Compliance dashboards are becoming essential tools for institutions, helping them manage regulatory oversight, reduce risks, and build trust in stablecoin markets.

Introduction

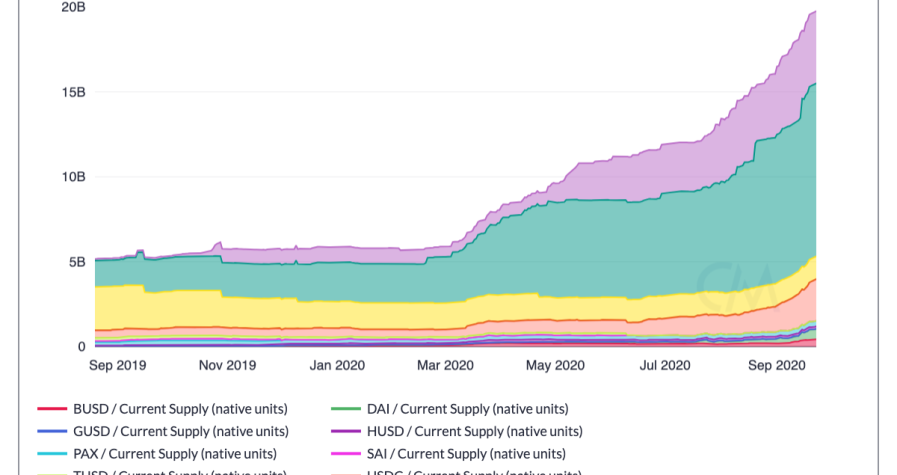

As stablecoins become systemic to global finance, institutions face mounting pressure to meet regulatory expectations. Transparency, anti-money laundering (AML) controls, sanctions screening, and reporting requirements are no longer optional — they are essential for both survival and trust.

Enter compliance dashboards. These tools give institutions real-time visibility into wallet flows, counterparty risks, and regulatory exposures. By consolidating compliance functions into a single platform, they allow institutions to monitor billions in stablecoin activity without compromising efficiency.

This guide explains step by step how institutions use compliance dashboards, the features they rely on most, and best practices for implementation.

What Are Compliance Dashboards?

Compliance dashboards are integrated platforms that centralize risk management and oversight for stablecoin transactions. Their core functions include:

Wallet screening against sanctions lists.

Transaction monitoring for unusual flows.

Audit reporting for regulators and boards.

Real-time alerts on compliance breaches.

For institutions, they serve as the nervous system of regulatory trust in stablecoin markets.

Why Institutions Need Compliance Dashboards

Regulatory Pressures

Stablecoin markets are growing, and regulators worldwide demand accountability. Dashboards help institutions meet evolving standards without constant manual intervention.

Risk Mitigation

Dashboards identify high-risk wallets or suspicious flows before they escalate into penalties or reputational damage.

Efficiency

Automated compliance reduces the cost of oversight compared to traditional manual audits.

Trust and Transparency

By using dashboards, institutions demonstrate proactive governance, increasing confidence from regulators and investors alike.

Core Features of Compliance Dashboards

1. Sanction Screening

Every transaction is automatically checked against updated global sanction lists. This ensures no flows involve restricted parties.

2. Transaction Scoring

AI-driven scoring systems flag unusual activity, such as sudden inflows from new addresses or circular transfers.

3. Geolocation and Jurisdiction Mapping

Dashboards tag flows by region, ensuring institutions remain compliant with jurisdiction-specific rules.

4. Audit-Ready Reporting

Institutions can generate reports instantly for internal committees or regulators, reducing compliance friction.

5. Real-Time Alerts

If high-risk activity is detected, compliance officers receive immediate notifications to act.

Step-by-Step Guide to Institutional Use

Step 1: Integration

Institutions connect dashboards to custody accounts, trading platforms, and settlement systems. APIs pull live transaction data into one consolidated view.

Step 2: Screening and Filtering

Transactions are screened automatically. Low-risk flows are approved instantly, while high-risk transactions are flagged for review.

Step 3: Risk Scoring

Wallets and flows receive dynamic risk scores. Compliance officers focus only on flagged items, reducing workload.

Step 4: Reporting

Reports are generated for regulators, boards, or investors. Dashboards store logs to ensure transparency in case of audits.

Step 5: Continuous Monitoring

Dashboards run continuously, updating sanction lists, refining AI models, and adapting to new risks.

Institutional Applications

Treasury Operations

Treasuries use dashboards to verify counterparties before settling cross-border transactions.

Funds and Asset Managers

Funds integrate dashboards to show investors that stablecoin holdings are managed transparently.

Custodians and Exchanges

Custody platforms use compliance dashboards to protect client funds and meet regulatory requirements.

Regulators

In some regions, regulators themselves use dashboards to monitor systemic flows, highlighting their growing importance.

Role of Artificial Intelligence

AI enhances compliance dashboards by:

Detecting hidden transaction patterns linked to risk.

Predicting potential breaches based on behavioral data.

Reducing false positives by learning from historical cases.

For institutions, AI ensures compliance tools are proactive rather than reactive.

Case Studies

Preventing Penalties

In one instance, a fund avoided sanctions violations when its compliance dashboard flagged a transfer linked to a restricted wallet. Early detection saved millions in potential fines.

Building Investor Trust

A custodian gained significant institutional clients after showcasing its compliance dashboard, which generated audit-ready transparency reports.

These cases show that dashboards are not just safeguards — they are competitive advantages.

Challenges in Compliance Dashboards

Data Overload

Institutions must filter millions of transactions daily. Dashboards need strong prioritization features.

Jurisdictional Conflicts

Different regions may require conflicting compliance standards. Dashboards must adapt dynamically.

Cost of Implementation

High-quality dashboards are resource-intensive, though savings outweigh costs over time.

Best Practices for Institutions

Customize Thresholds

Set transaction limits and risk alerts that reflect institutional exposures.

Integrate With Other Dashboards

Link compliance monitoring with portfolio and risk dashboards for full visibility.

Audit Frequently

Use dashboards to run internal audits before external reviews.

Leverage AI Forecasting

Adopt predictive compliance tools to anticipate risks, not just report them.

The Future of Compliance Dashboards

By 2025 and beyond, compliance dashboards will expand into systemic infrastructure. Expect:

Standardization across regions with global regulatory alignment.

Predictive compliance frameworks powered by AI.

Integration with CBDCs to unify monitoring of digital and fiat money.

Adoption as mandatory tools for large institutional participants.

Compliance dashboards are not temporary solutions. They are becoming permanent fixtures in institutional stablecoin strategies.