Introduction

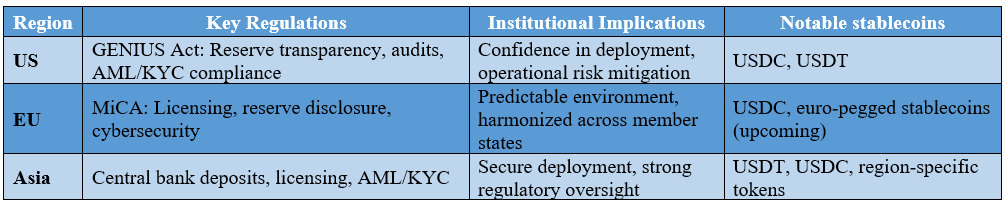

As stablecoins become increasingly integral to institutional finance, understanding the global regulatory landscape is essential. Regulatory clarity affects adoption, risk management, and operational strategies for banks, corporate treasuries, and institutional crypto investors. This blog provides a comparative analysis of stablecoin regulations across the United States, European Union, and Asia, highlighting implications for institutional adoption, compliance, and market stability in 2025.

Stablecoin Regulations in the United States

The United States has taken significant steps to regulate stablecoins through legislation such as the GENIUS Act. Key requirements include:

-

Mandatory Reserve Transparency: Issuers must disclose reserve composition, including cash and short-term government securities.

-

Regular Audits and Attestations: Third-party verification is required to confirm fully-backed reserves.

-

Operational Compliance: Stablecoin issuers must comply with AML/KYC rules and maintain secure operational protocols.

-

Consumer Protection Measures: Ensuring reliable redemption and limiting systemic risk.

These provisions have provided institutional confidence in deploying stablecoins such as USDC and USDT for treasury management, cross-border payments, and DeFi lending. Banks and hedge funds have leveraged compliance to integrate stablecoins into daily operations, facilitating faster transactions and reducing liquidity risk.

European Union (EU) Regulations

The EU is implementing the Markets in Crypto-Assets (MiCA) framework, which sets rigorous standards for stablecoin issuance and governance. Key features include:

-

Licensing Requirements: Stablecoin issuers must obtain authorization from a relevant EU regulatory body.

-

Reserve Backing and Transparency: Full disclosure of reserve assets and attestation reports are mandatory.

-

Operational and Cybersecurity Standards: Issuers must implement robust technological safeguards and operational transparency.

-

Investor Protection Measures: Includes redemption guarantees and clear terms of use for token holders.

MiCA aims to harmonize regulation across EU member states, providing a predictable environment for institutional participants. European banks are actively preparing euro-pegged stablecoins under consortia initiatives, ensuring compliance with MiCA and enabling secure treasury operations and cross-border settlement within the EU.

Asian Regulatory Landscape

Asia presents a diverse regulatory environment, with countries like South Korea, Hong Kong, and Singapore leading initiatives:

-

South Korea: The Bank of Korea requires stablecoin issuers to maintain central bank deposits as part of reserve requirements. This ensures liquidity and operational reliability.

-

Hong Kong: The Hong Kong Monetary Authority (HKMA) has received 36 stablecoin license applications, indicating strong institutional interest and regulatory oversight.

-

Singapore: The Monetary Authority of Singapore (MAS) focuses on compliance, requiring transparency in reserves and adherence to AML/KYC standards.

Asian regulations emphasize reserve adequacy, transparency, and operational security, enabling institutions to deploy stablecoins with confidence in treasury operations, cross-border payments, and decentralized finance.

Comparative Analysis

Institutions operating globally must navigate differing frameworks while ensuring compliance. Treasury teams need to monitor reserve transparency, audit reports, and legal obligations in each jurisdiction to maintain operational efficiency and minimize regulatory risk.

Implications for Institutional Adoption

1. Treasury Management and Liquidity

Clear regulatory frameworks allow treasuries to integrate stablecoins into daily operations. Fully-backed and compliant tokens provide predictable liquidity for cross-border payments, lending pools, and corporate cash management.

2. Risk Mitigation

Compliance with regulatory requirements reduces exposure to counterparty and operational risk. Attested reserves and audits ensure peg stability, while licensing requirements provide assurance that issuers adhere to standards.

3. Strategic Allocation Across Jurisdictions

Institutions must balance holdings of stablecoins across regions to optimize liquidity, yield, and operational flexibility while adhering to local regulations. Predictive analytics can help monitor flows, peg deviations, and reserve health.

Case Studies in 2025

US Institutional Adoption:

JP Morgan and Circle reported increased USDC adoption in treasury operations, leveraging GENIUS Act compliance for secure deployment. Treasury teams monitored attestation reports to ensure peg stability during high-volume lending activity.

EU Developments:

European banks are preparing euro-pegged stablecoins compliant with MiCA, targeting cross-border settlement efficiency and institutional adoption. Treasury teams are designing dashboards to track reserve allocation, audit reports, and operational compliance across multiple platforms.

Asia-Pacific Adoption:

Hong Kong’s licensing program has encouraged banks and fintech companies to deploy stablecoins for treasury and liquidity management. In South Korea, institutions monitor central bank deposit-backed stablecoins to ensure operational reliability and regulatory alignment.

Future Outlook

Global regulatory harmonization will be crucial for the next phase of institutional adoption. Institutions that proactively align treasury and payment strategies with the US, EU, and Asian frameworks will be positioned to leverage stablecoins efficiently.

Technological innovation, such as interoperability protocols and cross-chain analytics, will enable treasuries to manage multiple stablecoins in real-time, optimizing liquidity and risk management. As regulations evolve, institutions that maintain transparency, audit oversight, and operational security will lead in adopting stablecoins for treasury, cross-border payments, and DeFi integration.

Conclusion

Understanding the global regulatory landscape is essential for institutional adoption of stablecoins. The US GENIUS Act, EU MiCA framework, and Asia-Pacific licensing programs establish standards for reserve transparency, operational compliance, and investor protection. Institutions that adhere to these regulations can deploy stablecoins with confidence, optimizing treasury operations, cross-border payments, and DeFi participation.

As regulatory clarity grows and markets mature, compliant stablecoins will continue to play a pivotal role in modern institutional finance. Treasury managers and institutional investors must monitor regional frameworks, reserve transparency, and compliance to maintain operational efficiency, mitigate risks, and capitalize on the growing stablecoin ecosystem.