The International Monetary Fund has advanced a comprehensive proposal to establish a global framework for the oversight of stablecoins. As these digital assets increase in use across jurisdictions, traversing borders and financial systems, the IMF argues that coordinated regulation is critical to maintain financial stability, protect consumers, and support innovation in tokenized finance. What was once a niche niche within the crypto-asset ecosystem is now a core focus for global financial policy makers.

Why Global Oversight Matters

Stablecoins have evolved beyond simple payment tokens into instruments used for liquidity, settlement, and digital finance infrastructure. The IMF notes that while stablecoins currently represent a smaller share of global payments, their growth and interconnectedness with traditional finance mean risks can escalate rapidly. IMF+2Financial Stability Board+2

In emerging markets, stablecoins can act as substitutes for local currency or traditional banking services. This can increase vulnerability to currency substitution or capital outflows, which in turn can amplify financial-stability risks. IMF+1

The proposal from the IMF highlights the need for consistent standards across jurisdictions so that no regulatory “safe havens” emerge where stablecoin issuers or service providers face weaker oversight. Such gaps can create cross-border vulnerabilities and undermine efforts to manage systemic risk. Financial Stability Board+1

Key Elements of the Proposed Framework

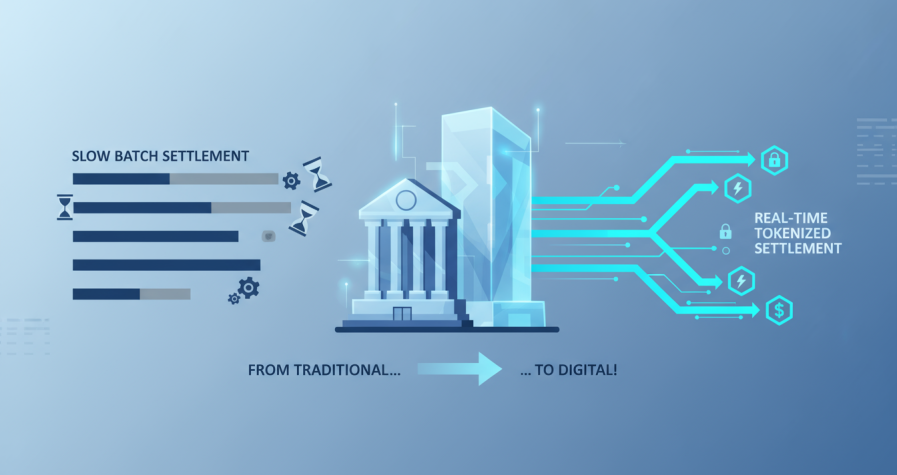

The IMF’s framework emphasises several core elements for effective oversight of stablecoins. First is the principle of “same activity, same risk, same regulation” meaning stablecoins that perform economic functions similar to bank deposits or money-market instruments should face equivalent regulatory standards. Financial Stability Board+1

A second element is ensuring transparency and reserve backing for issuers. Stablecoins should clearly disclose structural features, redemption rights, stabilization mechanisms, and the nature of reserve assets. This aligns with previous IMF guidance that issuers must manage liquidity, redemption, credit, operational and market-integrity risks. IMF+1

Third is cross-border cooperation and data sharing. The IMF proposes stronger mechanisms for information exchange, coordinated supervision, and data collection so authorities can monitor transnational stablecoin flows, prevent regulatory arbitrage and address systemic risks arising from cross-border activities. IMF+1

Finally the framework underscores the need to integrate stablecoin oversight into broader macro-financial surveillance. This includes embedding stablecoin risks into the IMF’s Article IV consultations and Financial Sector Assessment Program (FSAP) reviews, especially in jurisdictions where stablecoins may become systemically significant. Center For Global Development+1

Implications for Institutions and Markets

For issuers, custodians and service-providers, the proposed global framework signals that jurisdictions will increasingly align on prudential standards, auditability and regulatory treatment of stablecoins. That may raise compliance costs but also brings greater legitimacy and institutional participation.

For institutional investors and tokenization platforms, it means a clearer route to scale and integration with traditional finance. When stablecoins meet rigorous oversight, they become more acceptable as settlement tools, treasury assets or instruments underpinning tokenized real-world assets.

For emerging markets the IMF’s approach offers assurance that stablecoins will be regulated in a way that supports financial inclusion while managing volatility and risks tied to currency substitution or external shocks.

Conclusion

The IMF’s proposal for a global framework for stablecoin oversight marks a pivotal moment in digital finance. By advocating consistent regulation, transparency, and cross-border cooperation, it aims to bring order and trust to a rapidly evolving segment of the financial system. The foundation for stablecoins is shifting from innovation frontier to regulated infrastructure. As tokenization, stablecoins and institutional liquidity deepen across markets, this kind of oversight will be central to how secure, efficient and global our financial architecture becomes.