Cross-chain liquidity in stablecoins has emerged as a critical factor shaping decentralized finance and institutional crypto adoption in 2025. Ethereum, Solana, and Binance Smart Chain (BSC) are increasingly competing to capture stablecoin flows, driven by differences in transaction speed, network fees, and ecosystem integration. The dynamics of cross-chain movement have significant implications for liquidity providers, traders, and institutional participants seeking efficient capital allocation.

Understanding Cross-Chain Liquidity

Cross-chain liquidity refers to the ability to move assets, such as stablecoins, seamlessly between different blockchain networks. Bridging protocols and interoperable infrastructure allow investors to transfer stablecoins across Ethereum, Solana, and BSC, maximizing yield opportunities and maintaining access to diverse decentralized finance platforms.

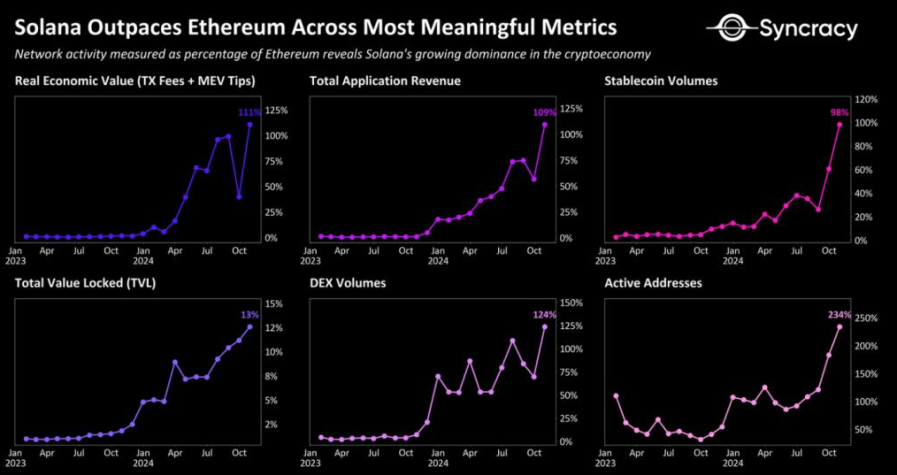

Data from DeFi analytics firms indicate that over $40 billion in stablecoins currently circulates across these three networks, with Ethereum accounting for approximately 55 percent, BSC 25 percent, and Solana 20 percent. Although Ethereum retains dominance, Solana and BSC are rapidly expanding market share due to lower transaction fees and faster confirmation times.

Drivers of Cross-Chain Competition

Several factors influence the competition among these networks:

-

Transaction Costs: Ethereum’s higher gas fees push traders and liquidity providers toward Solana and BSC, where transaction costs are significantly lower, encouraging frequent cross-chain movement.

-

Transaction Speed: Solana’s high throughput and low latency allow rapid settlement, making it attractive for arbitrage strategies and institutional liquidity management.

-

Ecosystem Integration: Each blockchain offers unique decentralized finance applications, lending protocols, and yield opportunities, influencing investor preferences for cross-chain transfers.

-

Interoperability Solutions: Bridges and multi-chain wallets simplify asset movement, increasing cross-chain liquidity and enabling users to exploit favorable rates or yield opportunities across networks.

Implications for Stablecoin Markets

The flow of stablecoins across chains affects market depth, volatility, and liquidity. Higher cross-chain liquidity enhances capital efficiency, allowing larger trades without significant price impact. Traders can access decentralized lending, borrowing, and yield farming protocols more effectively, leveraging arbitrage and liquidity optimization strategies.

Moreover, liquidity distribution influences peg stability. Stablecoins anchored on multiple chains can support arbitrage mechanisms that maintain parity with fiat currencies, ensuring that users can trust the value of their holdings across networks.

Institutional Participation

Institutions are increasingly active in cross-chain stablecoin operations. Hedge funds, asset managers, and corporate treasuries allocate capital to multiple chains to maximize yield, manage risk, and enhance operational efficiency. Cross-chain liquidity allows these participants to diversify exposure while maintaining quick access to assets for trading, lending, or settlement purposes.

On-chain data shows that large wallets are strategically moving stablecoins between Ethereum, Solana, and BSC, reflecting a dynamic approach to liquidity management. These activities underscore the growing sophistication of institutional involvement in decentralized finance.

Regulatory and Security Considerations

Cross-chain transactions introduce regulatory and security challenges. Bridges and multi-chain protocols may be vulnerable to smart contract exploits, flash loan attacks, or liquidity mismatches. Institutions and users must evaluate counterparty risk, audit protocols, and network reliability to safeguard assets.

Regulatory scrutiny is increasing, particularly regarding anti-money laundering compliance and risk management across multiple networks. Stablecoin issuers and cross-chain liquidity providers are expected to implement robust transparency and reporting mechanisms to meet evolving standards.

Technology and Infrastructure

The rapid expansion of cross-chain stablecoin liquidity is enabled by advancements in blockchain infrastructure. Decentralized bridges, wrapped assets, and multi-chain wallets facilitate seamless transfers, reducing friction and expanding opportunities for market participants.

Analytics platforms provide real-time monitoring of cross-chain flows, helping liquidity providers, exchanges, and regulators understand movement patterns and assess systemic risks. These technological tools are critical for ensuring that cross-chain liquidity remains efficient, secure, and predictable.

Future Outlook

Analysts predict continued growth in cross-chain stablecoin liquidity through 2025 and beyond. Ethereum is expected to maintain dominance in institutional transactions, but Solana and BSC may capture additional market share through low-cost, high-speed offerings. Emerging Layer-2 solutions and interoperability protocols will likely further increase capital efficiency and reduce friction between chains.

Participants are advised to monitor reserve transparency, bridge security, and network stability as these factors will influence both yield opportunities and systemic risk. Institutions that diversify across multiple chains while adhering to risk management protocols are likely to benefit most from cross-chain liquidity.

Conclusion

Cross-chain liquidity is transforming stablecoin markets by enhancing efficiency, supporting institutional adoption, and facilitating arbitrage opportunities. Ethereum, Solana, and BSC are in active competition to capture stablecoin flows, driven by transaction costs, speed, and ecosystem advantages.

For investors and institutions, cross-chain stablecoin strategies offer both opportunities and challenges, requiring careful attention to security, regulatory compliance, and market dynamics. The ability to efficiently move assets across chains is becoming a critical factor in decentralized finance, shaping the evolution of digital asset liquidity and the future of financial innovation.