A7A5, a ruble denominated stablecoin issuer linked to entities under U.S. sanctions, is pressing ahead with international expansion efforts as it positions itself as a cross border payment rail for trade involving Russian businesses.

Oleg Ogienko, director for regulatory and overseas affairs at A7A5, has publicly defended the company’s compliance framework, stating that the firm operates fully within the legal and regulatory boundaries of Kyrgyzstan, where it is incorporated. He said the company maintains know your customer procedures, anti money laundering controls and audit processes aligned with international standards, including Financial Action Task Force principles.

The complexity surrounding A7A5 stems from the fact that its issuing entities and affiliated organizations, as well as the bank reported to hold its reserves, are sanctioned by the U.S. Treasury. These sanctions effectively prevent U.S. dollar based institutions and many Western counterparties from engaging directly with the entities. However, under Kyrgyz and Russian law, facilitating trade settlements for Russian firms is not prohibited.

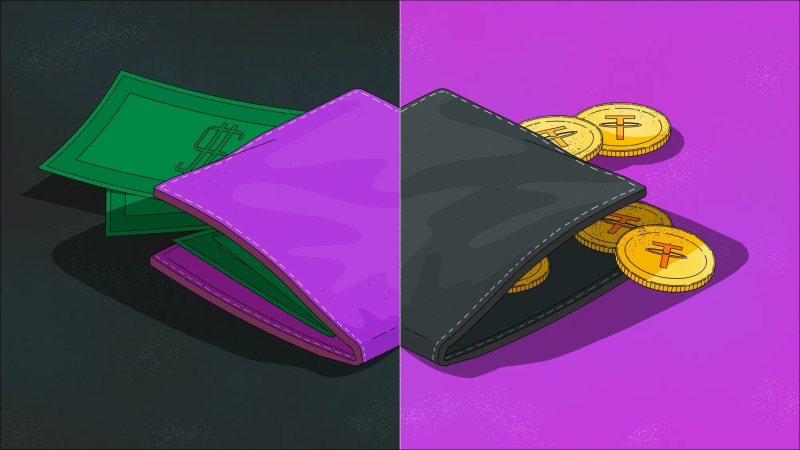

A7A5 has presented its stablecoin as a tool for businesses in Asia, Africa and South America that maintain commercial relationships with Russian exporters and importers. According to market data cited by industry analysts, the token experienced rapid supply growth over the past year, expanding faster than several leading dollar backed stablecoins. Observers note that restrictions on traditional banking channels may have accelerated demand for alternative settlement mechanisms in sanctioned trade corridors.

Liquidity constraints remain a challenge. Major centralized exchanges have generally avoided listing the token due to concerns about secondary sanctions exposure. Limited liquidity pools reportedly exist in decentralized finance environments where A7A5 can be swapped into dollar stablecoins, though volumes remain relatively modest compared to established tokens.

Ogienko has indicated that the company is pursuing partnerships with additional blockchain networks and digital asset platforms to expand infrastructure and improve market access. Deployments on major public chains such as Tron and Ethereum have already taken place, with discussions ongoing about further integrations.

Despite geopolitical sensitivities, A7A5 has expressed ambitions to capture a significant share of Russia’s international trade settlements over time. At the same time, the token is not yet fully integrated into domestic Russian financial systems, as lawmakers continue to draft comprehensive stablecoin regulations.

The case underscores how stablecoins are increasingly intersecting with geopolitics and sanctions policy. As digital asset settlement rails expand, regulators and market participants are grappling with the balance between compliance, financial sovereignty and the evolving role of tokenized currencies in global trade.