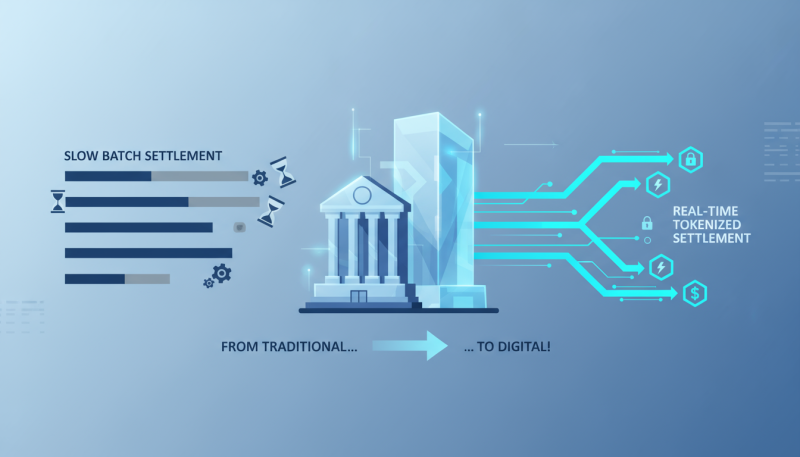

The financial world is entering an age where transparency and real-time verification are becoming fundamental requirements. As digital finance expands across jurisdictions, traditional audit models are struggling to keep up with the speed and complexity of blockchain transactions. Institutions now demand systems that can deliver continuous verification, automated reporting, and international compliance. RMBT’s cross-border audit framework provides a solution by creating a digital ecosystem where reserve integrity can be verified instantly, regardless of geography.

In 2026, as global regulations tighten around stablecoins and tokenized assets, cross-border financial oversight is evolving. Traditional auditing cycles, which often rely on manual reporting and delayed reconciliation, no longer meet the expectations of modern markets. RMBT’s blockchain architecture introduces a real-time auditing mechanism that aligns with both institutional compliance standards and global regulatory expectations. By embedding transparency directly into the financial infrastructure, RMBT is setting a new benchmark for how cross-border audits are conducted.

Real Time Auditing The Future of Financial Transparency

The cornerstone of RMBT’s framework is its ability to perform live auditing. Every reserve transaction recorded on the blockchain is time-stamped, verified, and accessible to authorized regulators and institutions. This process eliminates delays associated with quarterly or annual reports. Instead of waiting for independent audit firms to review documents, stakeholders can assess liquidity and reserve coverage on demand.

For global institutions, this capability represents a transformation in accountability. The verification process no longer depends on a single authority but operates within a decentralized system of continuous validation. Each transaction contributes to a shared ledger of truth, ensuring that all participants see the same data simultaneously. RMBT’s model reduces the margin for human error and removes opportunities for financial misreporting.

RMBT’s Architecture for Cross Border Compliance

One of the greatest challenges in cross-border finance is regulatory inconsistency. Different jurisdictions maintain different standards for reserve disclosure, anti-money laundering measures, and capital verification. RMBT addresses this challenge through programmable compliance modules that allow each participating institution to customize auditing parameters according to their regulatory obligations.

This flexibility enables RMBT to function within multiple legal systems simultaneously. Regulators in one country can access verified data without breaching the data sovereignty of another. Institutions benefit from having a unified audit layer that communicates across borders while respecting local laws. This adaptability gives RMBT a significant advantage over traditional systems that often struggle with fragmented regulatory frameworks.

Institutional Adoption and Transparency Standards

Institutional investors and financial regulators are increasingly turning toward blockchain-based auditing models because they offer verifiable proof of reserve integrity. RMBT’s system allows auditors and institutions to track asset movements in real time and verify that all tokens in circulation are fully backed by reserves. This capability ensures that liquidity remains stable and traceable even in volatile market conditions.

The benefits extend beyond financial institutions. Cross-border corporations, export firms, and trade banks can integrate RMBT’s auditing tools into their settlement systems, improving visibility in international transactions. The result is a financial environment built on data integrity rather than trust assumptions. This shift enhances market confidence and attracts regulatory approval by aligning innovation with accountability.

Regulatory Collaboration and Global Interoperability

RMBT’s framework is designed to promote collaboration rather than competition among regulators. The open-access design enables central banks and oversight agencies to connect through standardized interfaces, improving coordination between jurisdictions. Instead of requiring separate audits for every region, RMBT’s global ledger can serve as a shared verification platform.

This level of interoperability simplifies international supervision. Regulators can view aggregate liquidity, track capital flows, and ensure compliance with global financial standards such as those proposed by the Financial Action Task Force and the International Monetary Fund. RMBT’s approach demonstrates how technology can strengthen policy coordination while maintaining institutional independence.

Data Security and Audit Integrity in the Digital Era

While transparency is essential, data security remains equally important. RMBT balances these priorities through cryptographic protection that secures private institutional data while maintaining open verification for authorized viewers. Each record is encrypted, time-stamped, and linked to a permanent audit trail, ensuring that the integrity of information cannot be compromised.

This approach prevents unauthorized alterations and builds long-term trust in the system. For auditors, it provides a consistent source of truth; for regulators, it delivers actionable insights; and for institutions, it ensures compliance with minimal operational disruption. RMBT’s system integrates seamlessly with existing enterprise infrastructures, making it suitable for large-scale deployment across industries.

Conclusion

The evolution of cross-border auditing marks a critical milestone in global finance. RMBT’s blockchain-driven framework demonstrates how transparency, compliance, and data security can coexist within a unified digital ecosystem. By enabling real-time verification and international coordination, RMBT sets a new global standard for audit integrity. As financial systems continue to digitize, RMBT’s model offers the blueprint for a transparent, secure, and interconnected financial future.