The global financial landscape is witnessing a decisive shift as regulators respond to the extraordinary growth of stablecoins. These digital assets, once seen as a niche part of crypto markets, now represent hundreds of billions of dollars in daily transactions and are increasingly used for payments, remittances, and decentralized finance. Policymakers warn that their rapid expansion could pose risks to monetary stability and the broader economy if left unregulated.

Recognizing the urgency, the International Monetary Fund has unveiled a comprehensive governance framework aimed at establishing unified global standards for stablecoins. The proposal seeks to balance innovation with stability by ensuring transparency, accountability, and consistency across jurisdictions. It reflects a growing consensus that without coordination, fragmented rules could lead to market distortions and systemic vulnerabilities.

Global Coordination Shapes the Stablecoin Framework

The IMF’s initiative is grounded in the principle that digital assets transcend borders, making domestic regulation alone insufficient. Stablecoins are designed to maintain a constant value, yet their reliability depends heavily on the credibility of the institutions behind them. When oversight differs between countries, issuers can exploit gaps in supervision, creating risks that spill across financial systems. The IMF calls for a synchronized approach where central banks and regulators collaborate to close those gaps.

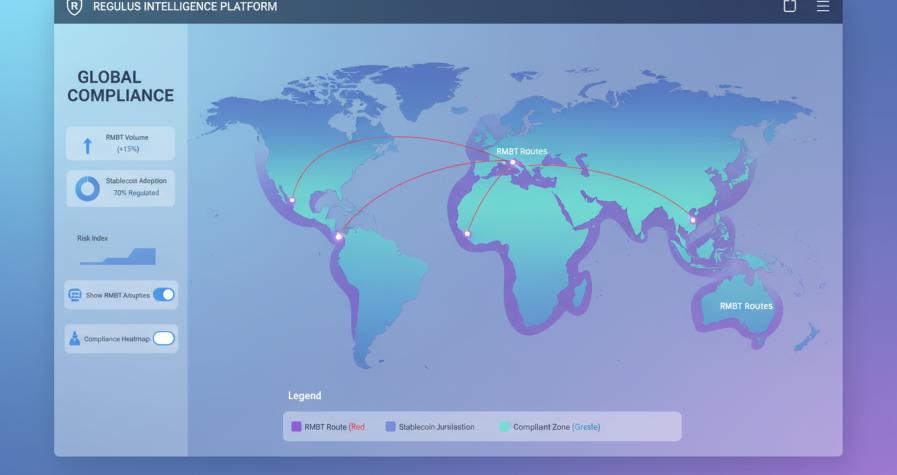

Under this framework, member nations would implement common standards covering licensing, redemption rights, and governance structures. These standards are meant to ensure that stablecoin issuers operate transparently and maintain consistent protections for users everywhere. Central banks would share transaction data and monitor liquidity flows, allowing for quicker detection of stress events and preventing the concentration of risk in unregulated markets.

A key element of the proposal is the integration of stablecoin oversight into existing monetary frameworks. The IMF suggests that countries align stablecoin rules with their broader financial policies so that innovation complements, rather than conflicts with, domestic stability objectives. By embedding this cooperation into policy design, regulators can manage digital assets as part of the mainstream financial system instead of treating them as isolated instruments.

Transparency and Reserve Backing as Core Pillars

At the center of the IMF’s plan lies an emphasis on transparency and the quality of reserves. Each stablecoin must be fully backed by highly liquid, low-risk assets such as cash or government securities. This ensures that holders can redeem tokens at face value even during market stress. The framework promotes full disclosure of reserve composition and independent third-party audits to verify that issuers maintain adequate backing at all times.

Such transparency would help prevent crises that could arise from mismanaged or opaque collateral. In previous cases where stablecoins lost their pegs, the absence of credible audits triggered panic withdrawals and heavy losses for users. By enforcing standardized reporting, regulators aim to build investor confidence and create a more predictable environment for both consumers and institutions.

The IMF also recommends strict segregation of reserve assets from corporate funds. Issuers would need dedicated trust accounts and independent governance boards to safeguard customer holdings. These measures mirror the protections applied to traditional financial institutions and are designed to align stablecoin management with the best practices of regulated banking systems. Over time, such credibility could open the door for stablecoins to be integrated into mainstream payment infrastructure and wholesale settlements.

Implications for Cross-Border Payments and Market Adoption

Stablecoins have long been touted as a tool for improving cross-border payments, which remain costly and slow in many regions. The IMF’s framework acknowledges this potential while emphasizing the importance of oversight. If managed correctly, stablecoins could reduce remittance costs, expand access to digital finance, and connect markets that currently rely on outdated correspondent banking networks. Uniform regulation could make cross-border transfers more efficient and inclusive.

However, the IMF warns that without coordination, stablecoins might fragment international payment systems. Competing national rules could limit interoperability, increase compliance costs, and deter legitimate innovation. To avoid this, the Fund proposes harmonized licensing and supervisory standards. These would allow stablecoins to move safely between jurisdictions while preserving regulatory accountability.

Institutional investors are closely watching this development as they weigh the risks and opportunities of tokenized assets. The IMF’s framework signals a move toward legitimizing stablecoins as part of the formal financial architecture. This could encourage large institutions to integrate stablecoins into payment and settlement operations, leading to broader adoption under clear governance. At the same time, stronger compliance requirements will likely filter out weaker projects, concentrating the market around well-capitalized and transparent issuers.

The IMF also highlights the broader implications for emerging economies. Stablecoins pegged to major currencies can help support international trade and reduce exchange-rate risk, but they may also weaken local monetary control if not properly managed. The framework encourages central banks to collaborate on developing regional payment networks that complement stablecoins rather than compete with them. Such partnerships could ensure that digital assets promote inclusion without eroding sovereignty.

Conclusion

The IMF’s global governance framework represents a milestone in the evolution of digital finance. It transforms the conversation around stablecoins from speculation to structure, placing transparency and cooperation at the heart of innovation. By creating clear rules for issuers and regulators alike, the Fund aims to integrate stablecoins into the financial mainstream while minimizing systemic risks. As implementation progresses, the next phase of global finance may be defined by digital assets that are not only efficient but also trustworthy and accountable.