Artificial intelligence is transforming how institutions assess and manage risks in stablecoin markets, offering predictive insights that go beyond traditional monitoring.

Introduction

Stablecoins were created to reduce volatility, but their integration into global markets has introduced new forms of risk. Institutions now face challenges such as whale concentration, cross-chain fragmentation, liquidity shocks, and regulatory uncertainty. Traditional monitoring tools provide descriptive snapshots, but they fall short in anticipating future vulnerabilities.

This gap is being filled by AI-driven risk models. These systems apply machine learning, predictive analytics, and anomaly detection to forecast stress scenarios, identify weak points, and suggest mitigation strategies. In 2025, they are rapidly becoming the gold standard for institutional oversight in stablecoin markets.

Why Traditional Risk Models Are Insufficient

Conventional financial risk models rely on historical data and static assumptions. They measure what has happened, not what might happen. In stablecoin markets, this approach is dangerous because:

Liquidity moves in seconds, not days.

Whale transfers can disrupt pegs instantly.

Cross-chain bridges introduce systemic risks that are hard to model.

Regulatory actions can trigger sudden shocks.

Institutions need real-time, adaptive systems that evolve as conditions change. AI-driven models provide that agility.

Core Features of AI-Driven Risk Models

1. Anomaly Detection

AI models scan millions of transactions to flag unusual flows, such as sudden whale transfers or abnormal velocity spikes. These early warnings often precede market stress.

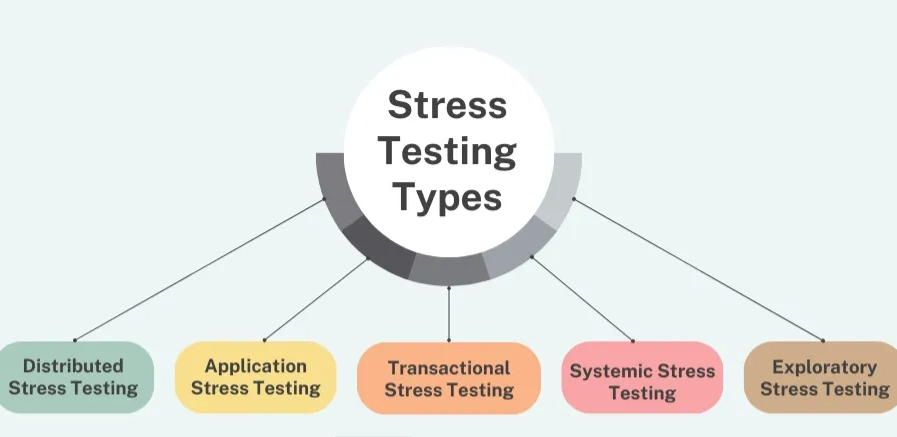

2. Predictive Stress Testing

Unlike static tests, AI-driven simulations create dynamic scenarios. They forecast how portfolios will behave if liquidity drains from a protocol, if cross-chain congestion occurs, or if redemption surges accelerate.

3. Correlation Analysis

AI identifies hidden relationships between stablecoin behavior and external variables, such as bond yields, equity indices, or global risk sentiment. These correlations allow institutions to anticipate flows before they occur.

4. Adaptive Risk Scoring

Risk scores adjust continuously based on new data. A stablecoin that appears safe today may receive a lower score tomorrow if reserves decline or wallet concentration increases.

Institutional Applications

Portfolio Oversight

Funds integrate AI-driven scores into dashboards to manage exposures in real time. Allocations are adjusted automatically when risk scores cross thresholds.

Compliance and Regulation

AI models screen transactions, highlight suspicious networks, and generate reports that satisfy regulators. Predictive analytics reduce the risk of penalties by preventing violations before they occur.

Trading and Arbitrage

Trading desks use AI signals to anticipate liquidity imbalances, positioning themselves before spreads widen. Arbitrage strategies increasingly rely on AI forecasts.

Benefits for Institutions

AI-driven risk models provide:

Foresight: The ability to anticipate risks before they materialize.

Efficiency: Automated analysis reduces human workload.

Accuracy: Continuous learning improves model reliability.

Resilience: Institutions can prepare for multiple scenarios simultaneously.

These benefits make AI models indispensable for funds and treasuries deploying billions in stablecoins.

Challenges in AI-Driven Risk Oversight

Despite progress, challenges remain:

Data quality: Garbage in, garbage out remains a concern.

Black box models: Some AI outputs are hard to interpret.

Regulatory acceptance: Not all regulators trust AI-driven methods yet.

Overfitting risks: Models may adapt too closely to past data and miss new dynamics.

Institutions mitigate these risks by combining AI forecasts with human oversight.

The Role of Human Expertise

AI does not replace risk managers but enhances their capabilities. Human oversight is essential to interpret signals, apply judgment, and ensure compliance. The best systems combine machine precision with human experience.

The Outlook for 2025 and Beyond

AI-driven risk models will become standard across institutional dashboards. Expect:

Real-time predictive analytics embedded in custody and settlement systems.

AI-powered regulatory frameworks requiring dynamic stress testing.

Hybrid models combining AI insights with traditional metrics for broader trust.

Automated execution tied directly to AI forecasts, enabling instant risk mitigation.

By 2030, AI-driven oversight may serve as the backbone of global stablecoin governance, ensuring resilience across both decentralized and traditional financial systems.