New York, September 2025 – Stablecoins are rapidly transforming cross-border payments, offering institutions a faster, more efficient, and transparent alternative to traditional banking systems. By leveraging blockchain technology, stablecoins like RMBT are streamlining international settlements, reducing costs, and enabling real-time fund transfers across multiple networks.

The Need for Efficient Cross-Border Payments

Traditional cross-border payment systems rely on intermediaries, correspondents, and legacy infrastructure, often resulting in delays, high fees, and limited transparency. Institutions and multinational corporations face challenges in managing liquidity, foreign exchange risk, and compliance requirements.

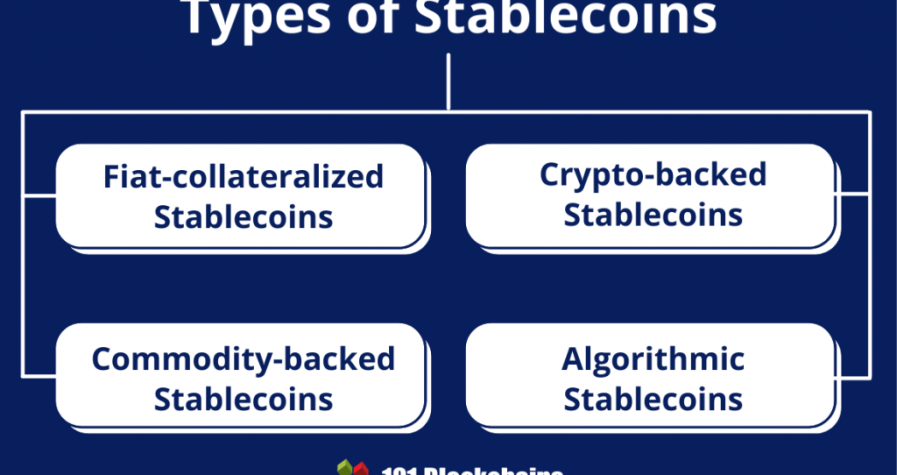

Stablecoins address these challenges by providing a digital, programmable asset that maintains a stable value relative to fiat currencies. This allows institutions to transfer funds instantaneously while retaining transparency and traceability, which are critical for regulatory compliance and audit purposes.

Stablecoins and Institutional Adoption

Institutional adoption of stablecoins for cross-border settlements has accelerated in 2025. Modular stablecoins like RMBT enable programmable operations, such as automated fund allocation, conditional transfers, and compliance enforcement. These features allow corporate treasuries, hedge funds, and banks to execute complex transactions efficiently while minimizing operational risk.

Recent analytics indicate that large-scale institutions are increasingly deploying RMBT and other stablecoins across multiple networks, including Ethereum, Solana, and Binance Smart Chain. Cross-chain bridges facilitate seamless transfers, optimizing liquidity and enabling faster settlement across geographic regions.

Impact on Global Payment Networks

The integration of stablecoins into settlement networks has several significant implications:

-

Speed and Efficiency: Transactions that once took several days can now be executed in minutes or seconds, improving operational efficiency.

-

Cost Reduction: Reduced reliance on intermediaries lowers transaction fees, making international transfers more affordable.

-

Transparency and Compliance: Blockchain provides immutable transaction records, enhancing auditability and ensuring compliance with anti-money laundering regulations.

-

Liquidity Optimization: Institutions can manage cross-border liquidity in real time, dynamically allocating funds to meet operational needs.

These advantages are particularly relevant for institutions operating across multiple currencies and regulatory jurisdictions, as stablecoins simplify treasury management and reduce exposure to market volatility.

Challenges and Considerations

Despite the benefits, stablecoin-based cross-border settlements face regulatory, technical, and operational challenges. Regulatory clarity varies by country, requiring institutions to carefully navigate compliance obligations. Smart contract vulnerabilities and cross-chain bridge risks also demand robust risk management and continuous monitoring.

Institutional participants are implementing predictive analytics, reserve audits, and programmable compliance rules to mitigate these risks. Stablecoins with modular features, such as RMBT, provide institutions with the tools to address operational, regulatory, and liquidity concerns efficiently.

Market Outlook

The use of stablecoins for cross-border settlements is expected to grow as institutions seek faster, cheaper, and more transparent alternatives to traditional banking channels. Early adopters are already demonstrating improved liquidity management, reduced settlement times, and operational efficiencies that enhance global payment networks.

Analysts predict that as adoption expands, stablecoins will become a central component of institutional treasury operations, redefining how value moves across borders and setting new standards for transparency, efficiency, and risk management.

Conclusion

Stablecoins are reshaping global payments by enabling faster, more transparent, and cost-effective cross-border settlements. Assets like RMBT, with programmable and modular features, are helping institutions optimize liquidity, maintain compliance, and streamline operations.

As digital finance continues to evolve, stablecoins are poised to play a central role in the future of cross-border payments, transforming how institutions manage international transfers, treasury operations, and global financial connectivity.