The race to dominate stablecoin custody is intensifying in 2025 as banks, fintechs, and exchanges fight for institutional clients.

The Battle for Custody Heats Up

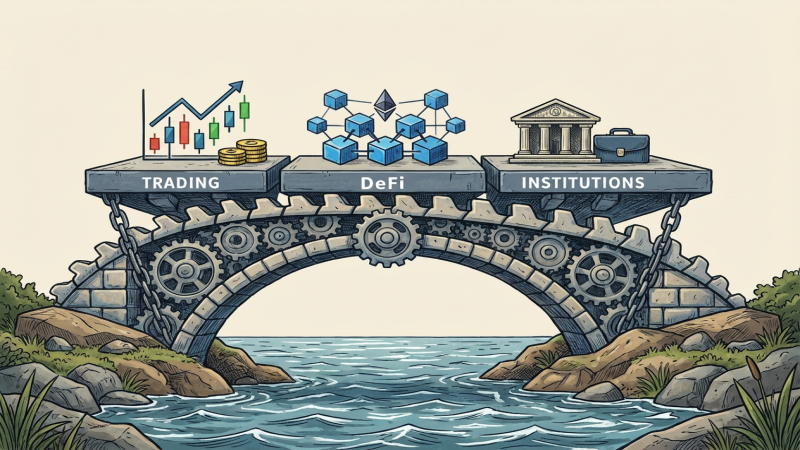

In 2025, custody has become the most critical service in the stablecoin ecosystem. Institutions ranging from hedge funds to multinational corporates demand secure, compliant, and insured storage solutions. What was once a niche offering is now a battleground, with global banks, fintech startups, and crypto exchanges competing for market dominance.

Stablecoin custody is not only about safekeeping. It involves governance, compliance, insurance, and seamless integration with trading, settlement, and reporting systems. Whoever wins the custody race will define the future of institutional adoption.

Banks Enter Aggressively

Legacy Institutions Adapt

Global banks like JPMorgan, HSBC, and Deutsche Bank are expanding custody offerings to include stablecoins alongside traditional assets.

Regulatory Edge

Banks enjoy regulatory credibility, reassuring boards and investors.

Integration with CBDCs

Many banks are preparing custody platforms that can handle both stablecoins and central bank digital currencies, giving them a hybrid advantage.

Fintechs Disrupt the Space

Specialized Solutions

Fintech custodians focus on multi-chain integration, automated compliance, and AI-driven risk detection.

Cost Advantages

Their leaner models often provide custody at lower fees than legacy banks.

Flexibility

Fintechs are faster to innovate, offering smart contract-based custody and DeFi integrations.

Exchanges Compete for Market Share

Built-In Liquidity

Crypto exchanges leverage their liquidity pools, providing custody that integrates directly with trading platforms.

Institutional Products

Major exchanges now market custody services tailored to funds, corporates, and treasuries.

Security Risks

Despite growth, exchanges still face skepticism due to past failures and hacks.

Institutional Demands

Insurance: Full coverage against theft, fraud, and technical failures.

Compliance: Custodians must integrate AML and sanction screening.

Transparency: Regular audits and reserve verification are mandatory.

Cross-Chain Support: Custody must handle stablecoins across multiple ecosystems.

Integration: Custody must connect with dashboards, reporting tools, and settlement systems.

Expert Commentary

Anna Schultz, Risk Officer at EuroFinance Group:

“For institutions, custody is not negotiable. Without robust custody, no board approves stablecoin exposure.”

James Li, CEO of a Singapore Fintech Custodian:

“Banks have scale, but fintechs have speed. The winner will be whoever can combine both trust and innovation.”

Case Studies

Bank-Led Custody Expansion

A European bank gained new institutional clients by launching insured custody integrated with CBDC settlement pilots.

Fintech Innovation

A U.S.-based fintech attracted hedge funds by offering custody with built-in DeFi access, allowing clients to earn yields safely.

Exchange Competition

A leading Asian exchange lost custody clients after a security breach, highlighting lingering trust issues.

The Role of Artificial Intelligence

AI is transforming custody competition by:

Automating transaction monitoring for compliance.

Forecasting liquidity needs across client portfolios.

Detecting anomalies that signal fraud or technical risks.

Enhancing reporting for regulators and investors.

AI-driven custodians are gaining an edge in institutional adoption.

The Road Ahead

The custody wars are just beginning. Analysts expect:

Consolidation: Smaller custodians may merge or be acquired by banks.

Global Standards: Regulators will set custody benchmarks for systemic institutions.

Hybrid Systems: Custodians will manage stablecoins, CBDCs, and tokenized assets in one framework.

Mandatory Insurance: Coverage will become a requirement for all custodians managing institutional reserves.

Whoever dominates custody will define how stablecoins scale from speculative instruments into global infrastructure.