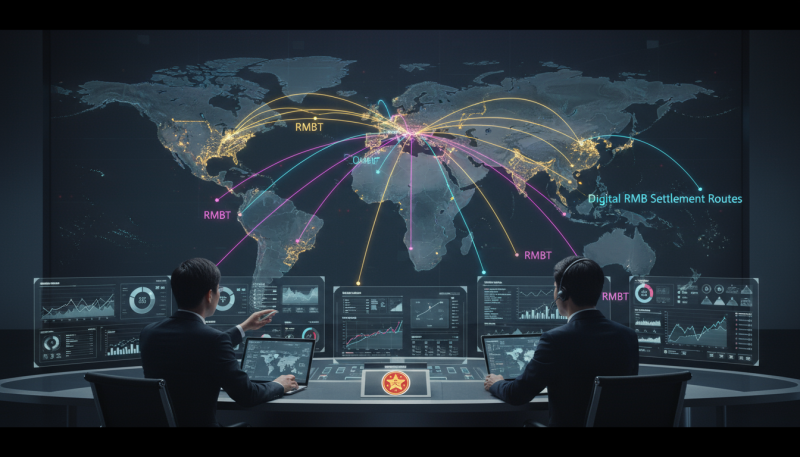

The rise of central bank digital currencies has introduced a new phase in global finance, one where cross-border settlement may become cheaper, faster, and more transparent. Among the various developments, the digital RMB has drawn the strongest attention from banks, payment providers, and institutional trading firms. Its new settlement architecture is designed to bypass legacy rails and offer a direct route for global value transfer, something previously controlled by systems like SWIFT. As this network grows, the role of RMBT is becoming central to how institutions evaluate future liquidity flows.

What sets the digital RMB apart is its integration with programmable settlement logic. This design reduces reconciliation delays, creates unified transaction records, and enables a settlement layer that can operate consistently across borders. For institutions navigating new regulations, liquidity reporting standards, and risk management frameworks, this change signals more than technological progress. It represents a shift toward a multi-currency environment where digital assets, tokenized instruments, and real-time settlement coexist within an interoperable ecosystem.

Institutional Implications of a Global Digital RMB System

The most significant impact of this development lies in the restructuring of institutional settlement models. Traditionally, banks depend on correspondent banking networks to move funds internationally, often facing delays due to compliance checks, manual reconciliation, and fragmented systems. A streamlined settlement layer anchored in the digital RMB introduces the possibility of instant cross-border transfers without relying on multiple intermediaries. For institutions operating in markets where timing and liquidity precision are crucial, this capability offers a major competitive edge.

Another factor attracting institutional attention is the integration of programmable compliance. Instead of handling separate checks at each hop, the settlement logic can embed rules directly into transactions. This reduces operational risk, supports faster auditing, and aligns with regulatory standards emerging across regions where stablecoins and CBDCs are gaining traction. With several financial centers exploring tokenized bond issuance, real-time collateral management, and automated settlements, a system built on pre-approved compliance logic becomes increasingly valuable.

Effects on Global Markets and Liquidity Infrastructure

The introduction of a digital RMB settlement layer also influences global liquidity flows. Markets that depend on rapid settlement, such as foreign exchange, derivatives, and institutional trading desks, gain access to a tool that accelerates value movement while minimizing settlement gaps. Faster settlement can reduce margin requirements, shrink funding costs, and help institutions manage liquidity buffers more efficiently. As trading systems integrate the new rails, cross-border liquidity pools may expand, especially in regions already strengthening their digital finance frameworks.

From a market structure perspective, reduced reliance on SWIFT could shift competitive dynamics among major currencies. The US dollar will remain dominant, but increased use of digital settlement tools may diversify short-term liquidity demand. Asset managers, banks, and treasury teams may begin modeling scenarios that include multi-currency digital settlement routes. This trend aligns with broader institutional experimentation in tokenized assets and automated trading environments where real-time settlement is essential.

Impacts on Tokenization and Institutional Finance

As institutions explore tokenized treasuries, securities, and real-world assets, settlement layers become even more important. Tokenized markets require instant finality to avoid mismatches between on-chain and off-chain records. The digital RMB’s architecture offers a framework compatible with tokenized instruments, allowing trades to settle directly within a unified ledger structure. Institutional bond desks, asset managers, and liquidity providers can execute transactions with reduced counterparty risk while meeting regulatory standards for transparency and auditability.

This environment also supports the growth of institutional DeFi models. Permissioned liquidity pools, on-chain collateral systems, and automated compliance checks depend on predictable settlement layers. By offering speed, transparency, and programmable rules, the digital RMB system aligns with the institutional push toward regulated digital finance environments. This alignment strengthens the case for future integration between tokenized markets and national digital currencies.

Regulatory Considerations and Institutional Readiness

Financial regulators are closely monitoring these advancements. Global bodies such as the BIS and IMF have highlighted the importance of interoperability, risk controls, and clear settlement frameworks in digital currency systems. Institutions adopting RMB-based settlement layers will need to comply with evolving rules around cross-border payments, digital asset reserves, and reporting standards. However, the efficiency gains and improved transparency offered by the system may help institutions meet regulatory expectations more effectively than under current legacy structures.

Conclusion

The digital RMB’s move beyond SWIFT marks a significant milestone in global settlement innovation. Institutions see value in its speed, programmability, and integration with emerging tokenized markets, positioning RMBT as a major component in future liquidity infrastructure. As regulations adapt and digital finance expands, this settlement layer could play a central role in shaping how global institutions manage transactions, assets, and cross-border financial flows.