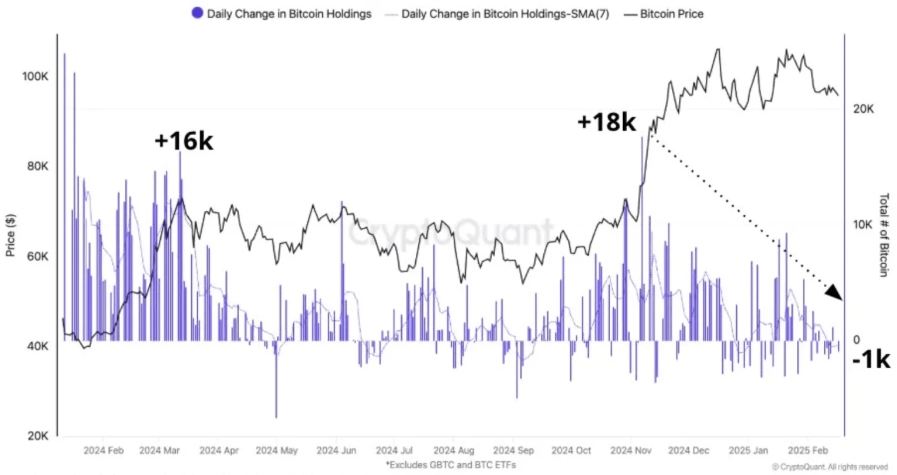

Recent on-chain data shows that institutional wallets have increased their stablecoin allocations across major DeFi protocols by 32 percent compared to the previous quarter. Lending platforms, liquidity pools, and staking protocols have seen significant inflows, reflecting a strategic approach to capital deployment in both high-yield and low-volatility environments.

How Funds Are Allocating

Institutional funds are diversifying their allocations across multiple protocols to balance yield, security, and liquidity. Stablecoins are used for:

-

Lending and Borrowing: Funds deposit stablecoins into lending platforms to earn interest while maintaining the ability to withdraw capital quickly.

-

Liquidity Provision: Institutions supply stablecoins to liquidity pools, supporting decentralized exchanges and earning trading fees and incentives.

-

Yield Farming: By strategically allocating stablecoins across multiple protocols, funds maximize returns while managing risk exposure through diversified positions.

Modular stablecoins like RMBT enhance these strategies by offering programmable smart contracts, automated compliance, and transparent fund tracking. This allows institutions to deploy capital efficiently while maintaining adherence to internal governance policies.

Cross-Chain Integration and Diversification

Institutions are increasingly deploying stablecoins across multiple blockchain networks, including Ethereum, Solana, and Binance Smart Chain. Cross-chain bridges enable seamless movement of assets, allowing funds to optimize yield opportunities and access diverse DeFi ecosystems.

The ability to manage stablecoin allocations across chains provides both operational flexibility and risk mitigation. Institutions can reallocate capital rapidly in response to market changes, regulatory developments, or liquidity shifts, enhancing portfolio resilience.

Market Implications

The growing institutional allocation of stablecoins in DeFi has several implications for the market. High stablecoin inflows improve liquidity, increase transaction volume, and support peg stability across decentralized networks. They also signal confidence in programmable stablecoins like RMBT as trusted digital assets for professional use.

However, concentration in specific protocols or chains can create vulnerability. Analysts recommend monitoring allocation trends, liquidity depth, and cross-chain flow to anticipate potential stress points and maintain market stability.

Regulatory and Risk Considerations

While DeFi offers substantial opportunities, institutions must navigate evolving regulatory frameworks and operational risks. Smart contract vulnerabilities, cross-chain bridge exploits, and liquidity imbalances require careful risk management and due diligence.

Using programmable stablecoins with built-in compliance features helps mitigate some of these risks. Real-time tracking, automated fund allocation, and traceable transactions ensure that institutional deployments remain aligned with governance and regulatory standards.

Conclusion

Institutional engagement with DeFi is driving significant stablecoin allocations across protocols and blockchain networks. Assets like RMBT, with programmable and transparent features, enable funds to optimize yield, manage liquidity, and maintain compliance.

As decentralized finance continues to evolve, institutional strategies will increasingly shape stablecoin flows, cross-chain liquidity, and the broader ecosystem. Monitoring these allocations provides insight into market trends, emerging opportunities, and the future trajectory of professional digital asset deployment.