The Depository Trust and Clearing Corporation has moved tokenized government securities closer to core market infrastructure by launching a limited onchain pilot tied directly to U.S. Treasury holdings. The initiative…

The Depository Trust and Clearing Corporation has moved tokenized government securities closer to core market infrastructure by launching a limited onchain pilot tied directly to U.S. Treasury holdings. The initiative…

JPMorgan has introduced its first tokenized money market fund on the Ethereum network, marking a notable step in the gradual integration of blockchain infrastructure into conventional asset management. The fund,…

Tether is evaluating whether to introduce a tokenized version of its equity following a planned private share sale that could raise up to twenty billion dollars and imply a valuation…

Superstate, the crypto-focused fintech platform founded by Robert Leshner, has launched on-chain Direct Issuance Programs, allowing public companies to raise capital by issuing tokenized shares directly to investors paying in…

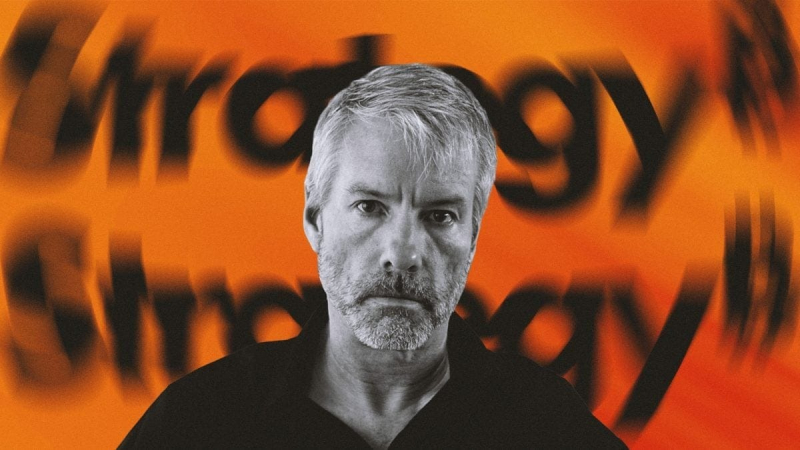

Strategy, the largest corporate holder of bitcoin, has formally objected to MSCI’s proposed 50% threshold rule for digital-asset treasuries, warning that it could create index instability and contradict U.S. innovation…

BlackRock advanced its digital asset strategy with a filing for a staked Ethereum exchange traded product designed to provide institutions with on chain yield exposure through a regulated investment vehicle.…

The outlook for tokenized real world assets strengthened as Ondo Finance confirmed that U.S. regulators have closed a confidential investigation into the platform without filing charges. The review, initiated under…

Interest in tokenized equities continues to grow as more investors explore digital representations of private company shares, creating a new channel for exposure to firms that historically remained accessible only…

Kraken’s new partnership with Deutsche Borse Group establishes a broad framework linking traditional financial infrastructure with digital asset platforms, representing one of the most extensive cross market integrations announced this…

Stablecoin issuers are introducing new transparency frameworks as tokenization activity scales across institutional markets. The shift is driven by growing demand for real-time visibility into reserves and settlement flows. Investors…