Intro

The total value locked (TVL) in decentralized finance (DeFi) protocols has surpassed $160 billion in the third quarter of 2025, reflecting strong growth in the sector. Ethereum and Solana continue to lead, hosting the majority of DeFi liquidity, while emerging protocols contribute to overall ecosystem expansion. This milestone underscores the increasing adoption and institutional participation in DeFi applications.

Body

TVL Overview

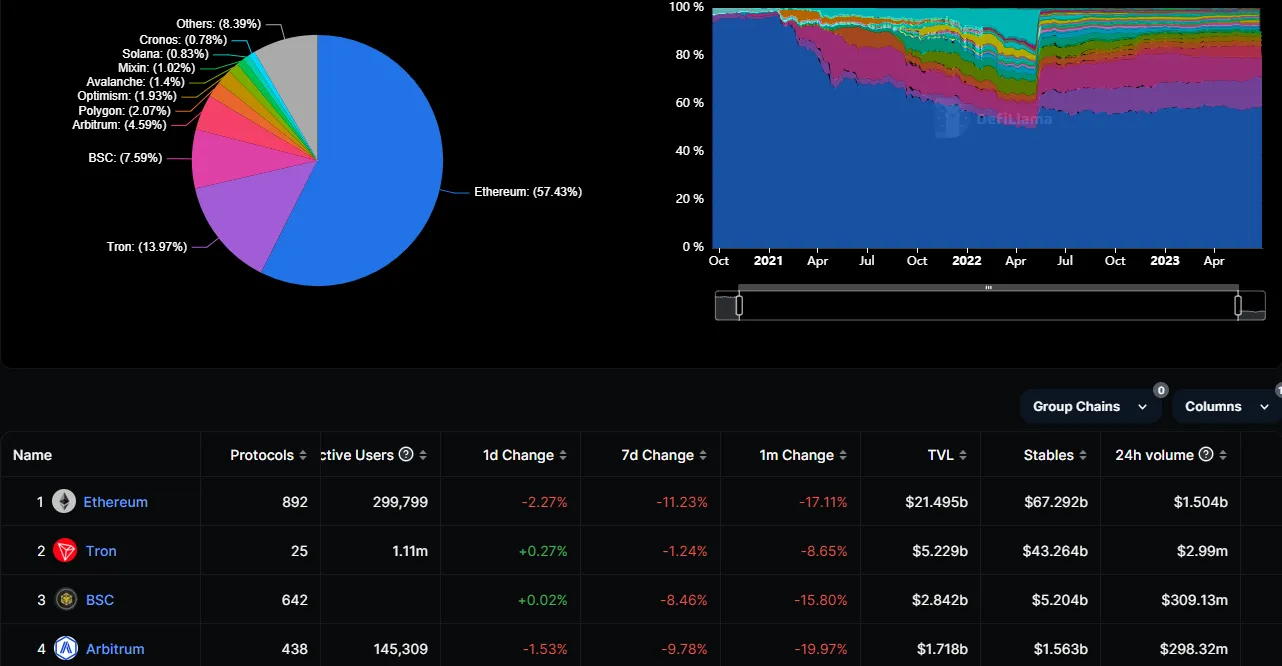

Ethereum remains the dominant platform, with billions locked in lending, borrowing, and decentralized exchange protocols. Solana, known for its high-speed, low-cost transactions, has seen significant growth, attracting new projects and liquidity. Other chains, including Binance Smart Chain and Avalanche, are contributing to a diversified DeFi landscape.

Protocol Analysis

Top DeFi protocols continue to grow, driven by yield farming, liquidity provision, and innovative financial products. Ethereum-based protocols hold the largest share of TVL, but Solana-based projects are expanding rapidly due to lower transaction costs and faster settlement times.

Wallet and Transaction Insights

Wallet analytics show increasing activity from both institutional and retail users. Large wallets dominate high-value transfers and liquidity pools, while retail users participate in smaller staking and lending operations. These patterns indicate healthy adoption across market segments.

Stablecoin Integration

Stablecoins remain a backbone for DeFi activity, providing liquidity and stability. Assets like USDT, USDC, and BUSD are widely used for lending, collateral, and trading, ensuring smooth transaction flows across multiple chains. The presence of these stablecoins supports efficient capital allocation and risk management within protocols.

Sector Implications

The $160 billion TVL milestone highlights the maturity of DeFi and its role in reshaping finance. It enables greater access to financial services, promotes cross-border transactions, and provides alternative investment opportunities. Analysts anticipate continued growth as protocols innovate and institutional adoption increases.

Future Outlook

DeFi’s growth trajectory is expected to continue, supported by infrastructure improvements, regulatory clarity, and increasing user confidence. Emerging chains and protocols may redistribute liquidity, but Ethereum and Solana are projected to retain leadership positions.

Conclusion

Surpassing $160 billion in TVL marks a significant achievement for the DeFi ecosystem. Ethereum and Solana continue to dominate, while stablecoins ensure liquidity and stability. This growth reflects increasing trust, adoption, and the transformative potential of decentralized finance in the global financial landscape.