Stablecoins have become a crucial component of institutional finance, offering predictable liquidity and operational efficiency across both decentralized and centralized platforms. For institutions, understanding reserve transparency, the extent to which the underlying assets backing a stablecoin are disclosed, is essential. Transparent reserves ensure confidence in peg stability, safeguard against liquidity risk, and support strategic deployment of capital across multiple financial operations.

Why Reserve Transparency Matters

Reserve transparency refers to the clear disclosure of assets backing a stablecoin. Fiat-backed tokens such as USDC and USDT maintain reserves composed of cash, short-term government securities, and other liquid instruments. Crypto-backed stablecoins like DAI rely on overcollateralized positions held in smart contracts. Institutions depend on verified transparency reports and audits to confirm that stablecoins are fully backed and can be redeemed without delay.

Lack of transparency increases operational risk. Institutions deploying large sums of stablecoins for lending, treasury operations, or DeFi participation must be confident that reserves are adequate. Any uncertainty can lead to reduced confidence, potential peg deviation, and restrictions on capital deployment. It can also increase compliance risk, as regulators expect verified disclosure of reserve holdings for financial reporting purposes.

Factors Driving Transparency Requirements

Several factors influence institutional expectations for stablecoin reserve transparency:

-

Regulatory Compliance: Increasing global scrutiny requires issuers to provide regular, verifiable disclosures. Institutions use these reports to ensure adherence to AML/KYC rules and jurisdictional requirements.

-

Liquidity Assurance: Transparent reserves give institutions confidence that assets are liquid and can be redeemed quickly during high-demand periods or stress events.

-

Market Confidence: Full disclosure of reserve composition and audit frequency helps maintain trust among institutional participants, reducing perceived risk and encouraging adoption.

-

Risk Management: Understanding reserve quality allows institutions to assess exposure to systemic or platform-specific risks, particularly during periods of high market volatility.

Institutional Monitoring Practices

Institutions deploy multiple strategies to maintain peg stability awareness.

-

On-Chain Analytics: Real-time monitoring of transactions, wallet activity, and liquidity distribution provides insight into potential peg stress.

-

Cross-Exchange Surveillance: Tracking price discrepancies between exchanges allows early identification of arbitrage opportunities and potential peg shifts.

-

Reserve Verification: Regularly reviewing attestation reports and audits ensures that stablecoins remain fully collateralized.

-

Whale Movement Tracking: Large stablecoin transfers can affect liquidity and peg maintenance. Institutions monitor these flows to anticipate volatility.

-

Smart Contract Health Checks: For crypto-backed stablecoins, monitoring automated liquidation events and collateral ratios ensures operational reliability.

Institutions also increasingly rely on predictive analytics to forecast liquidity events and identify potential risks before they manifest. Combining historical transaction data with real-time monitoring enables treasuries to prepare for sudden redemption spikes or periods of high demand.

Case Studies in 2025

In March 2025, USDC experienced a brief dip below its $1 peg during a surge in lending demand on Ethereum-based platforms. Institutions monitoring real-time liquidity flows were able to redeploy capital to lending pools and minimize exposure, maintaining operational efficiency.

DAI’s algorithmic collateral adjustments maintained peg stability even during high volatility periods in the crypto market. Institutional participants leveraged on-chain dashboards to track overcollateralization and liquidation events, allowing them to manage risk and optimize capital allocation without disruptions.

USDT demonstrated peg resilience across multiple exchanges, though monitoring whale transfers was critical. A large whale moved significant USDT holdings to a major exchange, temporarily increasing lending demand and creating minor fluctuations. Institutions that anticipated these flows were able to optimize yield and maintain liquidity readiness.

Extended Strategies for Institutions

In addition to real-time monitoring, institutions increasingly use predictive modeling and scenario analysis to prepare for potential peg deviations. This includes simulating redemption events, liquidity shortages, and sudden market volatility. Combining historical data on stablecoin flows with macroeconomic indicators allows institutions to anticipate risk periods and make proactive adjustments to treasury and lending operations.

Institutions also coordinate peg monitoring with governance oversight for crypto-backed stablecoins. By participating in protocol votes or following governance updates, they can influence risk parameters such as collateral types, liquidation thresholds, and stability fees. This ensures their exposure remains controlled and aligned with operational objectives.

Furthermore, institutions are incorporating stress-testing frameworks that integrate on-chain metrics, market depth data, and potential withdrawal scenarios. These frameworks allow financial managers to prepare contingency plans and ensure liquidity is sufficient to handle unusual redemption patterns or market shocks without compromising peg stability.

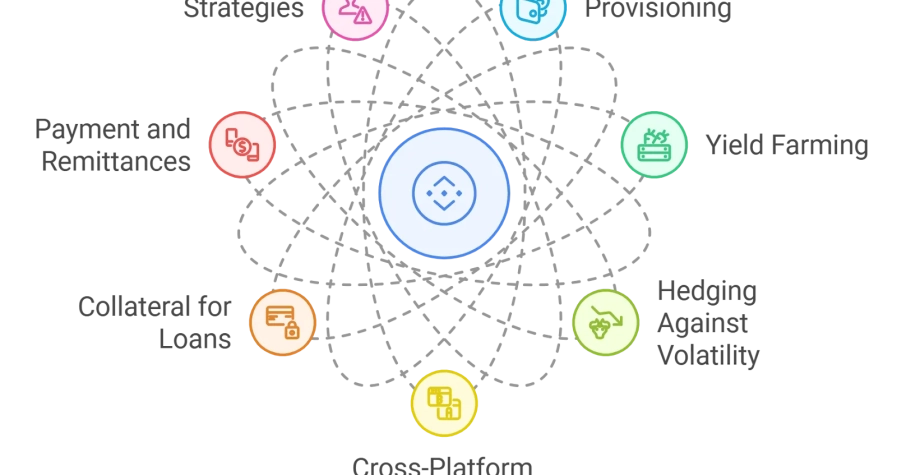

Additional strategies include maintaining diversified stablecoin holdings, spreading allocations across multiple protocols, and integrating cross-chain monitoring to ensure that liquidity and reserves remain balanced across all networks. Institutions are also enhancing transparency by integrating reporting tools that track exposure, reserve ratios, and pool health in real time, allowing decision-makers to act swiftly during periods of market stress.

Future Outlook

Peg stability and reserve transparency will remain core concerns as institutional adoption of stablecoins continues to grow. Advanced analytics, predictive dashboards, and cross-chain monitoring will allow institutions to maintain confidence in large-scale stablecoin deployment. Institutions that integrate these practices into treasury management, lending, and DeFi strategies will achieve greater operational efficiency, risk mitigation, and yield optimization.

Stablecoin reserve transparency is increasingly recognized as a strategic function. By combining liquidity tracking, whale activity insights, reserve verification, stress-testing protocols, and cross-chain oversight, institutions can ensure that deployments remain secure and efficient. As regulatory clarity improves and protocols mature, reserve transparency will become a fundamental aspect of institutional risk management frameworks.

In conclusion, understanding and monitoring factors that influence stablecoin reserve transparency is essential for institutional traders and treasury managers. By observing reserve composition, liquidity flows, algorithmic adjustments, whale activity, cross-chain movements, and conducting comprehensive stress tests, institutions can maintain confidence in capital deployment, optimize yield, and ensure smooth operations. Transparent reserves support peg stability, provide insight into market risk, and enhance operational decision-making. Institutions that monitor and act on these signals will be best positioned to thrive in the growing stablecoin ecosystem and leverage these digital assets effectively across multiple financial strategies.