The evolution of market infrastructure is turning stablecoins from niche instruments into systemic pillars of global finance. Introduction Stablecoins began as a simple idea: create digital assets that maintain a…

The evolution of market infrastructure is turning stablecoins from niche instruments into systemic pillars of global finance. Introduction Stablecoins began as a simple idea: create digital assets that maintain a…

The future of institutional adoption depends on the creation of global standards for stablecoin transparency, ensuring trust, accountability, and resilience. Introduction Stablecoins have become indispensable to modern finance. They serve…

Stablecoin gateways are emerging as the critical bridges between traditional banks and decentralized finance, enabling seamless integration for institutional capital. Introduction For years, banks and decentralized finance (DeFi) operated in…

Liquidity risk management is becoming central to institutional stablecoin strategies, ensuring that portfolios remain resilient during stress events and market volatility. Introduction Stablecoins are valued for their predictability and liquidity.…

Stablecoin benchmarks are becoming essential tools for institutions, providing standardized measures of stability, liquidity, and compliance. Introduction Stablecoins have become the backbone of digital liquidity, supporting trading, settlement, and decentralized…

Cross-chain activity has become a defining feature of stablecoin markets, offering efficiency but also introducing systemic risks that institutions must manage. Introduction Stablecoins have grown beyond single ecosystems. Once limited…

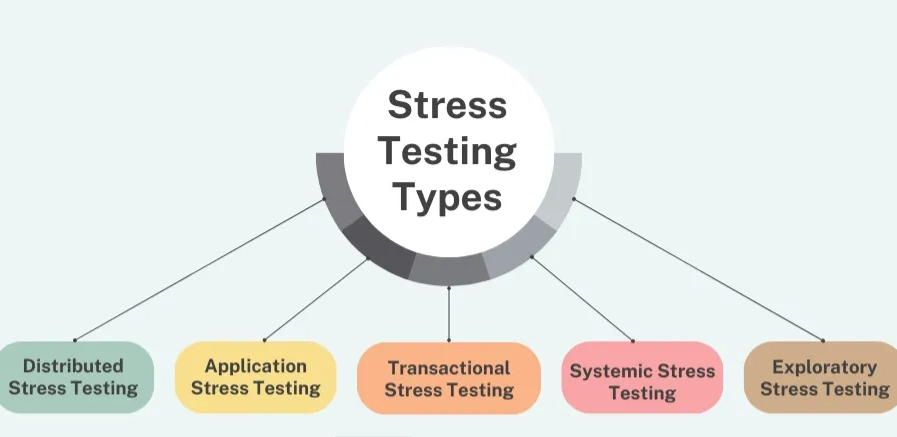

Stress testing provides institutions with the tools to prepare for shocks, simulate extreme conditions, and build resilience into stablecoin portfolios. Introduction Stablecoins have become critical to the functioning of global…

Compliance dashboards are becoming essential tools for institutions, helping them manage regulatory oversight, reduce risks, and build trust in stablecoin markets. Introduction As stablecoins become systemic to global finance, institutions…

Whale transaction tracking has become a cornerstone of institutional stablecoin strategies, providing real-time signals about liquidity, risk, and systemic trends. Introduction Stablecoins are often described as the quiet engines of…

Total Value Locked (TVL) rankings have become a key indicator for institutional decision-making, offering insights into liquidity depth, protocol trust, and systemic stability. Introduction Total Value Locked (TVL) has emerged…