Stablecoins have become a foundational component of the digital finance ecosystem. Unlike traditional cryptocurrencies that fluctuate widely in price, stablecoins are designed to maintain a stable value relative to a reference asset, usually the US dollar. Peg stability is critical not only for retail users but also for institutional investors, cross-border payments, and decentralized finance protocols. Understanding how major stablecoins such as USDT, USDC, and DAI maintain their peg provides important insights into their operational frameworks, market resilience, and broader implications for global finance.

Mechanisms Behind Peg Maintenance

Stablecoins utilize different mechanisms to preserve value. They can generally be classified as fiat-backed, crypto-backed, or algorithmic. Each model has unique operational structures that support peg stability while mitigating risk for users.

Fiat-backed stablecoins, including USDT and USDC, rely on reserves held in regulated financial institutions. Each token in circulation is theoretically backed by an equivalent amount of fiat currency or highly liquid assets. These reserves undergo periodic audits or attestations by independent firms to enhance transparency and credibility. When demand fluctuates, issuers adjust token supply by minting or burning tokens, ensuring that the market price remains close to the intended peg.

Crypto-backed stablecoins such as DAI operate differently. They use other cryptocurrencies as collateral, held in smart contracts. These tokens are over-collateralized, meaning the value of locked assets exceeds the issued tokens. Automated liquidation mechanisms activate if collateral value falls below certain thresholds, preventing under-collateralization and maintaining peg stability. While this approach offers decentralization and transparency, it also introduces additional risks due to the inherent volatility of the collateral.

Algorithmic stablecoins manage supply through code-driven adjustments rather than direct collateral. The system expands or contracts the number of tokens in circulation based on market demand. Innovative, algorithmic approaches are more vulnerable during periods of extreme market stress. Historical examples indicate that these tokens require high liquidity and strong market confidence to maintain a stable value.

Liquidity as a Stabilizing Factor

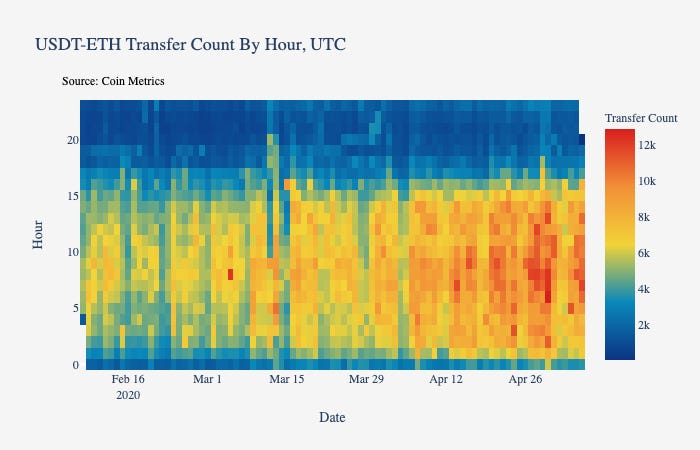

Liquidity plays a central role in peg stability. Leading stablecoins operate on multiple exchanges, over-the-counter markets, and DeFi platforms, allowing large trades without significantly impacting token value. Institutional participants frequently execute arbitrage strategies to correct minor deviations from the peg. These coordinated activities across different markets reinforce stability even during periods of heightened volatility in the broader cryptocurrency ecosystem.

Advanced monitoring tools allow investors to track token supply, reserve movements, and wallet activity in real time. Dashboards displaying total value locked, exchange inflows, and whale transactions provide actionable insights for institutional actors. The combination of automated monitoring, market participation, and analytics helps maintain stablecoin reliability under challenging conditions.

Case Studies of Peg Stress in 2025

Earlier in 2025, a sudden equity market sell-off caused USDT to briefly trade at 0.997 across major exchanges. Although the deviation lasted only a few minutes, institutional investors quickly shifted liquidity into USDC and DAI, demonstrating how minor stress events influence large market decisions.

DAI also faced challenges when the value of its crypto collateral dropped sharply during March. Automated liquidations created a temporary premium on DAI, indicating that smart contract mechanisms were functioning effectively to maintain the peg while absorbing market shocks. These cases show that while stablecoin pegs are resilient, they are sensitive to rapid changes in liquidity and market conditions.

Whale Behavior and Market Signals

Large holders, or whales, often act as early indicators during periods of peg instability. Market data from 2025 highlights three common strategies employed by whales. First, they move capital into tokens with the highest transparency, typically USDC, a strategy analysts call flight to transparency. Second, whales allocate funds into decentralized pools such as DAI as a non-custodial hedge against centralized risk. Third, regional arbitrage occurs when whales exploit minor price differences across exchanges to balance supply and demand. Observing these flows allows analysts to predict which stablecoins gain or lose confidence during short-term stress events.

Regulatory Influence on Stability

Stablecoin peg stability is increasingly influenced by regulatory oversight. The European Union’s MiCA framework and updated U.S. SEC guidance require clear reporting of reserves, stress testing, and operational transparency. These regulations reinforce confidence among institutional participants, who often manage large stablecoin volumes. Fiat-backed tokens benefit from stricter compliance requirements, whereas crypto-backed and algorithmic stablecoins face evolving scrutiny to ensure reserves and automated mechanisms are sufficient to maintain peg stability.

Lessons for Institutional Investors

Institutional investors managing large stablecoin holdings can draw several lessons from the current market environment. Diversification is essential, as no single stablecoin is immune to market stress. Monitoring whale flows and large wallet movements provides early warning signals about stress points. Cross-platform liquidity, including total value locked across multiple DeFi protocols, helps absorb volatility and indicates where confidence is flowing in the market.

Understanding these patterns is crucial for risk management. Institutions can adjust allocations, hedge exposure, and leverage arbitrage opportunities to protect against temporary peg deviations. Combining data-driven insights with real-time monitoring tools ensures that institutional participants maintain resilience even during volatile periods.

Outlook for Stablecoin Markets

Stablecoins have shown improved peg resilience in 2025 compared to earlier years. While minor deviations occasionally occur, markets now absorb shocks more efficiently, reflecting the growing maturity of the ecosystem. Future stability will continue to depend on strong liquidity management, transparent reserves, regulatory compliance, and active monitoring. For regulators, analysts, and investors, understanding the mechanisms behind peg maintenance provides a framework for evaluating risk, guiding investment decisions, and shaping the evolution of digital finance.

Maintaining stablecoin reliability is essential for cross-border payments, DeFi lending, institutional investment, and broader financial integration. By combining reserve management, liquidity strategies, regulatory compliance, and real-time monitoring, the leading stablecoins remain a dependable tool in global financial markets.