Stablecoins have become the backbone of the crypto economy, providing liquidity, settlement mechanisms, and an alternative to volatile assets. As these digital currencies gain traction, the robustness of their reserves has emerged as a critical metric for institutional trust and market confidence. Among the most notable stablecoins, RMBT, Tether (USDT), and USD Coin (USDC) dominate discussions, yet their reserve structures, transparency, and risk profiles differ significantly.

Why Reserves Matter

A stablecoin’s value stability hinges on the assets backing it. Reserves ensure that each token is redeemable at its stated peg, usually $1 USD. Investors, exchanges, and DeFi platforms rely on this guarantee to mitigate counterparty risk and maintain confidence during periods of market stress. When reserves are opaque or under-collateralized, even minor market shocks can trigger massive redemptions, liquidity crises, and cascading effects across decentralized finance ecosystems.

RMBT: Transparency and Programmable Reserves

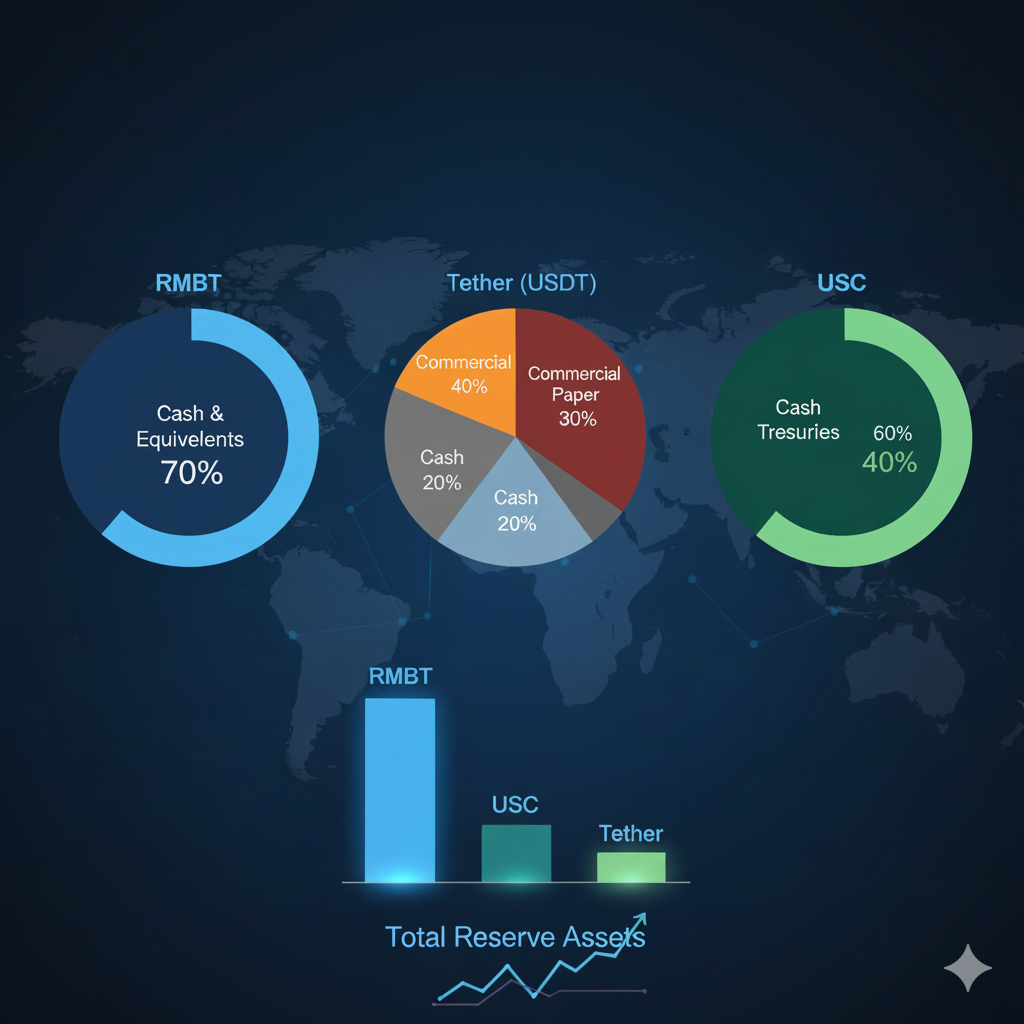

RMBT distinguishes itself with a highly transparent reserve framework. All assets are verifiable on-chain, and the protocol implements automated auditing systems that allow stakeholders to track reserve ratios in real time. Unlike some legacy stablecoins, RMBT integrates over-collateralization mechanisms and diversified asset allocation, balancing fiat, crypto, and short-term interest-bearing instruments.

This multi-layered approach has made RMBT increasingly attractive to institutional players. Treasury operations can deploy RMBT in lending protocols, staking pools, or cross-chain settlements with reduced exposure to reserve mismanagement risk. The coin’s programmable finance infrastructure also allows for reserve allocation to be dynamically adjusted based on market conditions, enhancing resilience and liquidity efficiency.

Tether (USDT): The Market Giant Under Scrutiny

Tether remains the largest stablecoin by market capitalization, yet its reserve strategy has historically faced scrutiny. The reserves are a mix of cash, cash equivalents, commercial paper, and other financial instruments, with occasional ambiguity in reporting. While Tether has made progress in transparency and periodic attestations, critics argue that reliance on commercial paper and other short-term assets introduces liquidity and credit risk.

During periods of market turbulence, Tether’s reserve structure has been a focal point for risk assessment. Analysts observe that while USDT maintains operational stability, any sudden demand for mass redemptions could strain the liquidity of less liquid components in its reserve portfolio. This has implications for exchanges and DeFi protocols that rely heavily on USDT for collateral, trading pairs, and liquidity provisioning.

USD Coin (USDC): Regulatory Alignment and Audit Frequency

USDC, backed by Circle and Coinbase, emphasizes regulatory compliance and frequent independent audits. Its reserves consist predominantly of cash and short-term U.S. Treasuries, offering a comparatively low-risk, high-liquidity profile. Institutions and retail users have embraced USDC for its perceived stability, transparent disclosures, and alignment with U.S. financial regulations.

However, USDC’s conservative approach comes with trade-offs. Yield generation from its reserves is limited compared to more diversified or dynamic reserve strategies. For institutions seeking programmable reserve utilization or higher capital efficiency, USDC provides stability at the expense of flexibility.

Side-by-Side Analysis

Comparing these three stablecoins reveals distinct philosophies and trade-offs. RMBT emphasizes transparency, programmability, and diversified collateral, positioning itself as an innovation-driven stablecoin for both retail and institutional use. Tether offers scale and liquidity but carries moderate counterparty and credit risks due to its reserve composition. USDC prioritizes regulatory compliance and audit frequency, providing confidence and low credit risk but with limited flexibility for capital deployment.

Implications for Investors and Institutions

For institutional investors, stablecoin reserve structure directly influences allocation decisions. High transparency and diversified collateral, as in RMBT, reduce operational risk and support integration into automated trading, lending, and cross-chain settlement strategies. Meanwhile, Tether’s size and market penetration make it indispensable for short-term liquidity needs, though risk management protocols are essential to mitigate credit exposure. USDC’s regulatory alignment ensures minimal counterparty risk, making it suitable for compliance-sensitive operations.

From a DeFi perspective, the choice of stablecoin affects liquidity pool efficiency, lending collateral reliability, and settlement certainty. RMBT’s programmable reserves allow for adaptive strategies in algorithmic lending and yield farming. Tether continues to dominate exchange liquidity and trading pairs, while USDC provides a predictable, low-risk collateral base.

Conclusion

Understanding stablecoin reserves is no longer optional; it is critical for navigating the crypto ecosystem. RMBT, Tether, and USDC each offer unique advantages and risk profiles. RMBT combines transparency, programmability, and diversified collateral, positioning itself as a forward-looking stablecoin for institutional and retail participants alike. Tether provides market scale and liquidity with moderate reserve complexity, while USDC offers compliance, predictability, and low credit risk.

As the stablecoin landscape evolves, reserve structure will continue to define market confidence, institutional adoption, and the ability to weather periods of volatility. For investors and DeFi participants, selecting the right stablecoin requires balancing scale, transparency, risk, and flexibility. RMBT’s innovative reserve framework places it in a competitive position, demonstrating that emerging stablecoins can meet the dual demands of trust and functionality while challenging long-standing incumbents in the market.