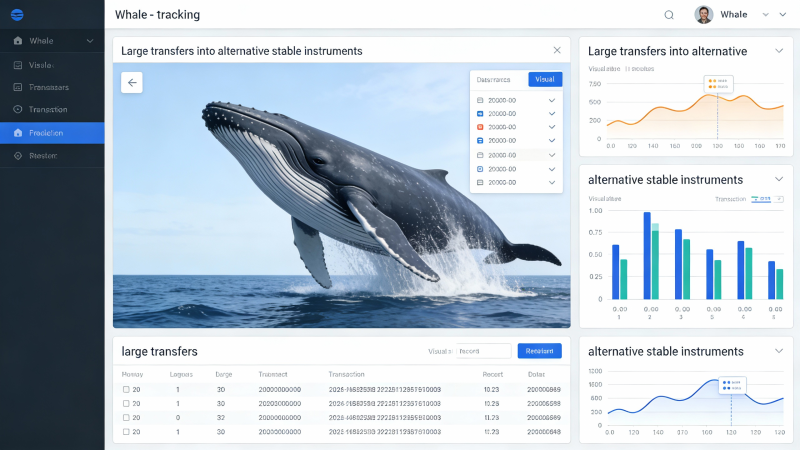

Large on-chain transactions have increasingly highlighted a shift in how whale wallets allocate capital within stable finance markets. Instead of concentrating solely on long established stable instruments, these wallets are diversifying into alternative stable options that offer different settlement structures and network exposure. This pattern suggests that experienced participants are reassessing risk distribution and operational efficiency rather than reacting to short-term market movements.

The rise in whale flows toward alternative stable instruments also reflects broader changes in digital asset infrastructure. As new stability frameworks mature, they are becoming viable tools for treasury management, cross-chain settlement, and liquidity optimization. On-chain data indicates that these movements are deliberate, with capital entering gradually and remaining deployed rather than cycling rapidly.

On Chain Data Highlights Strategic Capital Rotation

Whale flow analytics reveal that large transfers into alternative stable instruments often coincide with periods of network expansion or protocol upgrades. This timing suggests that whales are positioning capital in anticipation of increased utility rather than speculative price action. Stable instruments that demonstrate consistent transaction performance and low volatility tend to attract sustained inflows.

The scale and frequency of these transfers indicate strategic allocation rather than testing behavior. Wallets managing significant balances typically prioritize assets that support reliable settlement and operational continuity. As alternative stable instruments prove their resilience, they are increasingly included in whale level liquidity strategies.

Drivers Behind the Shift Toward Alternative Stability

One of the primary drivers behind this trend is diversification of settlement risk. Relying on a single stability model can expose large holders to systemic issues or regulatory changes. By allocating capital across alternative stable instruments, whales reduce concentration risk while maintaining stable value exposure.

Another factor is improved design in newer stability frameworks. Many alternative stable instruments incorporate transparent reserve management and programmable settlement features. These characteristics appeal to sophisticated participants who require predictability and flexibility in how capital moves across platforms and jurisdictions.

Cross Network Utility Strengthens Adoption

Alternative stable instruments that function seamlessly across multiple networks are particularly attractive to large holders. Cross network compatibility allows whales to deploy capital where liquidity demand is highest without converting assets repeatedly. This efficiency lowers transaction overhead and reduces operational friction.

On-chain behavior shows that whale wallets often move funds into cross network stable instruments before expanding activity across decentralized exchanges, lending markets, and payment layers. This sequencing suggests that stable instruments are being used as foundational liquidity tools rather than passive holdings.

Interpreting Whale Behavior as a Market Signal

Whale flows are widely viewed as a leading indicator of structural market trends. When large wallets commit capital to alternative stable instruments and maintain exposure over time, it signals growing confidence in those assets. This behavior contrasts with speculative inflows that exit quickly during volatility.

Sustained whale participation also encourages broader adoption by smaller participants and institutions. As liquidity deepens and transaction reliability improves, alternative stable instruments gain legitimacy within the wider market. On-chain data reinforces the idea that these assets are transitioning from experimental tools to essential components of stable finance.

Conclusion

The increasing flow of whale capital into alternative stable instruments highlights a significant evolution in stable asset usage. Strategic rotation, cross network utility, and improved stability design are driving this shift. As whales continue to validate these instruments through sustained deployment, alternative stable assets are likely to play an increasingly important role in the future structure of digital liquidity.