Introduction

Stablecoins have become a foundational element of decentralized finance (DeFi), providing predictable liquidity and operational efficiency in an otherwise volatile cryptocurrency ecosystem. For institutional investors, corporate treasuries, and financial institutions, understanding stablecoins’ role in DeFi is crucial for optimizing liquidity, yield, and risk management. In 2025, stablecoins such as USDC, USDT, and DAI have increasingly been integrated into lending protocols, liquidity pools, and cross-chain platforms. This blog explores the significance of stablecoins in DeFi, institutional adoption trends, challenges, and emerging opportunities.

Why Stablecoins Are Central to DeFi

1. Peg Stability and Predictable Liquidity

DeFi platforms rely heavily on stablecoins for lending, borrowing, and automated trading. Fully-backed stablecoins maintain parity with fiat currencies, ensuring that institutional participants can deploy large sums of capital with confidence. Peg stability reduces operational risk and facilitates planning for treasury operations and cross-border payments.

2. Collateral for Lending and Borrowing

Stablecoins serve as both collateral and lending assets on decentralized protocols. Institutions can provide liquidity to lending pools, earn interest, and access loans while maintaining exposure to predictable assets. Smart contracts automate these transactions, allowing for real-time adjustments to interest rates and collateral requirements.

3. Enabling Cross-Chain Interoperability

Stablecoins bridge multiple blockchain networks, allowing institutions to transfer liquidity across chains efficiently. This interoperability is essential for decentralized applications (dApps), multi-chain lending, and cross-border corporate operations.

Institutional Adoption Trends

1. Treasury and Liquidity Management

Corporate treasuries are deploying stablecoins in DeFi platforms to manage liquidity efficiently. For example, U.S.-based banks and hedge funds use USDC to provide liquidity in lending pools, earning interest while keeping reserves fully backed and auditable. Real-time dashboards track collateral ratios, peg stability, and liquidity across multiple protocols.

2. Risk Mitigation Through Diversification

Institutions diversify stablecoin holdings across multiple platforms and issuers to reduce concentration risk. Allocating capital among USDC, USDT, and DAI ensures operational resilience even if one protocol experiences liquidity stress or technical issues. Predictive analytics and automated monitoring help treasuries anticipate redemption surges and adjust allocations accordingly.

3. Integration With Cross-Border Operations

Stablecoins in DeFi are increasingly used for cross-border payments. Institutional participants can move assets globally with minimal fees and predictable settlement times, integrating treasury management with blockchain-enabled DeFi platforms.

Case Studies in 2025

USDC in DeFi Lending

A major U.S. financial institution deployed USDC across multiple lending platforms to generate yield while maintaining peg stability. Monitoring dashboards allowed treasury teams to track collateralization and automated liquidation events, ensuring operational continuity during periods of high demand.

DAI in European Protocols

European hedge funds have utilized DAI for decentralized lending, leveraging overcollateralized smart contracts. By monitoring protocol health and collateral ratios, institutions maintained liquidity and minimized risk while earning returns on treasury allocations.

USDT in Global Treasury Operations

Multinational corporates use USDT for cross-border treasury operations integrated with DeFi lending. This allows companies to earn interest while facilitating liquidity transfers between subsidiaries, reducing reliance on traditional banking systems and optimizing cash flow.

Challenges in Institutional DeFi Adoption

Regulatory Compliance

DeFi is still evolving in terms of regulatory oversight. Institutions must ensure that stablecoins comply with local and international regulations, including AML/KYC standards. Adherence to frameworks such as the GENIUS Act in the U.S., MiCA in Europe, and licensing in Asia is essential to avoid compliance risks.

Operational and Smart Contract Risks

Smart contract vulnerabilities, protocol bugs, or network congestion can impact DeFi operations. Institutions mitigate these risks through audits, predictive modeling, and scenario planning. Real-time dashboards and monitoring tools are essential for identifying liquidity bottlenecks or potential peg deviations.

Reserve Transparency

Institutions prioritize stablecoins with transparent, audited reserves. Tokens lacking verifiable backing may expose treasuries to counterparty or liquidity risk, especially during periods of high demand or redemption stress.

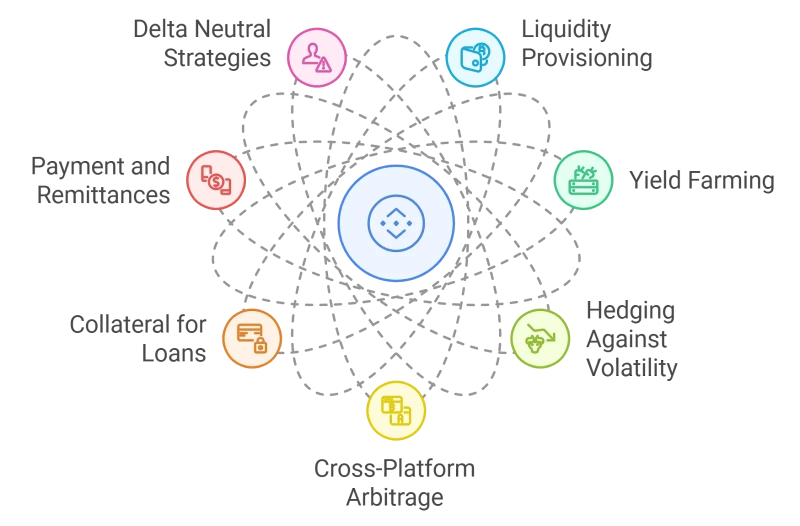

Opportunities for Institutions

1. Yield Generation and Capital Efficiency

Stablecoins in DeFi provide predictable yields while allowing institutions to deploy idle treasury funds efficiently. Lending, liquidity provisioning, and automated yield strategies create opportunities for income generation without compromising peg stability.

2. Cross-Border Treasury Optimization

Integrating stablecoins in DeFi allows institutions to optimize cross-border treasury operations. Real-time settlement reduces delays, lowers fees, and ensures liquidity availability for operational or strategic purposes.

3. Strategic Partnerships and Innovation

Collaboration with DeFi platforms, fintech providers, and stablecoin issuers allows institutions to leverage innovative treasury and operational solutions. Automated dashboards, cross-chain interoperability, and risk management frameworks enhance operational flexibility and strategic decision-making.

4. Diversification Across Platforms

Allocating stablecoins across multiple protocols and issuers reduces operational concentration risk. Diversified exposure ensures that institutional deployments remain resilient to individual protocol disruptions, network failures, or regulatory changes.

Future Outlook

The role of stablecoins in DeFi will expand significantly over the next few years. Regulatory clarity, technological improvements, and institutional adoption will enable large-scale deployment for treasury management, cross-border payments, and decentralized lending.

Institutions that invest in monitoring tools, predictive analytics, and governance participation will lead in leveraging DeFi opportunities. Cross-chain liquidity management, yield optimization, and operational risk mitigation will be central to maximizing the benefits of stablecoins in decentralized ecosystems.

Conclusion

Stablecoins are foundational to the future of DeFi, providing predictable liquidity, operational efficiency, and compliance alignment. Institutional adoption in 2025 has demonstrated their value for treasury management, cross-border payments, and yield generation. While challenges remain, including regulatory uncertainty, operational risks, and reserve transparency, fully-backed and compliant stablecoins provide institutions with secure tools for strategic deployment. By adopting best practices in monitoring, diversification, and risk management, institutions can capitalize on DeFi opportunities, optimize treasury operations, and position themselves at the forefront of digital finance innovation.