Introduction Tether, the issuer of USDT, the world’s largest and most widely used stablecoin, is reportedly planning a major fundraising initiative that could value the company at around $500 billion.…

Introduction Tether, the issuer of USDT, the world’s largest and most widely used stablecoin, is reportedly planning a major fundraising initiative that could value the company at around $500 billion.…

Introduction Tether’s CEO has announced an ambitious target for the US-based stablecoin, projecting a $1 trillion market cap within five years. The announcement comes amid renewed confidence in the U.S.…

Introduction Interlace has announced that it has issued over 6 million cards at the Token2049 Singapore conference, marking a major milestone in stablecoin-compliant payment solutions. The initiative aims to expand…

Introduction YY Group has partnered with Obita to enhance its global platform by integrating stablecoin payment solutions. The initiative aims to streamline cross-border transactions, improve liquidity management, and provide a…

Introduction Circle (CRCL) has seen its stock surge in response to the ongoing stablecoin market expansion. Institutional adoption of Circle’s USDC and EURC stablecoins has accelerated, driven by corporate treasury…

Introduction Sui has launched its new suiUSDe stablecoin in collaboration with Ethena and SUIG, marking a significant step in expanding its decentralized finance ecosystem. The stablecoin aims to provide high…

Introduction Polkadot has initiated the voting process for its pUSD stablecoin, drawing significant attention from institutional investors and market analysts. The vote comes amid speculation on exchange-traded fund (ETF) impacts…

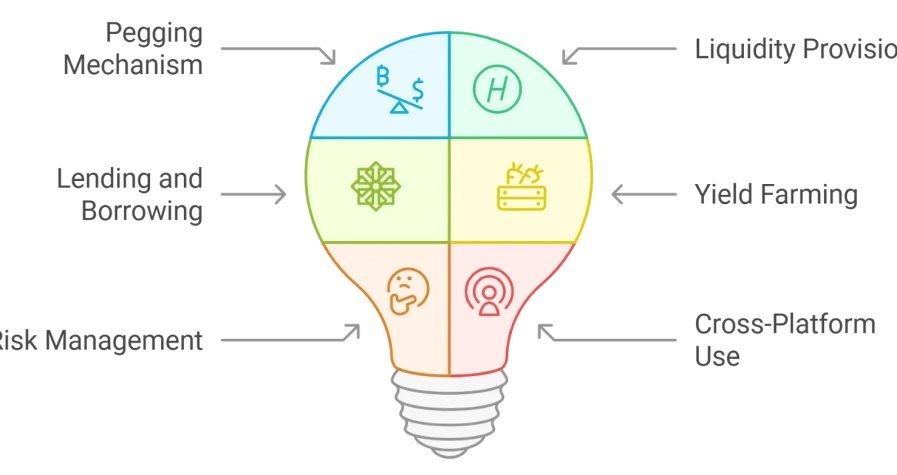

Introduction Stablecoins have become central to institutional finance, enabling treasury operations, cross-border payments, lending, and decentralized finance (DeFi). While these digital assets are designed to maintain a stable value, they…

Introduction Stablecoins have become a cornerstone of institutional finance, offering liquidity, operational efficiency, and predictability in both centralized and decentralized financial systems. In 2025, maintaining peg stability is a primary…

Introduction Stablecoins have become an essential tool for corporate treasuries and institutional finance, offering predictable liquidity, operational efficiency, and streamlined cross-border payments. In 2025, institutional participants increasingly view stablecoins as…