As global markets face growing uncertainty, investors are turning to assets that promise safety, stability, and liquidity. Rising inflation, geopolitical tensions, and monetary policy shifts have renewed interest in instruments that can preserve value in turbulent times. From stablecoins to tokenized government securities, the movement toward safe assets is accelerating, signaling a broader transformation in how capital seeks security.

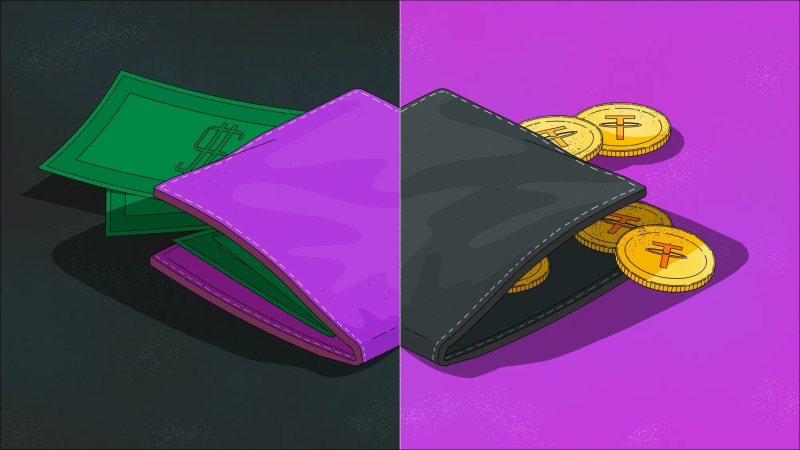

In the past, investors would typically retreat to gold, cash, or government bonds during market downturns. Today, digital equivalents are taking center stage. Stablecoins, tokenized treasuries, and blockchain-based money market funds are emerging as the new generation of safe-haven assets, offering both stability and technological efficiency. This evolution reflects a world where trust is increasingly digital and safety is being redefined through transparency and programmability.

Digital Stability in an Unstable World

The surge in demand for stable assets is directly tied to the growing volatility across traditional and digital markets. Investors, corporates, and even governments are looking for tools that can protect value without sacrificing liquidity. Stablecoins like Tether (USDT), USD Coin (USDC), and newer entrants such as PayPal USD (PYUSD) have become essential instruments in navigating uncertain markets.

Stablecoins provide dollar stability while enabling instant transfers across borders and blockchains. They are used not only by crypto investors but also by corporations managing cross-border payrolls, fintech platforms handling remittances, and institutional investors seeking on-chain liquidity. The appeal lies in their dual nature they combine the reliability of fiat currency with the efficiency of blockchain settlement.

At the institutional level, the growth of tokenized assets is amplifying this trend. Tokenized U.S. Treasury bills and money market funds are gaining traction as investors look for regulated, yield-bearing digital alternatives. BlackRock, Franklin Templeton, and JPMorgan have already introduced or tested tokenized funds that offer real-time settlement and on-chain transparency. These innovations are reshaping how investors perceive safety and efficiency in the digital economy.

For emerging economies, where inflation and currency instability are pressing concerns, stablecoins have become a modern hedge. They offer access to dollar stability without requiring traditional banking infrastructure. This combination of accessibility and security explains why stablecoin adoption continues to climb even during global market stress.

Institutional Liquidity and Tokenization

Institutional interest in safe digital assets is redefining capital allocation. Tokenization allows traditional instruments such as bonds, equities, and real estate to exist as blockchain-based assets, increasing liquidity and improving settlement efficiency. As a result, stablecoins and tokenized treasuries are becoming central to the infrastructure of the digital financial system.

Major financial institutions are no longer observing from the sidelines. Asset managers are integrating tokenized products into portfolios, while banks are experimenting with blockchain-based settlement networks. These developments reflect a recognition that the future of liquidity will depend on tokenized, interoperable, and programmable assets.

Stablecoins serve as the connective tissue between these tokenized markets. They facilitate seamless transactions, collateralize digital loans, and power decentralized finance ecosystems that increasingly appeal to institutional investors. As tokenization gains scale, stablecoins will likely act as the settlement currency for trillions in digital asset value.

This institutional embrace of digital safe assets also aligns with broader economic policy objectives. Governments and central banks are exploring how private stablecoins and central bank digital currencies (CBDCs) can coexist to enhance financial stability. The result could be a blended system where public and private digital assets work together to support global liquidity.

Regulation as the Foundation of Trust

As the demand for safe digital assets grows, so does the need for strong regulatory frameworks. Clear rules build confidence among institutional and retail investors, ensuring that stablecoin reserves are transparent and that tokenized products meet legal standards.

In the United States, proposed stablecoin legislation aims to formalize reserve requirements and issuer oversight. Europe’s MiCA regulation is already providing a foundation for compliant stablecoin and asset tokenization operations. Across Asia and the Middle East, regulatory sandboxes are allowing financial institutions to test tokenized securities and blockchain-based settlements under controlled conditions.

This global regulatory alignment is fostering trust and encouraging broader participation. As oversight improves, stablecoins and tokenized safe assets are expected to become a permanent feature of diversified portfolios, serving both institutional needs and retail demand for financial protection.

Conclusion

Market volatility is accelerating the transition toward safe, stable, and transparent digital assets. Investors are not retreating from innovation; they are embracing new forms of safety that blend the reliability of traditional finance with the efficiency of blockchain technology. Stablecoins and tokenized treasuries are leading this shift, proving that security and innovation can coexist. As regulation matures and institutions deepen their engagement, the global financial system is moving toward a future where safety is programmable, liquidity is global, and trust is built on transparency.