A new wave of financial architecture is taking shape as modular ecosystems begin to replace traditional, monolithic systems that have dominated banking and capital markets for decades. Driven by blockchain technology, tokenization, and decentralized infrastructure, modular finance is creating a more agile and interoperable framework where institutions can integrate specialized components for payments, lending, custody, and settlement.

This transformation represents a fundamental shift from closed financial networks to open, composable ecosystems. Instead of relying on centralized intermediaries, modular finance allows institutions to connect directly through interoperable layers of code and protocol. The result is a system that is faster, more transparent, and capable of supporting the growing demands of the digital asset economy.

The Shift Toward Modular Financial Infrastructure

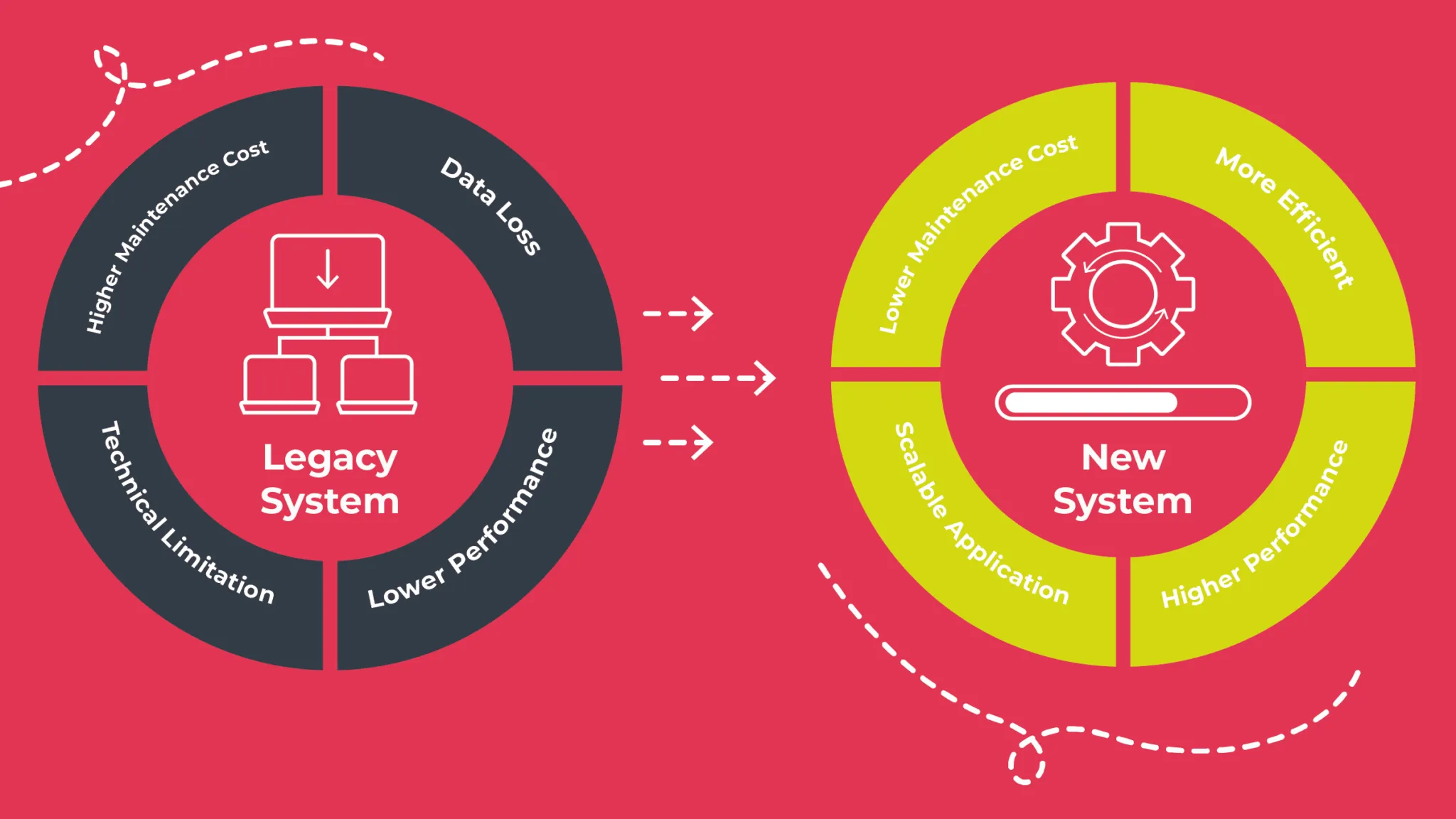

Traditional financial systems were built as isolated structures with limited interoperability. Each function from clearing and settlement to asset management was controlled by a specific institution or network. While this design ensured stability, it also created inefficiencies, high costs, and barriers to innovation.

Modular finance breaks this model apart. It introduces a structure where financial services exist as interchangeable modules that can be combined, upgraded, or replaced without disrupting the entire system. This modularity mirrors how modern software ecosystems evolved, where open APIs and standardized protocols enable innovation through connectivity.

In practice, this means that a digital bank can integrate separate modules for stablecoin payments, tokenized asset custody, and compliance automation all connected through blockchain-based settlement layers. Each module is designed for a specific function but operates seamlessly within the broader ecosystem.

Tokenization plays a central role in this evolution. By turning assets into programmable digital tokens, financial institutions can move, trade, and settle value instantly across networks. These tokenized assets interact with modular finance components to enable real-time collateral management, cross-border payments, and smart contract-based lending.

Stablecoins are the connective element of this new ecosystem. They provide the liquidity and price stability that allow different modules whether for DeFi platforms or institutional systems to interoperate smoothly. Stablecoins like USDC, PYUSD, and RMBT are already acting as the settlement layer across tokenized markets and payment infrastructures.

Institutional Adoption and Technological Integration

Institutions are increasingly adopting modular finance models to enhance flexibility and reduce dependency on legacy systems. Global banks, asset managers, and fintech firms are unbundling their core infrastructure, integrating blockchain-based components that can be customized for different market functions.

For example, a financial institution may use a permissioned blockchain module for internal settlements while connecting to public networks for cross-border transactions. Custody can be managed through tokenized vault modules, while compliance is automated through programmable KYC and transaction monitoring layers.

This modular structure enables scalability and innovation without sacrificing control. Institutions can choose which modules to operate internally and which to outsource to third-party providers, creating a balance between security, efficiency, and compliance.

The shift toward modular systems is also driving the growth of tokenization platforms. Companies specializing in digital asset issuance and management now offer infrastructure modules that banks can plug directly into their existing frameworks. These solutions provide full lifecycle management from issuance to trading and redemption within regulated environments.

At the policy level, regulators are taking note. The European Union’s MiCA framework, the Monetary Authority of Singapore’s digital finance initiatives, and the U.S. Treasury’s pilot projects all emphasize modularity as a means to achieve interoperability and systemic transparency. Modular design ensures that each financial function remains accountable and auditable while maintaining overall system integrity.

Efficiency, Risk Management, and Global Connectivity

The modular approach does more than improve efficiency it enhances resilience. In traditional systems, a single point of failure can disrupt entire markets. In modular finance, each component operates independently, so one malfunction does not jeopardize the entire network. This decentralized resilience makes modular ecosystems better suited for global, always-on financial activity.

Liquidity management is another major benefit. Modular finance enables real-time movement of capital between networks, assets, and participants. Tokenized treasuries, on-chain money markets, and algorithmic liquidity engines can interact seamlessly, providing institutions with precise control over reserves and funding flows.

AI-driven analytics are increasingly being integrated into modular ecosystems to optimize performance. Machine learning algorithms can evaluate market conditions, predict liquidity demand, and automatically reallocate assets between modules. This intelligent coordination enhances both profitability and systemic stability.

From a regulatory standpoint, modular systems also improve transparency. Each component logs data independently, providing regulators and auditors with clear visibility into transactions, collateral, and risk exposure. This traceability supports the development of trust and compliance across jurisdictions.

As global finance moves toward tokenization, modular ecosystems provide the infrastructure necessary to handle complex, multi-asset operations. They allow traditional and decentralized systems to coexist through standardized protocols that maintain both efficiency and regulatory oversight.

Conclusion

Modular finance ecosystems represent the future of global financial infrastructure. By replacing legacy systems with interoperable, scalable, and transparent modules, institutions are creating a financial environment that is more flexible, efficient, and resilient. Tokenization, stablecoins, and blockchain-based architecture are the building blocks of this transformation. As these technologies mature, modular finance will become the dominant model bridging traditional markets with digital innovation and laying the groundwork for a more connected, intelligent financial world.