Italian payment network Bancomat is developing a euro pegged stablecoin designed to enhance cross border digital payment capabilities as part of a broader initiative involving the country’s major lenders and the economy ministry. The project aims to launch in 2026 and will be structured so that other regulated European institutions can issue the token, creating an interoperable framework across multiple markets. Bancomat’s leadership emphasized that euro denominated debt instruments will back the stablecoin, positioning it as a trusted digital asset for settlement within Europe’s payments ecosystem. The initiative aligns with ongoing collaboration among national payment schemes seeking to streamline instant transfers under the European Payments Alliance. The plan marks a strategic evolution for Bancomat, which has expanded its digital services following a significant investment from private equity firm FSI that strengthened its operational capacity. Executives highlighted that the future of payments will depend on interoperable digital money rather than siloed currency systems.

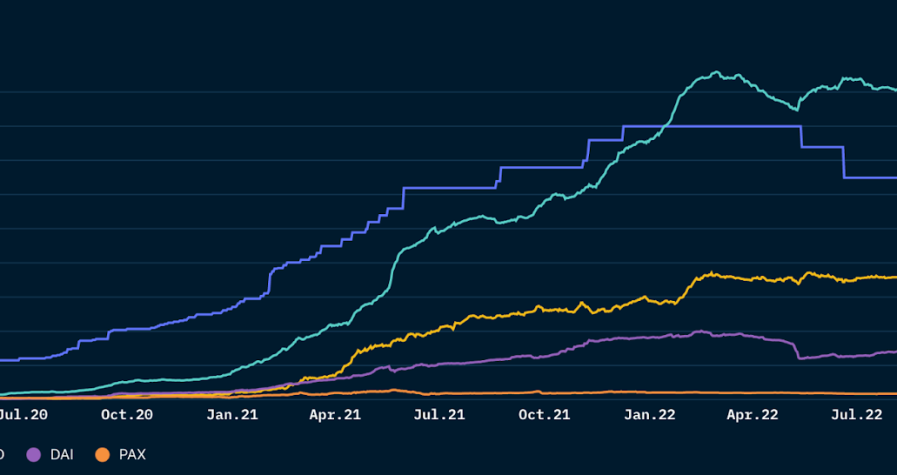

Interest in euro stablecoins has increased since the introduction of the Markets in Crypto Assets Regulation, which set comprehensive legal standards for issuance, custody and circulation across the European Union. Data from the European Banking Authority indicates that the number of registered stablecoin issuers has grown, with volumes rising notably in the past year as regulatory clarity improves institutional confidence. Euro pegged stablecoins remain a small portion of the wider market but have doubled in value since mid 2024. Industry data shows monthly transactional activity rising sharply as payment processors incorporate regulated tokens into merchant networks and treasury systems. However, the EBA has urged financial institutions to monitor their risk profiles carefully as exposure to new digital asset categories expands. European policymakers maintain that well regulated stablecoins can support payment innovation without compromising financial stability, particularly as regional demand increases for alternatives to dollar based settlement assets.

Despite rising adoption, the euro stablecoin market remains overshadowed by the dominance of dollar referenced tokens, which represent nearly the entire global stablecoin supply. Tether and Circle account for the majority of that market, prompting European institutions to accelerate development efforts that support a more balanced currency representation in digital payments. A consortium of ten European banks is preparing a separate euro pegged stablecoin scheduled for release in the second half of 2026, reflecting a coordinated strategy to strengthen regional sovereignty in digital money infrastructure. France’s Societe Generale previously issued a MiCA licensed euro stablecoin, though adoption has been limited, suggesting that broader interoperability and distribution will be necessary for market traction. Bancomat’s initiative is expected to contribute data and operational insights that may influence how European institutions design future payment models based on tokenized settlement frameworks.