Global foreign exchange desks are adopting token based settlement methods at a faster pace as the industry explores ways to reduce friction in international payments. Several institutions participating in cross border pilots have expanded their use of USD backed tokens to streamline intraday settlement and improve liquidity management. These tests are designed to measure the operational efficiency of digital settlement instruments when compared with traditional correspondent banking pathways.

FX desks have historically relied on a network of intermediaries to complete transactions across currencies and jurisdictions. While effective, these systems introduce delays and require firms to allocate significant liquidity buffers. Token based settlement offers a model that can reduce both time and capital requirements. Early test results indicate that USD backed tokens can move across networks more quickly than conventional transfers and support more precise cash management during active trading periods.

USD backed tokens reshape cross border settlement workflows

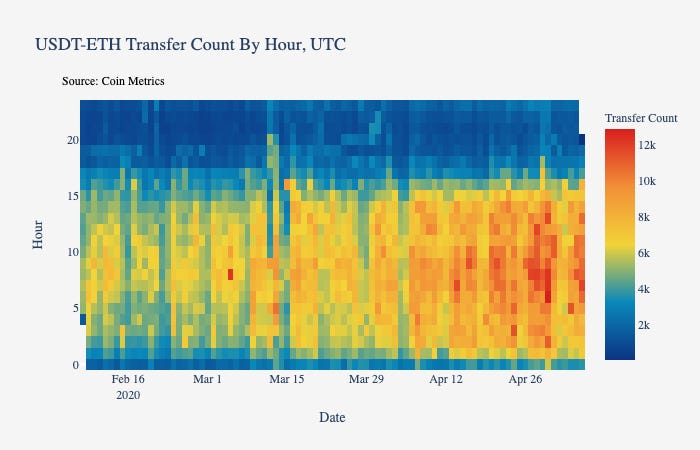

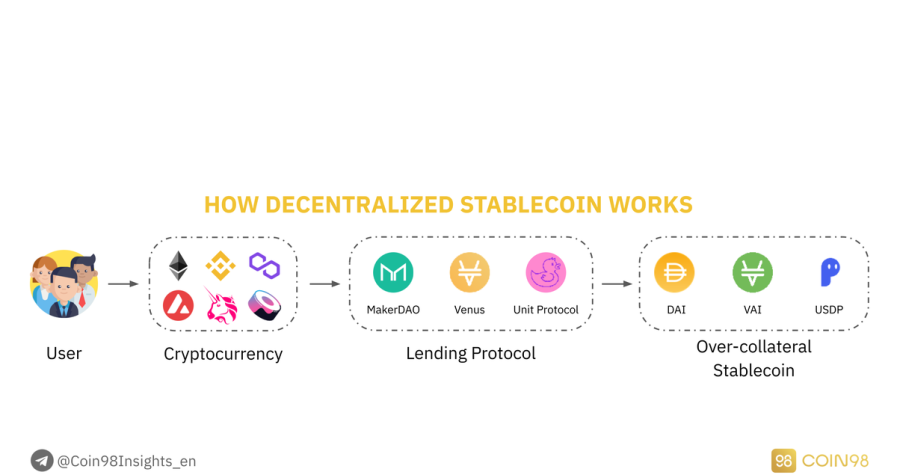

The integration of USD backed tokens into settlement trials marks a significant evolution for FX operations. Settlement processes that previously required several steps across multiple correspondent banks can now be completed within a single digital framework. This creates an opportunity for desks to synchronize execution and settlement more closely, reducing the mismatch between when trades occur and when cash is finalized. Improved timing can help firms manage intraday liquidity more effectively and minimize exposure to settlement risk.

Participating institutions have also observed greater transparency in transaction flows. Traditional processes often involve limited visibility as payments move through different intermediaries. Token based systems provide clearer audit trails and real time confirmation, allowing treasury teams to monitor liquidity positions with greater accuracy. The reduction in uncertainty helps improve cash deployment strategies across global desks and enhances the reliability of settlement operations.

Liquidity benefits drive institutional interest

One of the main incentives for FX desks to expand token usage is the potential for more efficient liquidity allocation. USD backed tokens allow institutions to reduce the amount of idle cash maintained in various settlement hubs. Instead of holding funds across multiple accounts in different regions, desks can operate with a more centralized liquidity structure while still executing cross border transfers on demand.

This centralization can lower funding costs and reduce the operational complexity of managing several liquidity pools. It also helps institutions meet their payment obligations more quickly and consistently. As settlement speed increases, liquidity tied up in transit decreases, freeing capital for trading or collateral needs. These dynamics explain why more institutions are willing to invest resources into testing token based settlement models.

Regulatory clarity supports experimentation

Growing regulatory engagement with tokenized settlement systems has helped create a more predictable environment for experimentation. Authorities have released guidelines that outline how token based instruments should be treated in the context of payments and settlement. This clarity allows FX desks to evaluate token usage without uncertainty about compliance or capital treatment. Institutions involved in the tests are able to build frameworks that align with oversight expectations, reducing barriers to adoption.

Regulators are particularly focused on how USD backed tokens maintain stability and how they integrate with broader financial market infrastructure. Their assessments have encouraged issuers to strengthen reserve transparency and risk management practices. This alignment has reinforced institutional confidence and expanded the base of large participants willing to explore tokenized settlement models.

Improved technology enhances settlement reliability

Advancements in settlement platforms have also contributed to rising participation. Institutions now have access to systems designed for high throughput transfers with real time verification. These platforms can integrate with existing FX systems, allowing desks to route tokenized payments without disrupting established workflows. The technical improvements reduce operational risk and make it easier for teams to evaluate token performance under realistic trading conditions.

The increased adoption of shared settlement layers allows participating desks to interact with each other more directly. This reduces the dependency on multiple intermediaries and supports more predictable settlement timeframes. As the interoperability of tokenized systems improves, institutions are able to explore more advanced use cases, including multi currency settlement cycles and automated liquidity management tools.

Conclusion

The rise in USD backed token usage among global FX desks demonstrates growing confidence in digital settlement systems. Institutions participating in cross border tests are reporting improved liquidity management, clearer transaction visibility, and faster settlement times. As technology and regulatory frameworks continue to advance, token based settlement models are positioned to play a larger role in modern FX operations and offer a more efficient foundation for international financial flows.