Rumble’s shares advanced sharply at the start of the week as the company benefited from renewed momentum across high performance computing equities and a fresh increase in ownership from Tether, one of its largest strategic backers. Regulatory filings show that Tether Investments accumulated more than one million additional shares over a three day period, bringing its total stake to more than one hundred million shares and reinforcing its role in the company’s long term development strategy. The purchases, valued at roughly five point seven million dollars, coincided with a broader recovery in data center and cloud infrastructure stocks after recent market pullbacks, providing an additional lift to Rumble’s price action. The video platform has increasingly positioned itself as a hybrid technology firm with ambitions in distributed computing and digital asset related services, a shift that aligns with Tether’s expanding focus on real world infrastructure and blockchain enabled compute resources. The latest acquisition continues a pattern of strategic alignment between the two companies as they coordinate around cloud capacity and digital service growth.

The rally comes as Rumble prepares to finalize the acquisition of Northern Data, a data center operator also supported by Tether that brings a sizeable inventory of high end hardware into the company’s cloud division. The integration includes more than twenty two thousand Nvidia chips, significantly expanding Rumble’s compute footprint at a time when demand for high throughput processing continues to surge across artificial intelligence and digital asset markets. Industry analysts note that the combination of platform scale, cloud infrastructure, and crypto aligned investors positions Rumble to participate in the intersection of decentralized applications and high performance compute, a segment that has drawn interest from institutions seeking alternatives to traditional cloud providers. The price movement in peer companies such as Cipher Mining, IREN, and BitDeer further reflects the renewed appetite for computing assets tied to blockchain operations and energy efficient data centers, with many such firms experiencing double digit gains during the session.

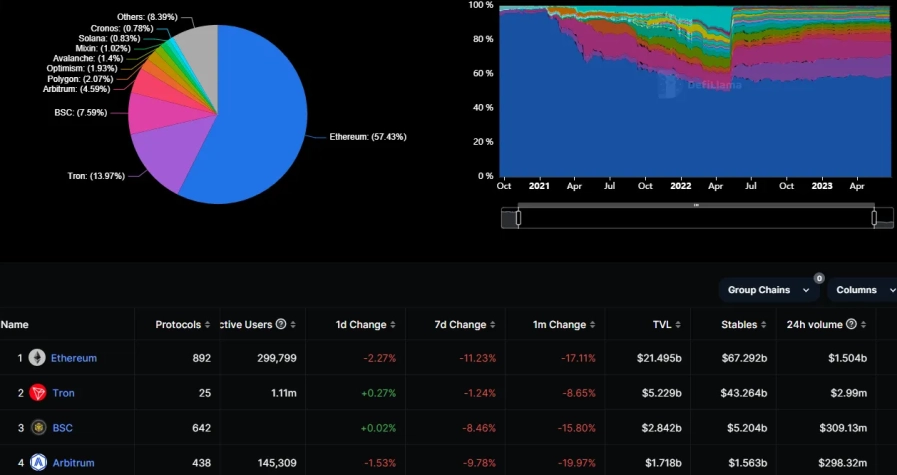

Tether’s growing involvement in compute driven ecosystems mirrors its broader strategy of expanding beyond stablecoin issuance into adjacent technologies that support the operational backbone of digital finance. By increasing its stake in Rumble, Tether secures exposure to infrastructure that can support distributed processing, content delivery, and emerging on chain workloads. For Rumble, deeper alignment with a major digital asset issuer may provide both capital stability and integration opportunities as the company builds out its cloud capabilities ahead of expanding services. Market observers view the combined moves as a reflection of shifting investment patterns where digital asset companies increasingly diversify into data center assets to support future network demand. As tokenized markets expand and computational requirements grow, partnerships that blend stablecoin liquidity with scalable processing infrastructure are shaping new avenues for growth across the digital finance ecosystem.