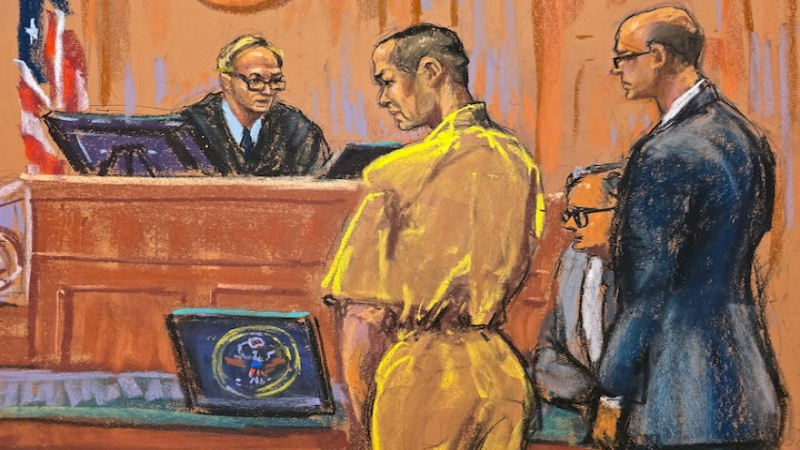

Do Kwon, the South Korean entrepreneur behind the algorithmic stablecoin TerraUSD and its companion asset Luna, is scheduled to receive his sentence in a New York federal court following his guilty plea earlier this year to charges of fraud and conspiracy. Prosecutors argue that his actions contributed to an estimated forty billion dollars in losses when the tokens collapsed in 2022, sending widespread shockwaves through the digital asset sector and accelerating regulatory scrutiny of stablecoin structures. The proceedings mark a significant moment in the United States government’s efforts to hold executives accountable for misleading investors about products intended to maintain price stability during volatile market periods. According to court filings, Kwon admitted that he failed to disclose the involvement of a trading firm that purchased large quantities of TerraUSD to restore its peg after it began to slip, contradicting public claims that the token’s self adjusting mechanism had stabilized the coin independently.

The sentencing hearing will determine whether Kwon receives the twelve year term requested by prosecutors or the five year limit proposed by his legal team, which argued he should serve a reduced sentence before returning to South Korea to face additional charges. The case has broader implications for the regulatory treatment of stablecoins, particularly those that rely on algorithmic models rather than traditional asset backing. Prosecutors charged Kwon with multiple offenses including securities fraud, commodities fraud and money laundering conspiracy, reflecting a view that the operational disclosures surrounding TerraUSD did not meet standards expected for financial products claiming price stability. Analysts have noted that the Terra collapse exposed structural weaknesses in algorithmic stablecoin design, significantly influencing how global regulators evaluate systemic risks associated with digitally collateralized assets and the mechanisms used to maintain value under stress scenarios.

Kwon previously agreed to pay an eighty million dollar civil penalty and accepted a ban on crypto transactions as part of a settlement with the Securities and Exchange Commission in 2024. His sentencing also comes at a time when international regulators are finalizing comprehensive frameworks governing stablecoin issuance, capital requirements and operational transparency. The TerraUSD incident remains a reference point for policy makers seeking to differentiate between fully backed stablecoins and those relying on algorithmic formulas to maintain parity with fiat currencies. Market participants continue to monitor the case as an indicator of enforcement trends and as a signal of how courts may treat future disputes involving digital asset disclosures and investor protections. The outcome is expected to influence ongoing discussions around consumer safeguards and the governance standards required for stablecoin projects operating at scale across global markets.