The future of institutional adoption depends on the creation of global standards for stablecoin transparency, ensuring trust, accountability, and resilience.

Introduction

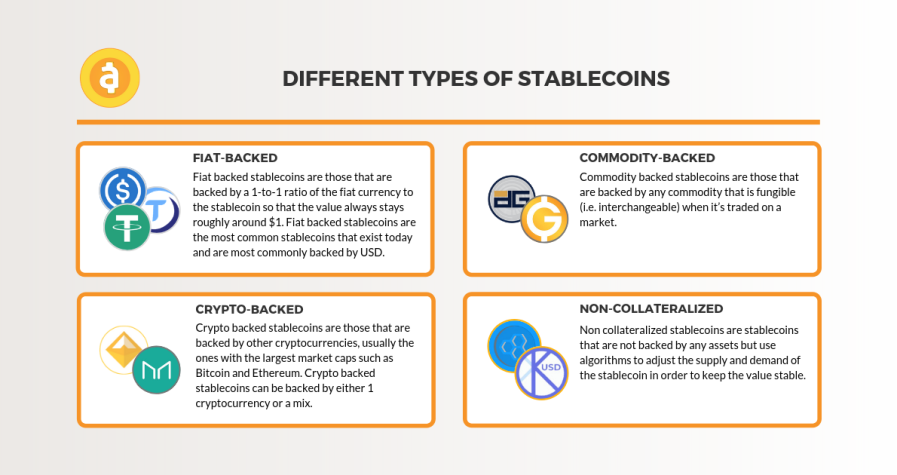

Stablecoins have become indispensable to modern finance. They serve as bridges between fiat currencies and digital ecosystems, power decentralized finance (DeFi), and increasingly support institutional liquidity management. Yet their rapid growth has outpaced regulatory clarity. Institutions are left navigating fragmented frameworks, inconsistent disclosures, and varying degrees of reserve verification.

The solution lies in global standards for transparency. Just as accounting principles or credit ratings provide common ground in traditional finance, stablecoin markets require uniform frameworks for reserves, reporting, and oversight. Without such standards, adoption risks being slowed by uncertainty. With them, stablecoins could become the backbone of a more efficient global financial system.

Why Transparency Matters

Transparency is the foundation of trust. For stablecoins, transparency ensures that:

Reserves are verifiable and sufficient to back circulating supply.

Redemption policies are clear, preventing runs or delays.

Liquidity flows are visible across chains and protocols.

Risks are identifiable before they threaten systemic stability.

Institutions demand this clarity before committing billions to stablecoin holdings. Without it, stablecoins remain attractive to traders but too risky for large-scale treasury operations.

Current Gaps in Transparency

The market today suffers from uneven practices:

Some issuers provide monthly reserve attestations, while others publish infrequent or partial reports.

Redemption policies vary widely, with inconsistent terms and settlement speeds.

On-chain transparency is high, but off-chain reserves remain opaque.

No universal format exists for presenting data to regulators or investors.

This patchwork limits trust. Institutions must conduct their own due diligence, slowing adoption and creating inefficiencies.

The Case for Global Standards

Global standards would bring uniformity, providing institutions with confidence regardless of geography or issuer. Key benefits include:

Comparability: Institutions can assess tokens on equal terms.

Accountability: Issuers face pressure to maintain reserves and governance.

Efficiency: Standardized reporting reduces costs of compliance and analysis.

Stability: Clear frameworks reduce panic during stress events.

These benefits mirror the role of International Financial Reporting Standards (IFRS) or Basel banking rules in traditional finance.

Components of a Transparency Framework

A robust global standard would likely include:

Reserve Disclosures

Daily snapshots of assets backing stablecoins.

Independent audits conducted quarterly.

Classification of reserve quality (cash, Treasuries, commercial paper).

Redemption Policies

Standardized settlement times (e.g., T+1 maximum).

Disclosure of redemption limits or caps.

Clear dispute resolution processes.

Liquidity and Circulation Data

Real-time on-chain reporting of supply.

Distribution metrics across wallets to highlight concentration risks.

Compliance and Oversight

Alignment with AML and KYC frameworks.

Sanction screening protocols.

Transparent governance structures.

Together, these elements create a holistic view of transparency.

Institutional Role in Pushing Standards

Institutions are not passive in this process. Many funds and custodians are already demanding enhanced disclosures as a condition of adoption. Their collective influence is pushing issuers toward higher transparency, even before regulation requires it.

In parallel, industry associations are drafting voluntary codes of conduct. These efforts lay the groundwork for eventual regulatory frameworks.

The Role of Regulators

Governments and central banks will play a decisive role in shaping standards. Europe’s MiCA framework sets a precedent, requiring detailed disclosures and reserve audits. In the United States, discussions around stablecoin legislation are increasingly focused on transparency.

Global coordination, however, remains the challenge. Without harmonization, issuers may face conflicting requirements, fragmenting markets further.

Artificial Intelligence and Automated Reporting

Next-generation transparency will leverage AI and blockchain automation. Smart contracts can publish reserve data in real time. AI systems can audit flows, detect anomalies, and flag inconsistencies.

These tools reduce the cost of compliance while increasing reliability, making global standards feasible at scale.

Obstacles to Global Standards

Despite progress, challenges remain:

Jurisdictional differences in regulatory priorities.

Resistance from issuers reluctant to expose reserve details.

Technical complexities in integrating off-chain and on-chain data.

Geopolitical competition over who sets the rules.

Resolving these challenges will require collaboration between regulators, institutions, and issuers.

Outlook for 2025 and Beyond

The road to global standards will not be immediate, but momentum is building. Over the next five years, expect:

Regional frameworks converging toward common practices.

Industry-led initiatives shaping voluntary standards.

Wider adoption of automated, AI-driven reporting systems.

Issuers competing on transparency as a market differentiator.

By 2030, it is likely that global standards will exist, backed by both regulators and market demand. At that point, stablecoins could stand alongside bonds, equities, and cash as universally trusted financial instruments.