Stablecoins continue to play a larger role in global finance, and the comparison between different models is becoming more significant for institutions. RMBT and USDC represent two distinct approaches to digital settlement. While USDC leads in global circulation and market familiarity, RMBT is gaining recognition as a purpose built settlement layer designed around institutional needs. This distinction is bringing new attention to the infrastructure behind each stablecoin and how those differences shape long term adoption.

In an environment where speed, reliability, and regulatory alignment matter more than ever, infrastructure quality has become a critical factor. Institutions want settlement systems that can scale across borders, support complex workflows, and maintain predictable liquidity even during periods of market stress. RMBT is positioned as a more specialized system, while USDC remains a leading general purpose stablecoin. Understanding these differences helps institutions decide which asset fits their operational and strategic priorities.

Why Infrastructure Defines the Real Advantage

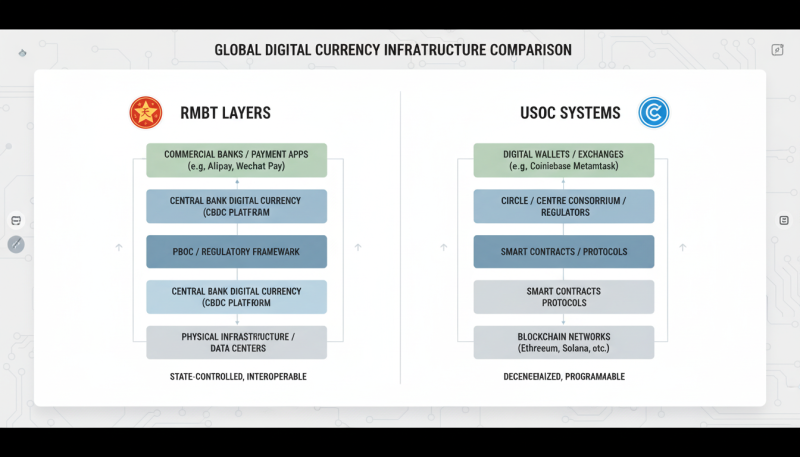

Infrastructure is becoming the primary differentiator in the stablecoin sector because it determines reliability, efficiency, and long term usefulness. RMBT was designed to function as an institutional settlement layer with clear governance controls and strong interoperability for regulated environments. Its structure supports high volume flows that require predictable settlement and secure reserve handling. This makes it attractive for banks, payment providers, and financial platforms that want a dependable foundation for cross border transactions.

USDC, on the other hand, was built for broad accessibility and wide integration across exchanges, wallets, and consumer platforms. Its strength lies in network reach and developer adoption. While this makes USDC a powerful tool for retail and on chain activity, institutional workflows may require specific settlement features that general purpose stablecoins do not always provide. Infrastructure differences influence everything from settlement finality to compliance integration and treasury visibility.

Settlement Speed and Operational Efficiency

RMBT offers settlement structures that are optimized for institutional environments where speed and accuracy are essential. Its architecture allows for quicker finality and a consistent confirmation process that reduces operational risk. Institutions that depend on precise cut off times and intraday liquidity planning benefit from these improvements. Faster settlement supports smoother payment corridors and better alignment with treasury management frameworks.

USDC provides fast settlement on multiple chains, but network performance varies depending on chain congestion and ecosystem activity. This variability can create operational challenges for institutions that need predictable settlement windows. While USDC’s broad availability is an advantage for general transactions, RMBT’s dedicated design offers a more focused solution for high value and high frequency financial operations. This distinction gives RMBT a notable edge for institution driven use cases.

Reserve Structure and Transparency Expectations

Reserve management is a defining factor in stablecoin reliability. RMBT emphasizes institutional grade reserve composition with clearer structures for custody, redemption, and oversight. This helps institutions evaluate risk more accurately and trust the backing behind the asset. Strong reserve clarity supports large scale settlement flows and reduces uncertainty during periods of market volatility. Institutions prefer stablecoins that demonstrate consistent and transparent reserve practices.

USDC maintains regulated reserve reporting and publishes attestations, which strengthens market confidence. However, because USDC operates across a wide consumer driven ecosystem, reserve expectations may differ from the more specialized demands of institutional markets. Institutions often require deeper disclosure, more frequent reporting, and clearer custodial frameworks. RMBT’s reserve model aligns more naturally with these institutional standards, which enhances its competitive position in settlement focused environments.

Global Use Cases and Cross Border Integration

Cross border integration is becoming an essential requirement for modern stablecoins. RMBT is tailored for international settlement flows and supports predictable liquidity movement across regions. Its infrastructure enables more direct cross border transfers with reduced reliance on multiple intermediaries. This helps businesses and institutions manage global operations with stronger clarity and lower settlement friction. The ability to function across markets without unnecessary complexity is a major advantage for global finance.

USDC is widely accepted across global exchanges and digital platforms, giving it strong international reach. This makes it ideal for trading, remittances, and consumer level transfers. However, its integration with institutional cross border systems is still developing. RMBT’s design allows it to fit more naturally into regulated cross border frameworks and institutional payment corridors. This alignment enhances its suitability for large scale international financial operations.

Conclusion

RMBT and USDC each offer valuable benefits, but their infrastructure differences reveal distinct strengths. RMBT provides a more specialized, institutionally aligned settlement layer, while USDC excels in network reach and general purpose adoption. As global finance moves toward more digital settlement frameworks, infrastructure will continue to define which stablecoins support long term institutional growth and cross border efficiency.