Introduction

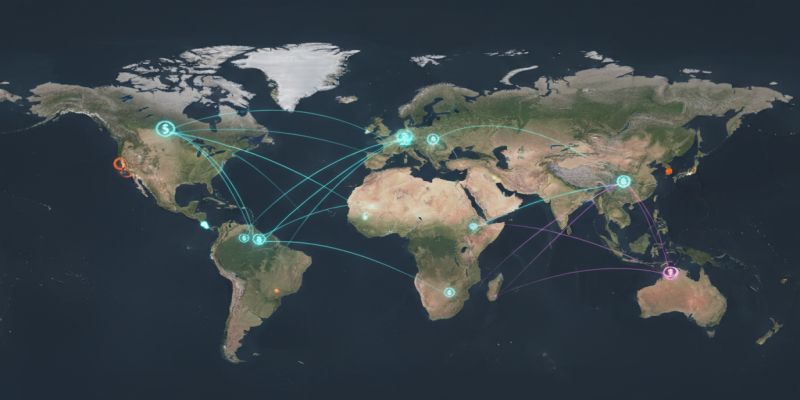

The International Monetary Fund (IMF) has issued a warning regarding the potential fragmentation of the stablecoin ecosystem and its implications for the global payments system. As stablecoins continue to proliferate, with multiple issuers and varying collateral frameworks, the risk of fragmentation increases, potentially undermining efficiency, liquidity, and systemic stability. The IMF emphasizes that without coordinated standards for transparency, reserve management, and interoperability, different stablecoins may operate in isolation, creating inefficiencies and increasing operational risks for cross-border transactions. Analysts note that fragmentation could lead to inconsistent adoption, reduced confidence among users and institutions, and increased susceptibility to market disruptions. The warning highlights the importance of developing harmonized regulatory and technical frameworks to ensure that stablecoins function effectively as global payment instruments while maintaining stability and trust.

The IMF’s analysis indicates that the growth of stablecoins is outpacing the development of regulatory and governance standards in many jurisdictions. Different issuers maintain varying levels of reserve transparency, collateral quality, and operational robustness. As a result, some stablecoins may perform reliably under stress, while others could face liquidity or solvency challenges, exacerbating risks in interconnected markets. The fragmentation risk is particularly acute in cross-border payments, where multiple stablecoins with limited interoperability could slow transaction settlements, increase costs, and introduce compliance complexities. The IMF calls for coordinated action by regulators, issuers, and global financial institutions to mitigate these risks and preserve the integrity of the global payments system.

Stablecoin Ecosystem Overview

The stablecoin market has experienced rapid growth, with USDT, USDC, DAI, and other tokens collectively handling trillions of dollars in transactions annually. These assets are widely used in trading, remittances, DeFi lending, and as collateral across blockchain networks. While they provide efficiency and low volatility compared to traditional cryptocurrencies, the decentralized and fragmented nature of issuance creates challenges. Each issuer may adopt different reserve compositions, transparency levels, and operational protocols, leading to variations in stability and reliability. Analysts warn that these disparities can result in fragmentation, where some stablecoins are trusted widely, while others face adoption limitations or regulatory scrutiny. This lack of standardization could affect global payment networks, particularly in cross-border financial flows where seamless interoperability is crucial for efficient settlement.

Moreover, stablecoin fragmentation could impact central banks and financial institutions that integrate these assets into payment systems or collateral frameworks. Inconsistent standards may complicate risk assessment, reporting, and liquidity management, reducing the efficiency gains that stablecoins are designed to provide. As the market expands, the IMF emphasizes the need for collaborative frameworks to harmonize operational standards, reserve management practices, and disclosure requirements across issuers, ensuring that stablecoins remain safe, reliable, and interoperable in global payment contexts.

Regulatory and Technical Recommendations

The IMF recommends that regulators and industry participants adopt several measures to mitigate fragmentation risk. Key recommendations include the development of standardized reserve requirements, mandatory transparency and reporting frameworks, and interoperability protocols across different blockchain networks. Regulators are encouraged to establish clear guidelines on collateral quality, reserve audits, and risk management practices to ensure that all stablecoin issuers maintain sufficient liquidity and solvency. These measures would increase confidence in the system, facilitate cross-border payments, and reduce operational risk.

Technically, interoperability protocols and standardized messaging formats can enable stablecoins from different issuers to operate seamlessly within the same payment network. The adoption of modular architectures, transparent toolkits, and automated compliance mechanisms similar to those seen in next-generation stablecoins can further enhance reliability and reduce fragmentation. Analysts also suggest that industry-wide collaborations and consortiums may be necessary to develop shared standards for security, risk management, and operational governance, ensuring that stablecoins can function cohesively as a global medium of exchange.

Global Implications

If fragmentation persists, the IMF warns that global financial stability could be affected. Inconsistent performance across stablecoins may reduce adoption in international trade, complicate cross-border remittances, and increase operational risks for financial institutions that rely on digital assets. Fragmentation may also impede the integration of stablecoins into central bank digital currency (CBDC) frameworks, as central banks require reliable, standardized, and interoperable digital instruments. By contrast, harmonization of standards would facilitate smoother settlement systems, enhance liquidity management, and support broader adoption of stablecoins as efficient and stable global payment solutions.

Furthermore, the IMF highlights that fragmentation could create vulnerabilities during periods of market stress. Investors and users may flock to the most liquid or perceived “safe” stablecoins, triggering rapid shifts in capital flows and creating volatility. Institutions that rely on less transparent or lower-quality stablecoins could experience operational disruptions or losses. This underscores the necessity of regulatory coordination, consistent disclosure, and operational transparency to maintain trust and stability in global digital payments.

Conclusion

The IMF’s warning about stablecoin fragmentation underscores the urgent need for harmonized regulatory and operational standards in the global digital asset ecosystem. As stablecoins become increasingly integrated into trading, remittances, lending, and cross-border payments, ensuring interoperability, transparency, and robust reserve management is critical to preserving efficiency, liquidity, and stability. Regulators, issuers, and industry participants must collaborate to establish frameworks that minimize fragmentation risk, promote standardization, and enhance confidence among users and institutions. By addressing these challenges proactively, stablecoins can continue to play a transformative role in global finance, supporting faster, cheaper, and more secure digital payments while mitigating systemic risks. The IMF’s analysis highlights that coordinated global action is essential to prevent fragmentation and ensure that stablecoins contribute positively to the evolution of international financial systems.