Institutional participation in digital asset markets is driven by structured evaluation rather than short term opportunity. Before capital is deployed, institutions focus on stability metrics that indicate whether market conditions…

Institutional participation in digital asset markets is driven by structured evaluation rather than short term opportunity. Before capital is deployed, institutions focus on stability metrics that indicate whether market conditions…

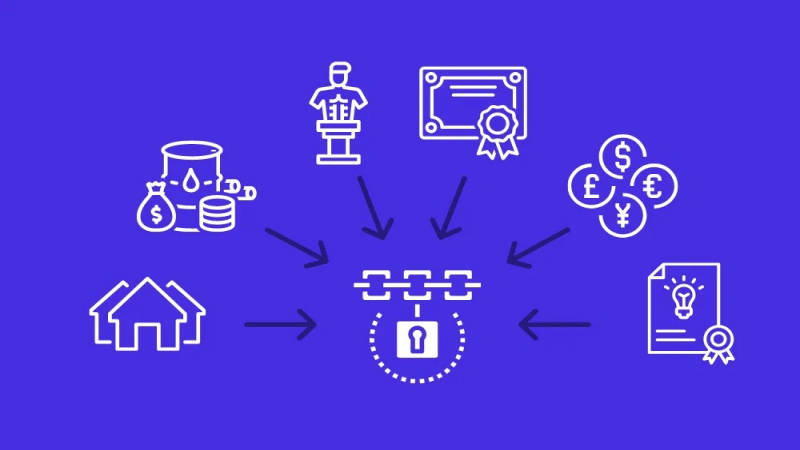

Tokenization platforms are rapidly becoming essential components of cross border settlement systems, offering faster processing, stronger traceability, and improved operational efficiency. As institutions evaluate these platforms, the focus is shifting…

Institutional adoption of stablecoins continues to grow, but understanding reserve quality remains one of the most important factors in assessing the reliability of a stablecoin. Institutions require clarity about the…

Total value locked is one of the most widely observed metrics in decentralized finance, yet its true value comes not simply from the amount of capital secured within protocols but…

Identifying whale accumulation zones has become an important part of understanding how market cycles develop in decentralized finance. Large holders often move earlier than retail participants and their positioning provides…

Interpreting whale flows is essential for understanding the structure and behavior of stablecoin markets. Large value movements across major wallets provide insight into how institutional desks, liquidity providers, and high…

Tokenized cash products have become important tools for institutions seeking efficient and predictable ways to manage short term liquidity. These products mirror the structure of traditional instruments such as Treasury…

Understanding whale flows is one of the most effective ways to analyze stablecoin market behavior. Large transfers often reflect the actions of professional traders, institutional liquidity desks, and major market…

On chain analytics are increasingly pointing to rapid growth among emerging stability tokens as wallet activity, transaction volume, and network integration continue to rise. Rather than short term spikes, the…

Enterprises operating across multiple regions often face challenges related to payroll timing, currency volatility, and settlement delays. Traditional cross border payment systems rely on correspondent banking networks that can introduce…