Stablecoins are rapidly transforming the landscape of cross-border payments. Traditional international transfers often involve multiple intermediaries, delayed settlement times, and high transaction costs, making them cumbersome for institutions and businesses. Stablecoins provide a predictable, programmable, and near-instantaneous method for moving value globally. Understanding how tokens like USDT, USDC, and DAI facilitate cross-border payments, the efficiency advantages they bring, and the challenges they face is crucial for regulators, institutional investors, and analysts tracking market trends.

Efficiency Gains in Cross-Border Transfers

Stablecoins significantly reduce transaction times. Transfers that previously required several days via correspondent banking networks can now settle within minutes. USDT and USDC allow institutions to move substantial sums across jurisdictions without exposing themselves to exchange rate volatility or the delays associated with multiple clearing intermediaries. Blockchain-based settlement also ensures transparency, immutability, and traceability, reducing the likelihood of errors or fraud during international transactions.

Transaction costs are another area where stablecoins offer benefits. Traditional international payments often incur multiple fees, including intermediary bank charges and foreign exchange costs. By using stablecoins, institutions bypass many of these costs, making the process faster and more affordable. These efficiency gains are particularly valuable for multinational corporations, fintech companies, and emerging market institutions seeking scalable and reliable settlement mechanisms.

Real-World Applications and Case Studies

Several real-world examples demonstrate the adoption of stablecoins for cross-border payments. In early 2025, a major fintech company used USDC to process payroll across three continents. The transactions are completed in under thirty minutes, at a fraction of the cost of traditional banking methods. Similarly, remittance providers in Southeast Asia started using USDT to send funds from urban centers to rural areas, reducing costs for end-users while maintaining predictable settlement times.

DAI, a crypto-backed stablecoin, has also been leveraged for decentralized peer-to-peer international payments. Although blockchain confirmation times can be slightly longer than fiat-backed tokens, DAI provides a non-custodial and decentralized settlement method that reduces counterparty risk. Institutions can use smart contracts to automate conditional payments, enabling efficient and secure execution of complex cross-border agreements.

Some institutions have integrated stablecoins into multi-currency treasury operations. By holding stablecoins denominated in USD or other major currencies, they can rapidly convert between jurisdictions without relying on traditional banking rails. This has improved operational efficiency for multinational corporations, particularly those operating in emerging markets with limited banking infrastructure.

Liquidity Considerations and Challenges

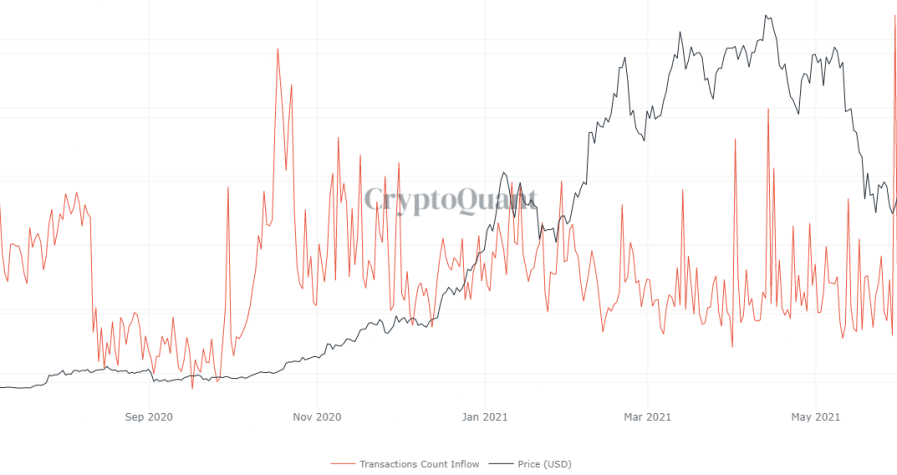

While stablecoins offer efficiency, liquidity is a critical factor. Tokens must have sufficient market depth to handle large transfers without creating price slippage. During periods of high demand, liquidity constraints can affect settlement speed and stability. Institutions need to monitor reserve health, exchange flows, and token supply to ensure that large transactions do not disrupt the peg or market equilibrium.

Operational challenges also exist. Although blockchain networks are transparent and secure, they can experience congestion or higher transaction fees during peak usage. Institutions must design payment flows to account for potential delays and integrate monitoring tools to track transactions in real time. Additionally, integrating stablecoins into existing enterprise systems requires planning and technical infrastructure to ensure smooth operations.

Regulatory Landscape

Stablecoins face diverse regulatory environments across jurisdictions. Some countries have yet to clarify whether stablecoins are considered legal tender, securities, or commodities, creating compliance challenges for institutions operating internationally. Frameworks such as the European Union’s MiCA regulation and U.S. guidance from the Financial Crimes Enforcement Network now require reserve transparency, anti-money laundering compliance, and stress testing.

Stablecoin issuers have responded by publishing attestation reports and maintaining rigorous reserve management practices. Institutional users need to monitor these reports to ensure regulatory compliance, confirm token backing, and manage operational risks. Regulatory clarity is increasingly recognized as essential for the continued scaling of cross-border payments using stablecoins.

Institutional Strategies and Best Practices

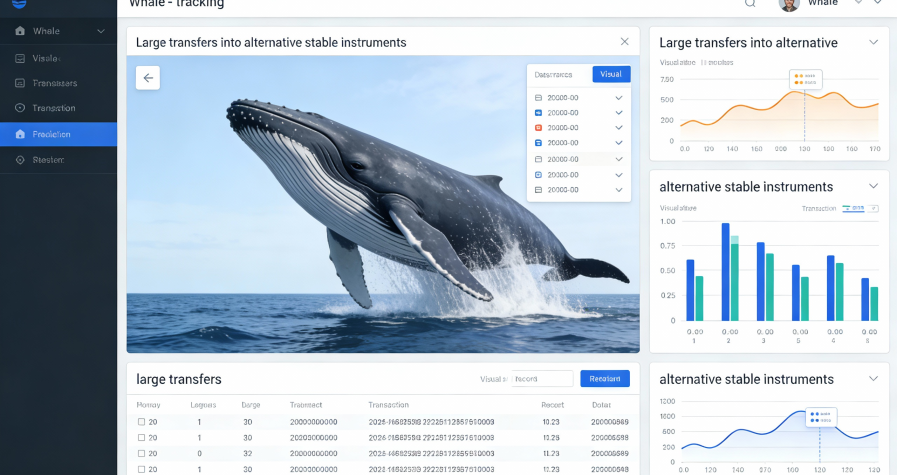

Institutions can adopt several strategies to maximize efficiency and minimize risk. Diversifying stablecoin holdings reduces exposure to a single token and mitigates counterparty risk. Monitoring whale activity and liquidity pools helps anticipate potential stress points, while selecting issuers with strong regulatory compliance ensures that transfers remain secure and legitimate.

Operational best practices include real-time tracking of settlements, automated reconciliation, and integration with enterprise payment platforms. By combining technical solutions with compliance frameworks, institutions can optimize cross-border transfers and maintain confidence even in volatile market conditions.

Case Studies of Stress Events

Even with efficiency gains, market stress can impact cross-border stablecoin payments. In March 2025, a surge in global cryptocurrency volatility temporarily strained liquidity for USDT on some decentralized exchanges. Large institutional transfers caused minor deviations from the peg, prompting arbitrage activity that quickly restored stability. Similarly, during regional remittance spikes in Southeast Asia, DAI transactions experienced slight delays due to network congestion. These events highlight the importance of liquidity management, monitoring, and proactive operational planning in maintaining efficient cross-border settlements.

Future Outlook

The potential for stablecoins in cross-border payments continues to expand. As regulatory frameworks evolve and market adoption increases, these tokens are likely to become central to global financial operations. Future developments may include enhanced smart contract automation, faster blockchain settlement protocols, and standardized compliance reporting, further reducing costs and increasing predictability.

Institutions that adopt stablecoins strategically, monitor liquidity flows, and integrate blockchain solutions into their operational frameworks will be well-positioned to leverage efficiency gains. Cross-border payments will become faster, more transparent, and less expensive, reshaping how businesses and institutions move value internationally.

By understanding the mechanisms, risks, and best practices associated with stablecoin cross-border payments, investors and financial professionals can make informed decisions. The combination of technological innovation, regulatory alignment, and operational strategy will define the success of stablecoins in international financial markets over the coming years. The adoption of stablecoins is expected to accelerate, with more financial institutions incorporating them into treasury management, remittance services, and corporate settlements, further cementing their role in the global financial system.