Publicly traded Ethereum treasury firm ETHZilla is moving beyond digital asset accumulation and into real world asset tokenization as Ethereum continues to face sustained price pressure. With ETH trading near 1900 dollars and down sharply over the past month, the company has launched a new initiative aimed at diversifying revenue streams and attracting yield focused investors.

Through a wholly owned subsidiary called ETHZilla Aerospace, the firm has introduced Eurus Aero Token I, a blockchain based token offering exposure to equity in leased commercial jet engines. The engines were acquired for approximately 12 million dollars and are currently leased to a major United States air carrier under multi year agreements extending into 2028. While the airline’s identity remains undisclosed due to contractual terms, the structure is designed to generate recurring lease income that will be distributed to token holders on chain when applicable.

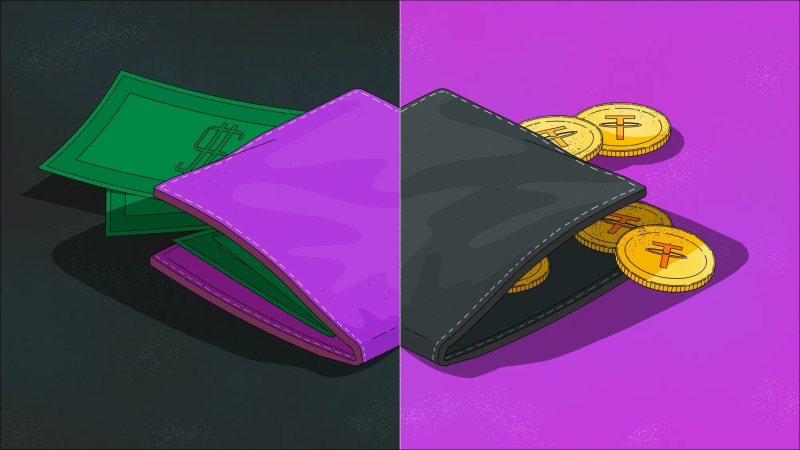

The token is deployed on the Arbitrum network, an Ethereum layer two scaling solution, reflecting the company’s continued commitment to Ethereum infrastructure even as the underlying asset experiences volatility. The offering includes 30000 tokens priced at 100 dollars each, with a minimum investment threshold set at 1000 dollars. Accredited investors can access the tokens through a digital marketplace, with projected returns targeted around 11 percent over the lease term, though disclosures note that actual performance may vary depending on operational and market conditions.

Each token is backed by a collateral package that includes the jet engines themselves, lease receivables, maintenance reserves, and related insurance proceeds. This structure aims to bridge traditional aviation finance and blockchain based fractional ownership, a segment many industry observers believe could expand as tokenization technology matures. Monthly lease generated cash flows are expected to be allocated proportionally to token holders through automated blockchain distributions.

ETHZilla’s strategic pivot comes amid broader challenges for Ethereum treasury firms. Shares of the company recently traded near 3.40 dollars, reflecting gains on the day but remaining significantly below previous highs. Over the past year, the firm implemented share buyback programs and adjusted capital allocation strategies as market enthusiasm around digital asset treasuries cooled. The tokenization move appears positioned as an effort to enhance shareholder value while reducing reliance on Ethereum price appreciation alone.

The company has also indicated plans to explore additional tokenized products tied to manufactured home loans and auto loans through existing partnerships. This signals a wider ambition to integrate blockchain based ownership models with asset classes that traditionally remain limited to institutional investors.

As Ethereum trades well below earlier cycle peaks and volatility persists, ETHZilla’s expansion into aviation backed tokens highlights a growing trend among treasury firms seeking diversified, cash flowing assets. Whether the strategy stabilizes earnings and improves investor confidence will likely depend on execution, market demand for tokenized real assets, and the broader trajectory of the Ethereum ecosystem.