Tablecoins are widely regarded as the backbone of the cryptocurrency ecosystem, providing predictable value and liquidity for trading, lending, and decentralized finance activities. However, the concentration of liquidity in a small number of wallets, exchanges, or protocols can present systemic risks. Analysts, institutional investors, and regulators closely monitor stablecoin liquidity patterns to assess risk exposure, anticipate potential peg deviations, and guide operational strategies. Understanding how liquidity concentration impacts stablecoin stability is essential for maintaining market confidence and managing institutional exposure.

Why Liquidity Concentration Matters

Liquidity concentration refers to the degree to which stablecoins are held in a limited number of wallets or platforms. When a significant portion of a token’s supply is controlled by a few large wallets, the market becomes more susceptible to sudden movements. Large transfers, redemptions, or withdrawals by these holders can influence peg stability, create temporary shortages in liquidity pools, and generate price volatility in secondary markets.

Institutions closely analyze liquidity concentration because it informs risk management decisions. High concentration may necessitate diversification of holdings across multiple stablecoins or platforms to reduce operational and counterparty risk. Conversely, evenly distributed liquidity across wallets and protocols can enhance market resilience and support stable peg maintenance during periods of volatility.

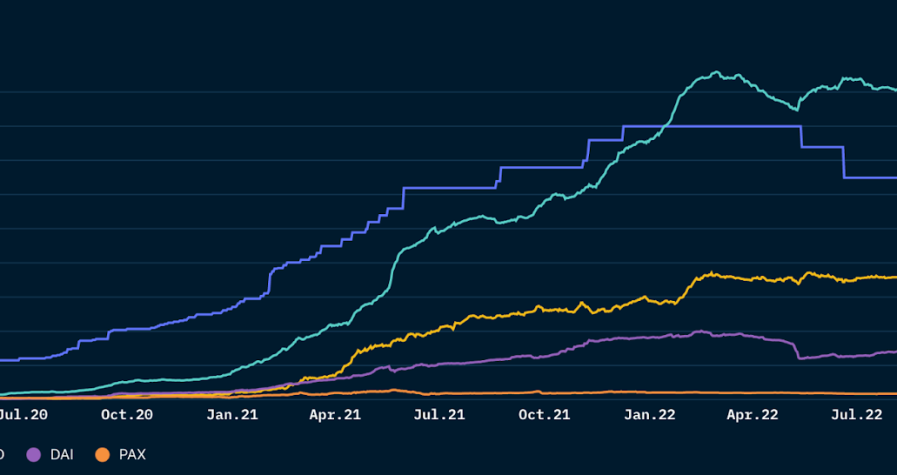

Examining Major Stablecoins

USDT remains the most widely traded stablecoin, with top wallets concentrated in exchanges and OTC trading platforms. These wallets serve as liquidity hubs, facilitating high-volume trades and enabling arbitrage across platforms. Analysts track these wallets for inflows, outflows, and sudden shifts in holdings, which may indicate potential stress events or strategic movements by large market participants.

USDC, by contrast, has a more balanced distribution, with significant holdings in regulated institutional accounts, corporate treasuries, and DeFi lending pools. This diversification reduces the likelihood of peg stress and increases investor confidence. DAI exhibits the highest degree of decentralized liquidity, with tokens distributed across multiple DeFi protocols and smart contracts. While this reduces the impact of single wallet activity, it also requires careful monitoring of collateral ratios, liquidation triggers, and protocol health.

Case Studies of Liquidity Shifts

In early 2025, analysts observed a sudden concentration of USDT in a few exchange wallets ahead of a market correction. This influx indicated that institutional traders were preparing for anticipated volatility, allowing market participants to anticipate potential liquidity constraints. By contrast, USDC flows showed steady deployment into lending protocols, demonstrating that institutional confidence in audited reserves supports distributed liquidity and reduces systemic risk.

DAI experienced temporary liquidity concentration in March when several smart contracts aggregated collateral in response to rising borrowing demand. The automated liquidation system ensured peg stability, illustrating that decentralized monitoring and smart contract protocols can effectively manage concentrated liquidity events when properly structured.

Implications for Institutional Investors

For institutions, liquidity concentration analysis is crucial for multiple purposes. First, it informs risk management by identifying wallets or platforms that could influence market stability during high-volume transactions. Second, it supports strategic deployment of capital by indicating where liquidity is available for lending, staking, or trading activities. Third, understanding concentration helps anticipate market stress and prepare mitigation strategies, such as adjusting allocations or hedging exposure.

Institutions may also integrate liquidity concentration metrics with reserve transparency reports and on-chain analytics. This combination provides a comprehensive view of risk, highlighting not only where tokens are held but also how they are backed and how resilient the system is under stress. By monitoring these variables, institutional participants can make data-driven decisions that optimize operational efficiency and maintain confidence in stablecoin markets.

Monitoring Tools and Techniques

Modern analytics platforms allow real-time monitoring of wallet concentration, transaction flows, and token distribution. On-chain dashboards track the movement of large stablecoin holdings, highlighting patterns that may affect peg stability. Institutional participants often combine automated alerts with manual review to detect anomalies, unusual inflows or outflows, and potential liquidity bottlenecks.

Cross-chain analysis is also becoming increasingly important. As stablecoins are deployed across multiple blockchain networks, tracking liquidity concentration across Ethereum, Solana, Binance Smart Chain, and other networks provides a more complete picture of systemic risk. Institutions use these insights to diversify holdings, optimize deployment, and maintain operational flexibility.

Regulatory Considerations

Regulatory oversight plays a growing role in evaluating stablecoin risk. Frameworks such as the European Union’s MiCA regulation and U.S. SEC guidance emphasize reserve transparency, liquidity management, and risk assessment. Regulators expect stablecoin issuers to maintain sufficient liquid reserves, disclose concentration risks, and implement stress-testing protocols. Institutional participants monitoring liquidity concentration can better align with regulatory expectations and mitigate compliance-related risks.

Future Outlook

Liquidity concentration will continue to be a central focus for analysts, institutions, and regulators in 2025 and beyond. As stablecoins grow in adoption for trading, lending, and treasury operations, understanding how concentrated liquidity can affect market stability is essential. Institutions that combine on-chain monitoring, reserve transparency, and cross-chain analysis will be best positioned to anticipate stress events and optimize capital deployment.

Stablecoins with more distributed liquidity and transparent reserve practices are likely to attract greater institutional adoption, while highly concentrated liquidity may trigger caution among risk managers. The combination of technology, transparency, and regulatory alignment will define which stablecoins become preferred for large-scale institutional use.

By closely tracking liquidity concentration, stakeholders gain actionable insights into market behavior, peg stability, and potential operational risks. This knowledge enables data-driven decision-making, proactive risk management, and enhanced confidence in deploying stablecoins across trading, DeFi, and treasury operations. Analysts expect that liquidity concentration analysis will become an indispensable tool for navigating the increasingly complex stablecoin ecosystem, supporting both institutional growth and market resilience.