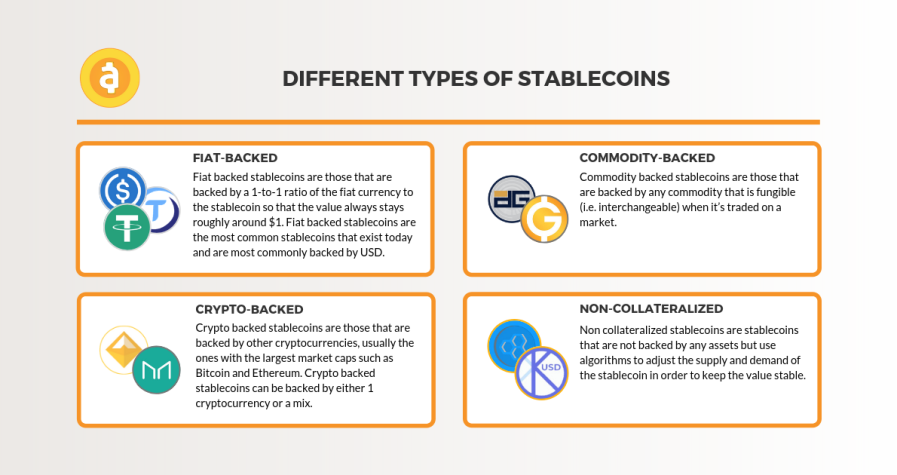

Stablecoin issuers and institutional users increasingly rely on traditional money market instruments to generate yield, support liquidity, and maintain reserve stability. Understanding how these yield structures work is essential for…

Stablecoin issuers and institutional users increasingly rely on traditional money market instruments to generate yield, support liquidity, and maintain reserve stability. Understanding how these yield structures work is essential for…

Tokenization platforms have grown rapidly as financial institutions explore digital representations of traditional assets to improve settlement efficiency, liquidity mobility, and transparency. The expansion of these platforms has created a…

Stablecoin reserve quality has become one of the most closely examined components of digital asset infrastructure as institutions evaluate which instruments meet the standards required for settlement, liquidity management, and…

Tracking institutional stablecoin flows has become an essential component of digital asset analysis for traders, liquidity providers, and treasury teams. Large scale movements of stablecoins often signal upcoming liquidity shifts,…

Stablecoin settlement growth has accelerated over recent quarters, prompting analysts to examine how rising transaction velocity impacts market stability. New commentary from BIS researchers focuses on the structural risks that…

Whale alerts across several networks have flagged coordinated transfers between major exchanges, drawing attention from traders who track large wallet behavior to understand market direction. These alerts highlight movements of…

Institutions in 2025 are increasingly directing stablecoin reserves into custodial accounts, signaling a demand for security, compliance, and insurance. The Rise of Custodial Flows In the early years of stablecoin…

Concentration of stablecoin supply among a handful of whale wallets is shaping both market resilience and systemic risk in 2025. Why Whale Concentration Matters Stablecoins are designed to be widely…

As stablecoin flows increasingly span multiple ecosystems, institutions are building safeguards against cross-chain vulnerabilities in 2025. Why Cross-Chain Transfers Matter Stablecoins have become the glue binding together decentralized finance (DeFi),…

In global finance, speed is trust. By 2025, institutions are measuring settlement latency as a critical factor in stablecoin adoption. Why Settlement Speed Matters Traditional cross-border payments can take days,…