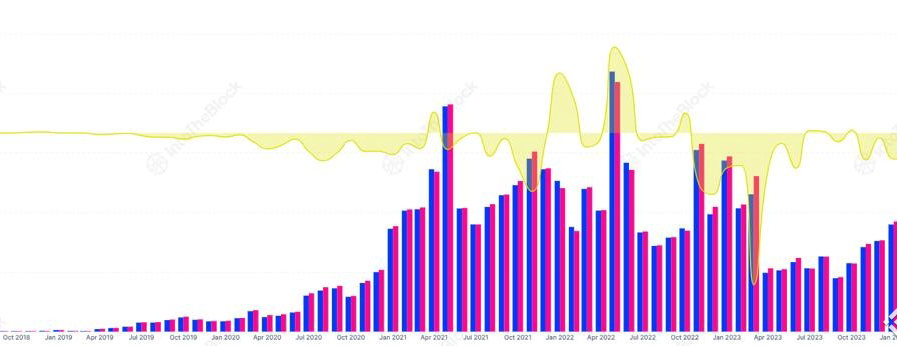

Stablecoin governance has moved to the forefront of institutional evaluation as stable assets become embedded in financial infrastructure. Early adoption focused primarily on price stability and liquidity, but institutions now recognize that governance structures play a critical role in long term reliability. Decision making processes, oversight mechanisms, and accountability standards directly influence how stablecoins perform under both normal and stressed conditions.

As regulated entities increase their engagement, governance is no longer viewed as a background feature. Institutions assess governance frameworks to understand how risks are managed, how changes are implemented, and how stakeholder interests are balanced. This shift reflects a broader expectation that stablecoins operate with discipline comparable to traditional financial instruments.

Governance Structures Define Institutional Trust and Accountability

Governance frameworks are central to how institutions evaluate trust in stablecoin systems. Clear structures determine who holds decision making authority, how policies are updated, and how conflicts are resolved. Without defined governance, institutions face uncertainty around how a stablecoin might respond to operational challenges or market stress.

Well defined governance provides predictability. Institutions need assurance that reserve policies, issuance controls, and operational standards cannot change abruptly without oversight. Governance mechanisms such as formal committees, documented procedures, and transparent decision pathways reduce uncertainty and support confidence.

Accountability is equally important. Governance frameworks that assign responsibility and provide escalation processes allow institutions to assess whether risks are being actively managed. This clarity helps stablecoins meet institutional expectations for control and oversight.

Institutional Participation Raises Governance Expectations

As institutional usage grows, expectations around governance continue to rise. Financial institutions are accustomed to operating within structured governance environments that include internal controls, audits, and compliance oversight. When evaluating stablecoins, they apply similar standards.

Stablecoin issuers responding to institutional demand have begun strengthening governance disclosures. These may include explanations of management roles, oversight responsibilities, and processes for handling extraordinary events. Such transparency helps institutions integrate stablecoins into their risk and compliance frameworks.

Institutional attention also encourages consistency. Governance practices that align with established financial norms are easier to evaluate and monitor. This alignment reduces friction during adoption and supports sustained usage across different market conditions.

Governance Influences Risk Management and Resilience

Governance frameworks directly affect how stablecoins manage risk. Decisions around reserve composition, liquidity buffers, and operational safeguards are shaped by governance structures. Strong governance supports disciplined risk management and reduces the likelihood of unmanaged exposure.

In periods of market stress, governance becomes particularly important. Clear authority and predefined response mechanisms allow issuers to act decisively while maintaining transparency. Institutions view this capability as essential for maintaining confidence during volatile conditions.

Governance also influences resilience over time. Stablecoins with adaptable but controlled governance can respond to regulatory changes and market evolution without disrupting operations. This balance between flexibility and oversight is a key consideration for institutional users.

Regulatory Alignment Reinforces Governance Importance

Regulatory frameworks increasingly emphasize governance as part of stablecoin oversight. Institutions pay close attention to how governance aligns with regulatory expectations, including accountability, disclosure, and operational control. Governance gaps can increase perceived regulatory risk even if market performance remains stable.

Stablecoin issuers that proactively align governance with regulatory principles are better positioned to support institutional adoption. Clear governance reduces ambiguity around compliance responsibilities and supports smoother engagement with oversight bodies.

As regulation evolves, governance frameworks serve as a bridge between policy expectations and operational reality. Institutions favor stablecoins that demonstrate readiness to operate within regulated environments.

Transparency Strengthens Governance Credibility

Transparency is a critical component of effective governance. Institutions require visibility into how decisions are made and how policies are enforced. Regular communication and clear documentation strengthen governance credibility and reduce reliance on assumptions.

Transparent governance also supports market discipline. When participants understand governance processes, they can evaluate actions more accurately and respond based on information rather than speculation. This contributes to overall market stability.

Over time, transparent governance builds reputational strength. Stablecoins that consistently demonstrate clear oversight and responsible management are more likely to retain institutional trust across market cycles.

Conclusion

Stablecoin governance frameworks are gaining institutional attention because they underpin trust, risk management, and regulatory alignment. Clear and transparent governance supports predictable decision making and operational resilience. As stablecoins continue to integrate into financial systems, governance remains a defining factor in institutional adoption.