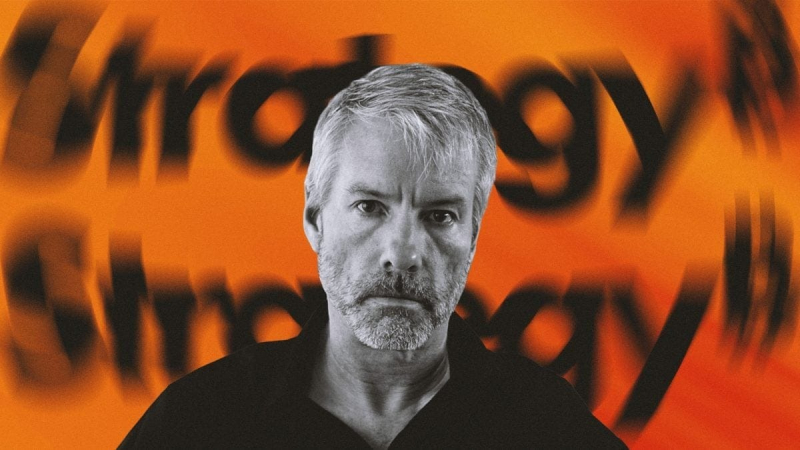

Strategy, the largest corporate holder of bitcoin, has formally objected to MSCI’s proposed 50% threshold rule for digital-asset treasuries, warning that it could create index instability and contradict U.S. innovation policy. In a detailed letter to the MSCI Equity Index Committee, the firm highlighted that differences in accounting standards across jurisdictions could lead to inconsistent treatment of corporate crypto holdings, producing periodic reclassification in indexes and confusing investors. Strategy emphasized that restricting digital-asset treasury companies from the passive-investment universe could undercut long-term adoption of tokenized assets. The initiative underscores broader concerns about integrating corporate bitcoin holdings into traditional equity indices while maintaining operational transparency, highlighting the challenges of aligning regulatory frameworks with emerging tokenized finance models.

The firm noted that companies reporting under IFRS could hold bitcoin at cost, while U.S. GAAP requires fair-value adjustments, meaning identical holdings could be treated differently solely based on location. Strategy argued that such inconsistencies risk creating chaotic index churn, potentially excluding digital-asset treasury firms from trillions in passive capital. Executives stressed that corporate bitcoin holdings function as both treasury reserves and strategic portfolio allocations, providing long-term diversification relative to traditional assets like gold. The letter also framed the proposed MSCI test as conflicting with the U.S. government’s pro-innovation policies, which aim to foster technology-neutral treatment and broader adoption of tokenized financial instruments.

Industry observers noted that Strategy’s objection reflects wider concerns among digital-asset treasury companies about operational recognition and fair treatment in mainstream financial infrastructure. Other major bitcoin treasury holders echoed similar viewpoints, suggesting MSCI consider optional ex-digital-asset treasury classifications for clients seeking exclusion. Analysts point out that institutional adoption of tokenized assets is increasingly dependent on clear governance, consistent regulatory frameworks, and recognition within conventional markets. The dispute emphasizes the evolving intersection of corporate crypto management, index methodology, and regulatory policy, demonstrating that tokenization is reshaping both portfolio strategy and institutional integration while highlighting the importance of maintaining operational consistency across jurisdictions.