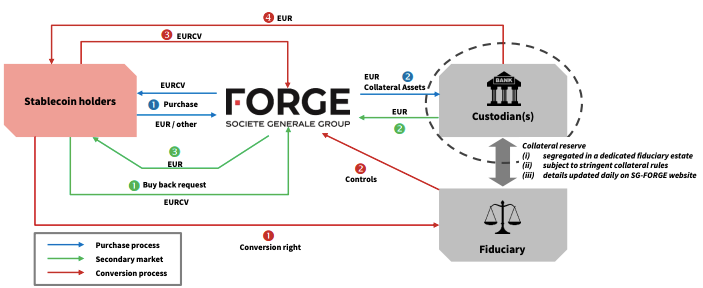

Global payments group Zepz has partnered with digital asset infrastructure provider Fireblocks to expand the use of stablecoins across its remittance platforms, WorldRemit and Sendwave. The collaboration is aimed at improving the speed, cost efficiency, and reliability of cross border transfers for millions of users, particularly in emerging markets. By integrating Fireblocks’ treasury and settlement infrastructure, Zepz is positioning stablecoins as a backend settlement layer rather than a consumer facing crypto product. The move reflects a growing focus on practical applications of blockchain technology in high volume payment corridors where traditional systems remain slow and expensive. For remittance providers, stablecoins offer a way to streamline settlement while maintaining familiar user experiences and regulatory alignment.

The integration allows Zepz to automate treasury operations, securely manage digital liquidity, and settle transactions in near real time. Stablecoins are used to reduce reliance on correspondent banking networks, which often introduce delays and additional foreign exchange costs. This structure is particularly relevant for remittance flows across Africa, Asia, and Latin America, where payment friction directly affects households that depend on timely transfers. By embedding blockchain infrastructure behind established brands, the partnership emphasizes operational efficiency rather than experimentation. The focus remains on improving affordability and predictability for users, while giving the operator greater control over liquidity management and settlement timing across multiple regions.

The collaboration highlights how remittances are emerging as a key growth area for stablecoin adoption beyond trading and decentralized finance. As global remittance volumes continue to expand, infrastructure providers are increasingly targeting real world use cases with measurable economic impact. The partnership also underscores a broader shift toward enterprise grade platforms that prioritize security, compliance, and scalability. Stablecoins in this context function as digital settlement instruments embedded within existing financial services, not as standalone assets. This approach aligns with a wider industry trend where blockchain based payment rails are being integrated incrementally into mainstream financial operations, driven by efficiency gains rather than speculative demand.