Compliance dashboards give institutions the tools they need to track reserves, transactions, and regulatory alignment across stablecoin ecosystems.

Why Compliance Dashboards Are Essential

Institutions cannot treat stablecoins as simple liquidity tools. Regulators demand proof of transparency, reserve backing, and responsible flows. Compliance dashboards meet this need by providing a consolidated view of regulatory data in real time.

In 2025, funds and treasuries view compliance not as a burden but as a safeguard. Dashboards that streamline reporting and monitoring have become indispensable.

Core Features of Compliance Dashboards

Modern compliance dashboards provide:

Reserve verification to confirm 1:1 backing with audited assets.

Transaction monitoring that highlights exposure to sanctioned addresses.

Geographic breakdowns for compliance with regional rules.

Audit-ready reports that satisfy oversight agencies.

These features transform compliance from a manual, time-intensive process into an automated and continuous practice.

Regulatory Pressure Across Regions

Compliance requirements differ globally.

In the United States, regulators emphasize audited reserves and systemic risk safeguards.

The European Union’s MiCA framework prioritizes consumer protection and detailed disclosures.

In Asia, regulators balance innovation with oversight, demanding reporting without stifling growth.

Dashboards allow institutions to adjust strategies region by region, ensuring seamless compliance no matter where liquidity flows.

How Institutions Apply Dashboards

Funds use compliance dashboards to avoid penalties and maintain trust. By tracking transactions, they ensure that none overlap with sanctioned entities. Treasuries rely on dashboards to prove reserves when reporting to boards. Trading desks use them to manage counterparty risk.

Compliance data has become part of every decision, not just regulatory reporting.

Integration With Other Analytics

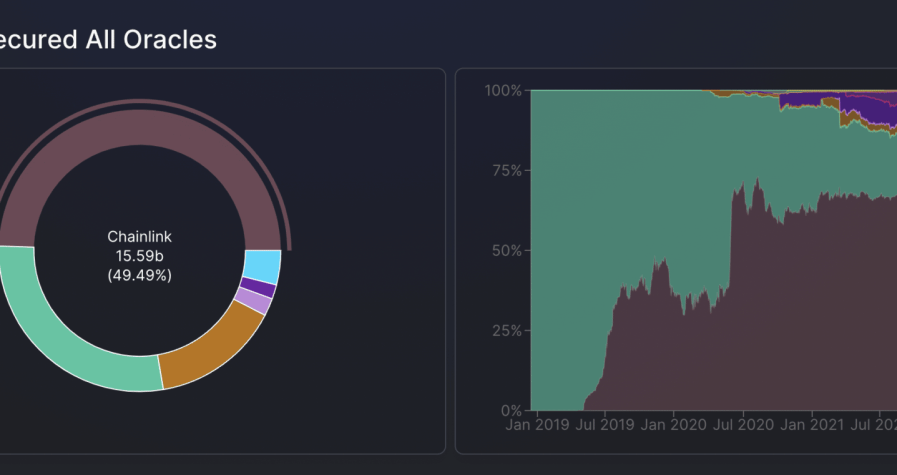

The most advanced dashboards integrate with whale monitoring, TVL data, and peg trackers. This unified approach ensures that compliance does not exist in isolation but connects to liquidity and risk.

Institutions gain a holistic view: regulatory safety combined with real-time market intelligence.

Outlook for 2025

Compliance dashboards will become even more important as regulation deepens. Automated monitoring, AI-driven alerts, and standardized reporting will define the future of institutional adoption.

In a world where regulators demand accountability, dashboards provide both transparency and trust.